- Japan

- /

- Specialty Stores

- /

- TSE:9831

Could Employee Share Incentives Reveal Yamada Holdings' (TSE:9831) Alignment With Long-Term Value Creation?

Reviewed by Sasha Jovanovic

- Yamada Holdings Co., Ltd. recently held a board meeting to approve the disposal of its own shares as part of an employee restricted share incentive plan.

- This initiative is designed to enhance employee ownership, bolster welfare, and better align staff interests with long-term company performance.

- We'll explore how the employee-focused share incentive plan could shape Yamada Holdings' investment case through workforce alignment.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

What Is Yamada Holdings' Investment Narrative?

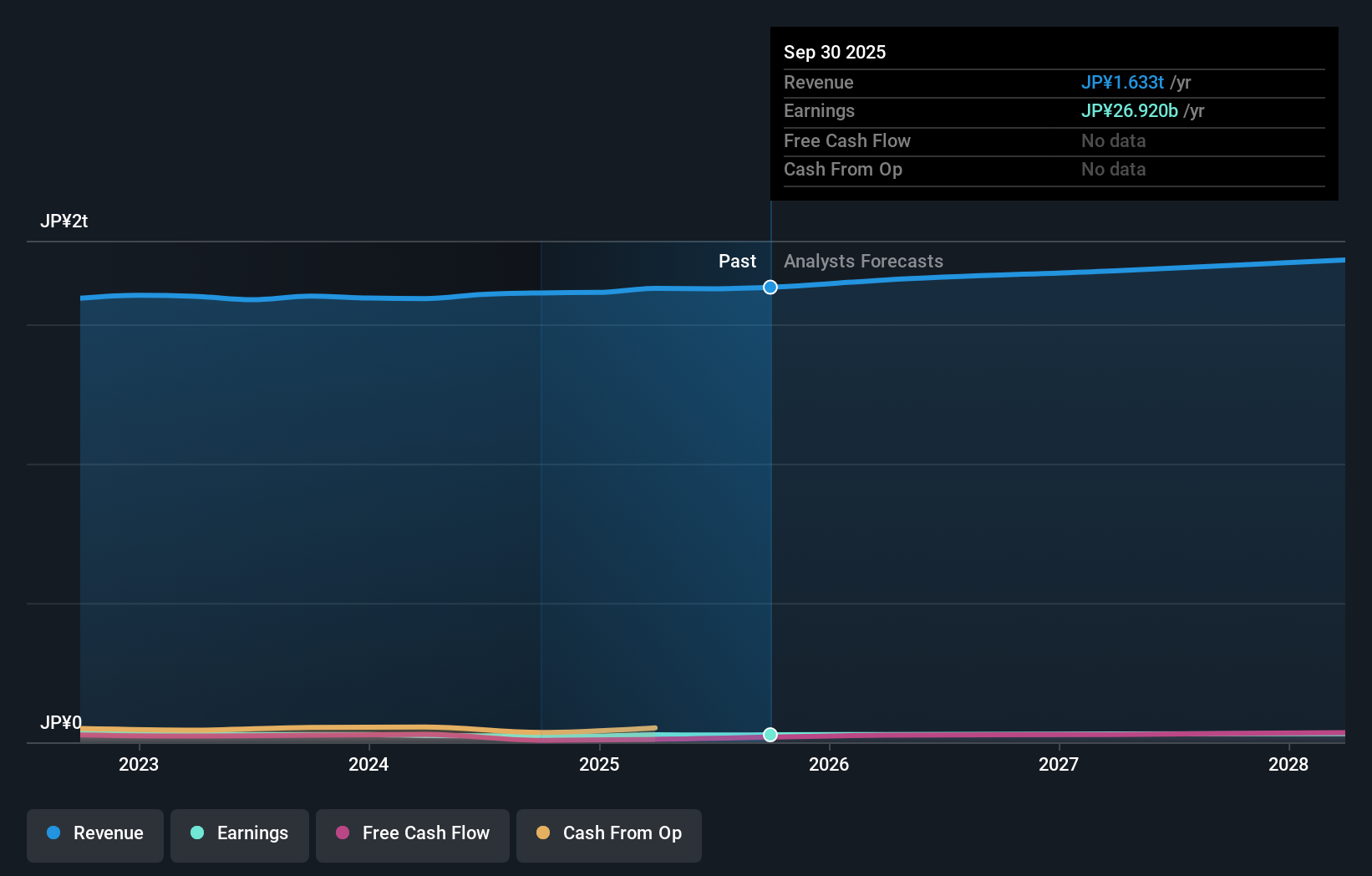

For anyone considering Yamada Holdings, one of the big ideas to understand is that investors are essentially betting on the company's ability to turn slow but steady growth and margin improvement into shareholder value, despite a mixed record on recent stock performance and slower profit growth forecasts compared to the wider market. The introduction of the employee restricted share incentive plan may not immediately move the needle on headline catalysts, such as top-line sales, buybacks, or rising dividends, but it does have the potential to subtly shift the risk profile. Tighter workforce alignment could support medium-term management goals and help stabilize results, particularly at a time when the company is contending with low returns on equity, board turnover, and high CEO compensation. While the direct market impact of this initiative is likely to be modest near term, it could play a part in building more sustainable value over time.

On the other hand, board and management experience remains a key consideration for investors to watch.

Exploring Other Perspectives

Explore 2 other fair value estimates on Yamada Holdings - why the stock might be worth 47% less than the current price!

Build Your Own Yamada Holdings Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Yamada Holdings research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Yamada Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Yamada Holdings' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9831

Yamada Holdings

Operates in the consumer electronics retailing activities in Japan and internationally.

Proven track record and fair value.

Similar Companies

Market Insights

Community Narratives