- Japan

- /

- Retail Distributors

- /

- TSE:7466

SPK (TSE:7466) Profit Growth Slows, High Earnings Quality Underscores Stable-Performer Narrative

Reviewed by Simply Wall St

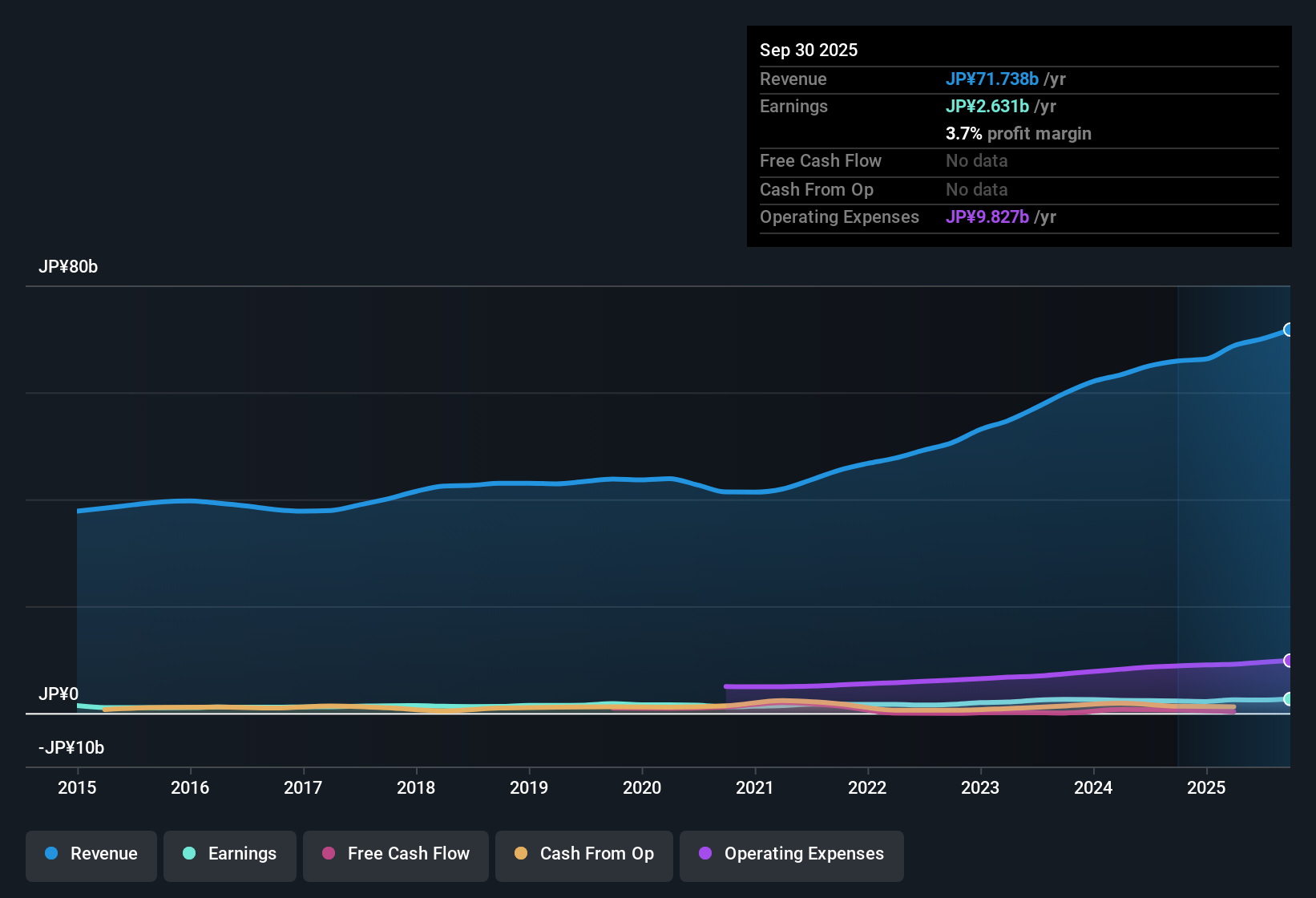

SPK (TSE:7466) has maintained an average annual earnings growth of 14.3% over the past five years. However, profit growth slowed to 4.9% in the most recent year. The company’s net profit margin currently stands at 3.5%, just below last year’s 3.6%. Investors looking for multi-year growth and good value may find the company’s latest results compelling, even as dividend sustainability remains a minor risk to monitor.

See our full analysis for SPK.Next, we will see how these numbers compare to the widely followed narratives for SPK and where expectations may need to adjust.

Curious how numbers become stories that shape markets? Explore Community Narratives

Earnings Quality Impresses Despite Slower Growth

- While profit growth slowed to 4.9% this year after averaging 14.3% annually over five years, SPK’s earnings quality remains high according to the EDGAR filing. This signals that profits are supported by underlying business operations rather than short-lived factors.

- Consistently high-quality earnings support the view that SPK is seen as a stable holding during sector calm.

- The 4.9% growth, while lower than historical averages, still positions SPK as a steady performer backed by structural drivers.

- Unlike companies whose earnings may swing widely, SPK’s sustained margin near 3.5% gives patient, risk-averse investors a reason to maintain confidence even when profit growth cools compared to historic peaks.

Industry-Leading Value, but Premium to DCF Fair Value

- SPK’s Price-to-Earnings Ratio is just 9.5x. This makes shares look inexpensive compared to both the JP Retail Distributors industry (11.8x) and closer peers (17.4x). However, the current share price of 2294.00 trades well above the DCF fair value of 436.57.

- This deep discount to peers supports value-oriented investor optimism, but the share price premium to fair value signals that market participants may be pricing in sector stability and expected growth rather than pure fundamentals.

- Industry P/E multiples suggest there could be upside if peer valuations re-rate higher. However, the DCF gap introduces caution for those focused strictly on intrinsic value measures.

- Investors attracted by the bargain P/E need to weigh the sector’s fundamental strength against the risk that shares could re-align downward toward fair value if growth or sentiment wavers.

Dividend Sustainability on Watch

- The only directly flagged risk in recent filings relates to dividend sustainability. This highlights that while SPK’s profit margins are still healthy at 3.5%, ongoing coverage of dividends may face slight pressure if earnings growth continues to decelerate.

- What stands out here is that, despite steady profits and attractive valuation metrics, even minor risks around future dividends may loom larger for income-focused investors.

- The prevailing market perspective treats sectors with stable earnings as safe havens, but even small declines in dividend coverage can quickly shift that perception.

- Portfolio managers balancing value and income should keep one eye on payout ratios to avoid being caught by an unexpected dividend reduction.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on SPK's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

SPK’s stock appears attractively valued compared to peers, but it trades significantly above its DCF fair value. This presents downside risk that pure value investors may want to consider.

If you do not want to overpay or risk a pullback, check out these 840 undervalued stocks based on cash flows to spot opportunities with more upside potential based on cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7466

SPK

Engages in the trading of automotive spare parts and accessories, and industrial vehicle parts in Japan, Asia, Oceania, Central America, and South America.

Adequate balance sheet average dividend payer.

Market Insights

Community Narratives