- Japan

- /

- Semiconductors

- /

- TSE:6227

A Piece Of The Puzzle Missing From AIMECHATEC, Ltd.'s (TSE:6227) 31% Share Price Climb

Those holding AIMECHATEC, Ltd. (TSE:6227) shares would be relieved that the share price has rebounded 31% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Notwithstanding the latest gain, the annual share price return of 7.3% isn't as impressive.

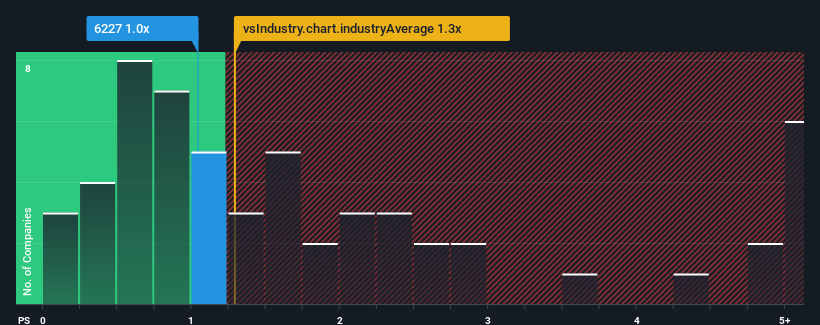

Although its price has surged higher, you could still be forgiven for feeling indifferent about AIMECHATEC's P/S ratio of 1x, since the median price-to-sales (or "P/S") ratio for the Semiconductor industry in Japan is also close to 1.3x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

We've discovered 1 warning sign about AIMECHATEC. View them for free.View our latest analysis for AIMECHATEC

What Does AIMECHATEC's Recent Performance Look Like?

AIMECHATEC could be doing better as it's been growing revenue less than most other companies lately. It might be that many expect the uninspiring revenue performance to strengthen positively, which has kept the P/S ratio from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on AIMECHATEC.Is There Some Revenue Growth Forecasted For AIMECHATEC?

The only time you'd be comfortable seeing a P/S like AIMECHATEC's is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered a decent 11% gain to the company's revenues. The latest three year period has also seen an excellent 48% overall rise in revenue, aided somewhat by its short-term performance. So we can start by confirming that the company has done a great job of growing revenues over that time.

Looking ahead now, revenue is anticipated to climb by 23% each year during the coming three years according to the dual analysts following the company. That's shaping up to be materially higher than the 7.6% per annum growth forecast for the broader industry.

In light of this, it's curious that AIMECHATEC's P/S sits in line with the majority of other companies. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Key Takeaway

Its shares have lifted substantially and now AIMECHATEC's P/S is back within range of the industry median. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Looking at AIMECHATEC's analyst forecasts revealed that its superior revenue outlook isn't giving the boost to its P/S that we would've expected. There could be some risks that the market is pricing in, which is preventing the P/S ratio from matching the positive outlook. It appears some are indeed anticipating revenue instability, because these conditions should normally provide a boost to the share price.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with AIMECHATEC, and understanding should be part of your investment process.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:6227

AIMECHATEC

Develops, manufactures, and sells for flat panel display equipment in Japan.

Reasonable growth potential with mediocre balance sheet.

Market Insights

Community Narratives