- Japan

- /

- Specialty Stores

- /

- TSE:8173

Joshin Denki (TSE:8173): One-Off Gain Masks Ongoing Margin Pressure in Latest Earnings

Reviewed by Simply Wall St

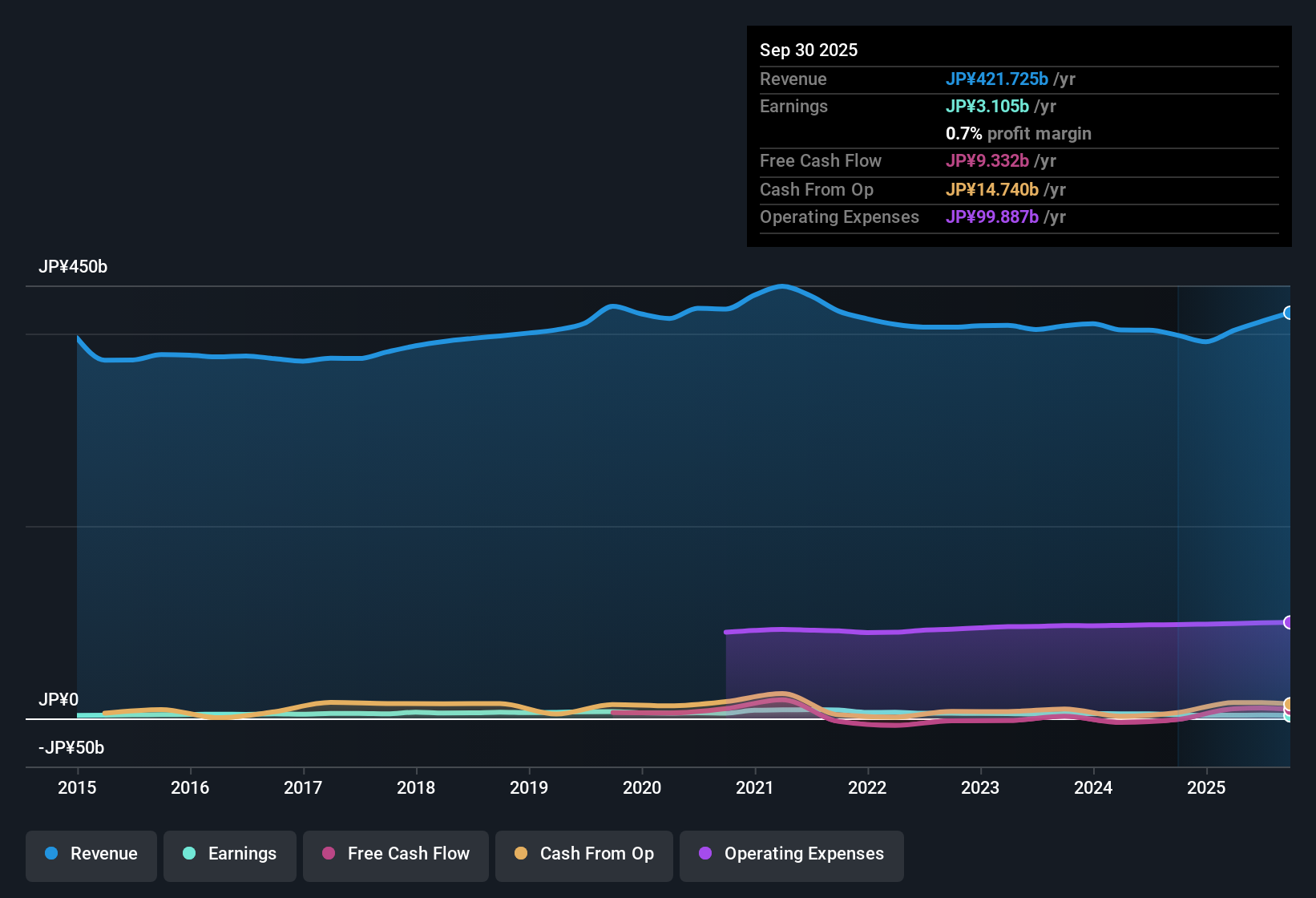

Joshin Denki (TSE:8173) saw its earnings decline by 18.7% per year over the past five years, with the most recent annual figures showing another drop and a net profit margin down to 0.8% from 1.2% a year ago. This latest twelve-month period also included a significant one-off gain of ¥2.6 billion, which substantially affected the results for the period ending September 30, 2025. While valuation signals look mixed given the higher P/E, the shares now trade well below estimated fair value. The focus for investors is on margin pressure and the long-term trajectory.

See our full analysis for Joshin Denki.Next, we will see how Joshin Denki’s numbers square up against the most widely followed narratives to cut through what is noise and what is signal.

Curious how numbers become stories that shape markets? Explore Community Narratives

One-Off Gain Distorts Profit Picture

- The company reported a substantial non-recurring gain of ¥2.6 billion in the latest twelve-month period, which had a major distorting effect on its final profitability for the year ending September 30, 2025.

- Market watchers caution that since a large portion of stated profit reflects this one-off windfall, repeatable earnings power remains in question, especially in light of a falling net profit margin seen at 0.8% this year.

- This one-off gain makes it tougher for investors to judge ongoing business health or forecast next year's earnings potential.

- Bulls may downplay the impact, but the numbers show how single events can disproportionately skew headline results. This is particularly important when assessing long-term growth prospects.

Margin Compression Raises Doubts

- Joshin Denki’s net profit margin fell to 0.8% from 1.2% in the prior year, signaling that the core business is having a harder time translating sales into bottom-line profit.

- What stands out in the recent narrative is that despite sector talk of digital transformation and efficiency, core profitability keeps slipping.

- Some investors look for signs that cost-cutting or e-commerce might help, but margins suggest operational improvements are being offset by tough, competitive pressures.

- The low, shrinking margin runs counter to hopes that structural sector changes would shore up profitability. This highlights ongoing headwinds and the need to see actual turnaround in future quarters.

Valuation: Discount to Fair Value Despite Premium P/E

- At ¥2,544 a share, Joshin Denki trades at a 54% discount to its DCF fair value estimate of ¥5,573.74, even though its price-to-earnings ratio is elevated at 19.1x versus the peer average of 15.6x and the Japan specialty retail sector median of 13.7x.

- The prevailing market view proposes that while some see the premium P/E as a red flag, others note that the share price may have already priced in much of the recent weakness, offering value relative to long-term discounted cash flow.

- This pricing gap is uncommon and points out that investors remain split on whether current results justify a rebound or if structural challenges mean the discount is deserved.

- The unusual combination of a high P/E but low price to DCF fair value offers a classic investor puzzle. Does the market's skepticism about recurring profits create an opportunity, or is it a sign to tread carefully?

Curious how numbers become stories that shape markets? Explore Community Narratives Curious how numbers become stories that shape markets? Explore Community Narratives

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Joshin Denki's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Joshin Denki’s falling margins, reliance on one-off gains, and questions around sustainable earnings make its long-term growth outlook uncertain.

If you want companies with a stronger record of consistent top and bottom-line expansion, our stable growth stocks screener (2083 results) highlights ones built for steady performance when others falter.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8173

Joshin Denki

Operates an electrical appliance retail and ancillary business in Japan.

Flawless balance sheet 6 star dividend payer.

Market Insights

Community Narratives