Rakuten Group's (TSE:4755) investors will be pleased with their respectable 55% return over the last three years

Buying a low-cost index fund will get you the average market return. But across the board there are plenty of stocks that underperform the market. For example, the Rakuten Group, Inc. (TSE:4755) share price return of 53% over three years lags the market return in the same period. In the last year the stock has gained 9.4%.

With that in mind, it's worth seeing if the company's underlying fundamentals have been the driver of long term performance, or if there are some discrepancies.

Given that Rakuten Group didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually desire strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last 3 years Rakuten Group saw its revenue grow at 8.9% per year. That's pretty nice growth. The annual gain of 15% over three years is better than nothing, but hardly impresses. So it's possible that expectations were elevated in the past, muting returns over three years. Of course, if the company can tread the path to profitability, then the current price might be too pessimistic.

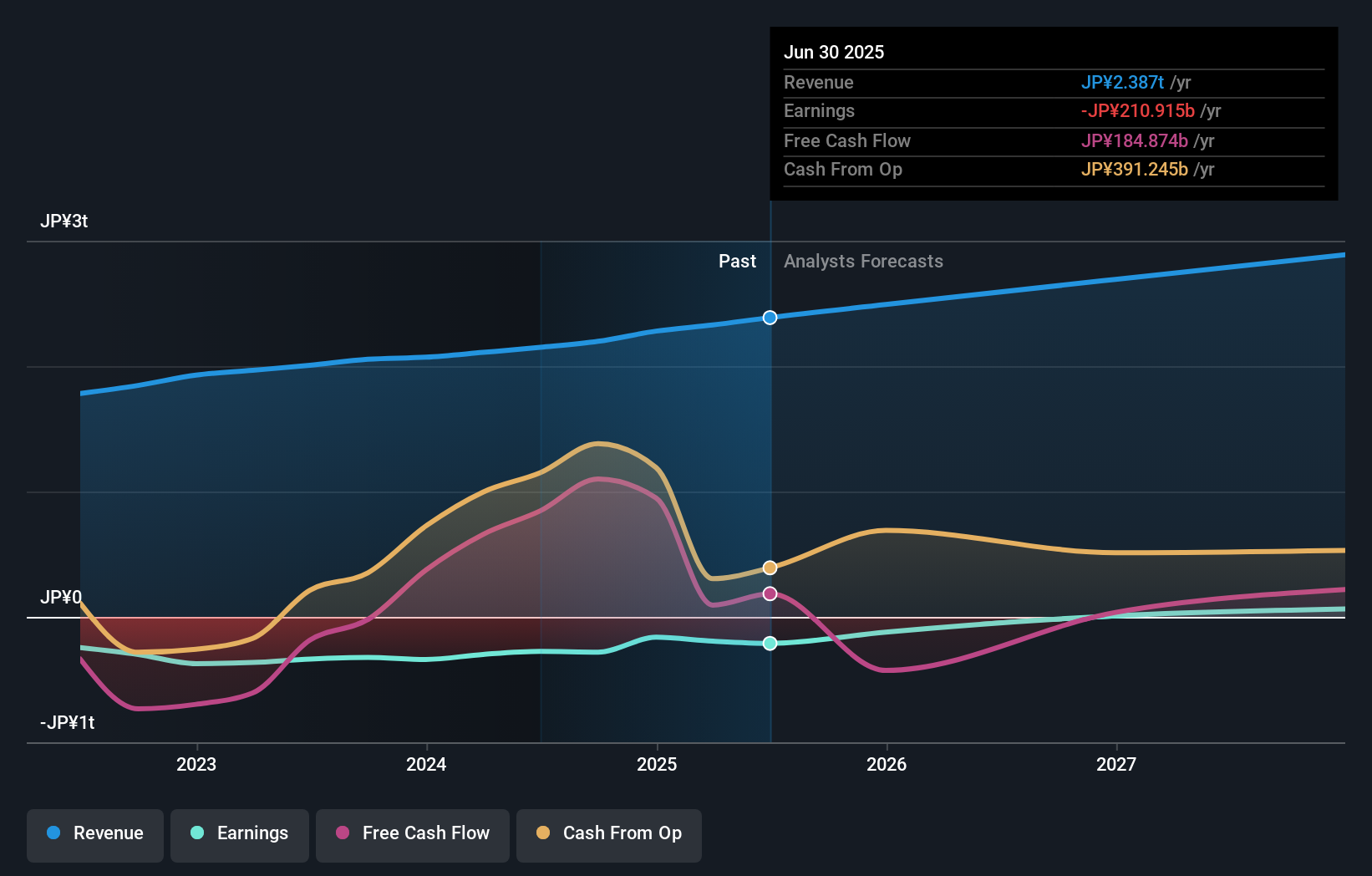

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Rakuten Group is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. So it makes a lot of sense to check out what analysts think Rakuten Group will earn in the future (free analyst consensus estimates)

A Different Perspective

Rakuten Group shareholders are up 9.4% for the year. Unfortunately this falls short of the market return. On the bright side, that's still a gain, and it is certainly better than the yearly loss of about 1.6% endured over half a decade. It could well be that the business is stabilizing. You could get a better understanding of Rakuten Group's growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

But note: Rakuten Group may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Japanese exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:4755

Rakuten Group

Provides services in e-commerce, fintech, digital content, and communications to various users in worldwide.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives