- Japan

- /

- Semiconductors

- /

- TSE:6337

With TESEC Corporation (TSE:6337) It Looks Like You'll Get What You Pay For

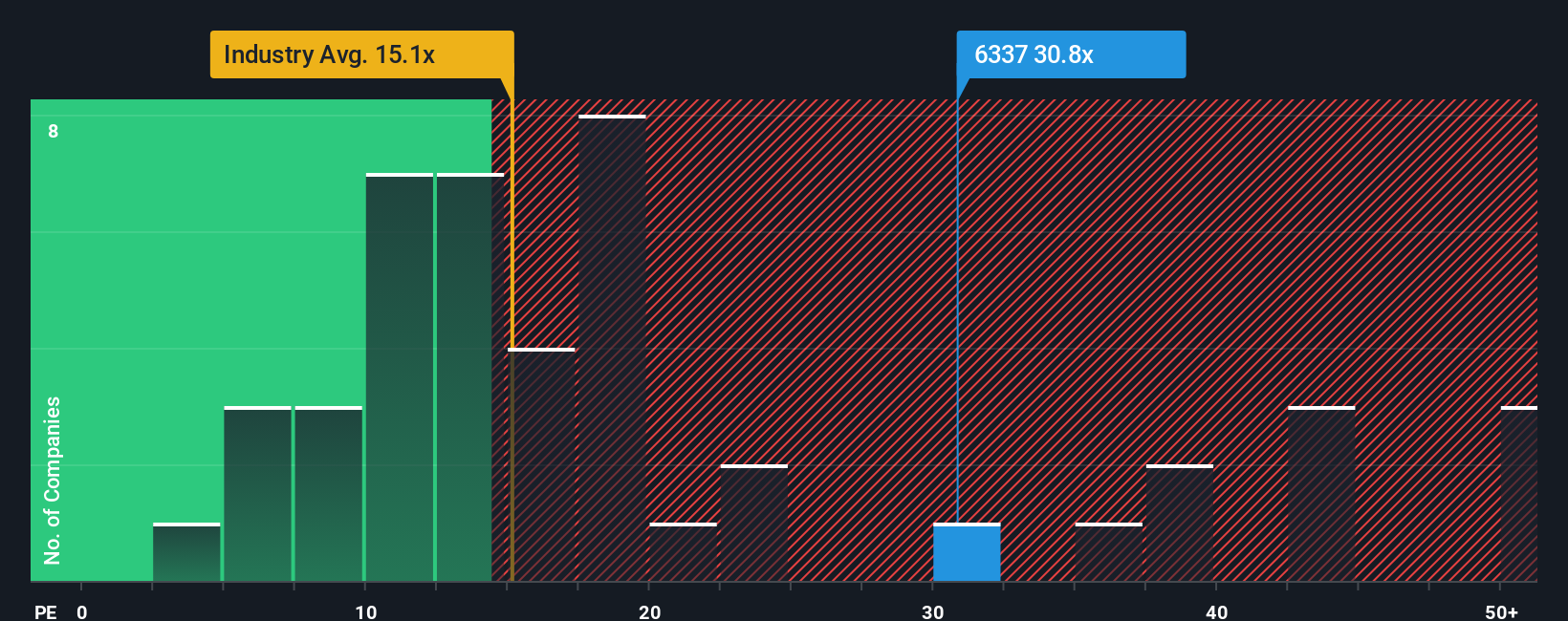

With a price-to-earnings (or "P/E") ratio of 30.8x TESEC Corporation (TSE:6337) may be sending very bearish signals at the moment, given that almost half of all companies in Japan have P/E ratios under 14x and even P/E's lower than 10x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

TESEC could be doing better as its earnings have been going backwards lately while most other companies have been seeing positive earnings growth. It might be that many expect the dour earnings performance to recover substantially, which has kept the P/E from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for TESEC

How Is TESEC's Growth Trending?

There's an inherent assumption that a company should far outperform the market for P/E ratios like TESEC's to be considered reasonable.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 67%. As a result, earnings from three years ago have also fallen 80% overall. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Turning to the outlook, the next three years should generate growth of 24% per annum as estimated by the sole analyst watching the company. With the market only predicted to deliver 9.6% per annum, the company is positioned for a stronger earnings result.

In light of this, it's understandable that TESEC's P/E sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Final Word

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that TESEC maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. Unless these conditions change, they will continue to provide strong support to the share price.

You should always think about risks. Case in point, we've spotted 4 warning signs for TESEC you should be aware of.

You might be able to find a better investment than TESEC. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if TESEC might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:6337

TESEC

Designs, develops, manufactures, and sells semiconductor test equipment in Japan and internationally.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives