Tourism Surge and Cold Snap Might Change The Case For Investing In J. Front Retailing (TSE:3086)

Reviewed by Sasha Jovanovic

- J. Front Retailing reported an 8.2% year-on-year increase in department store sales for October 2025, marking the third consecutive month of growth, driven by strong spending from overseas visitors and brisk demand for autumn and winter apparel after a sudden temperature drop.

- This sustained sales momentum highlights how both tourism recovery and weather shifts are materially influencing the company's retail operations.

- We’ll explore how robust foreign visitor spending is shaping J. Front Retailing’s investment narrative following these strong October sales results.

Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

What Is J. Front Retailing's Investment Narrative?

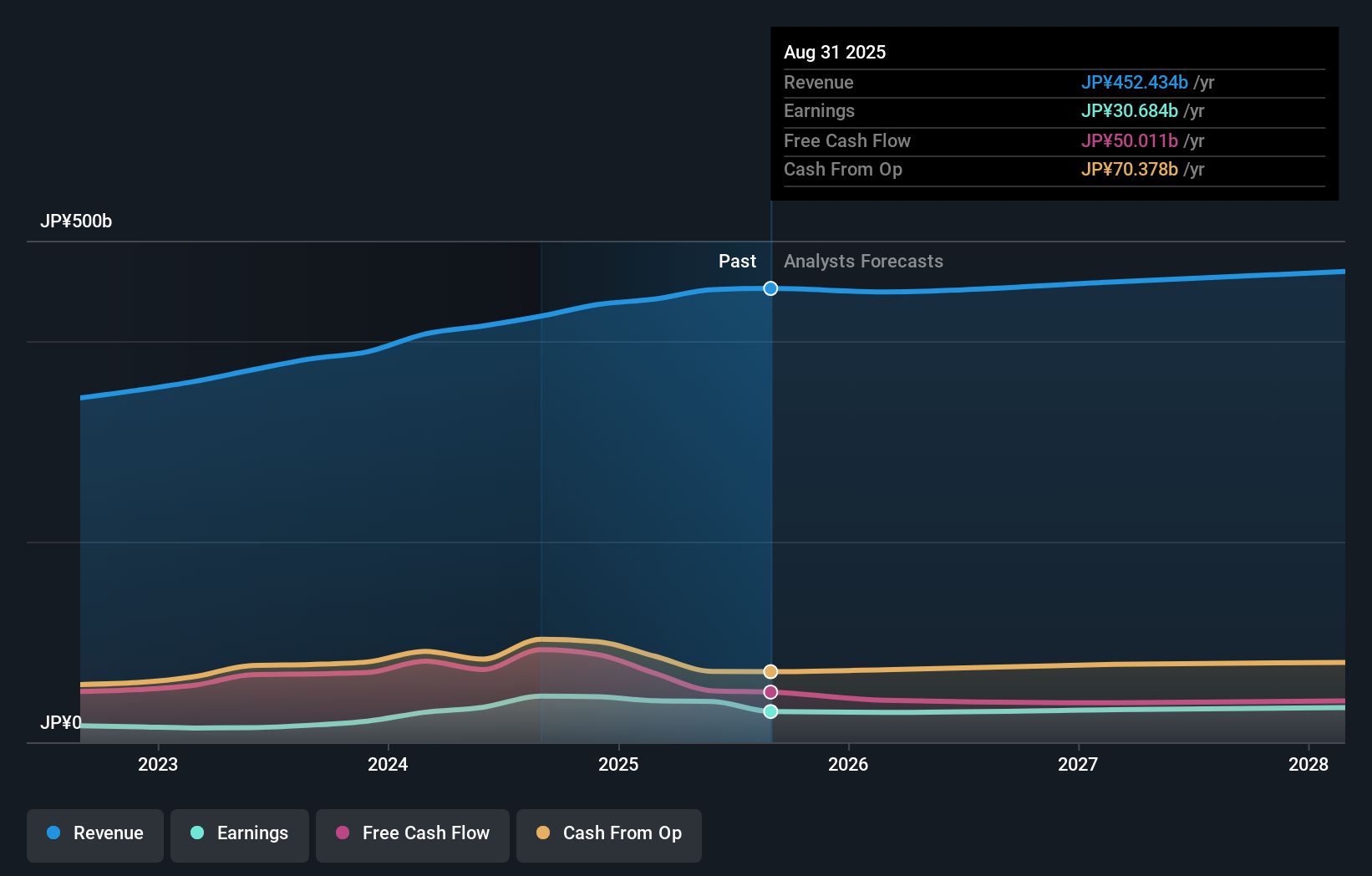

For someone considering J. Front Retailing as an investment, the big picture often hinges on a belief in the sustained revival of consumer activity and the continued influx of overseas shoppers fueling department store traffic. The recent 8.2% jump in October sales, propped up by foreign visitor spending and seasonal apparel demand, provides encouraging evidence that tourism and weather-driven trends can temporarily outweigh broader concerns. However, this comes against the backdrop of management’s recently lowered earnings outlook and a less experienced executive team, which previously cast shadows over near-term catalysts. The strong October figures introduce a potential turning point: if this momentum holds, it could prompt a reassessment of the company’s guidance and possibly temper some immediate risks around slow growth or further operating profit downgrades. Yet, the resilience of these drivers remains to be proven as the year unfolds.

But while October’s surge is encouraging, concentrated reliance on tourist demand remains a risk worth your attention. J. Front Retailing's share price has been on the slide but might be dropping deeper into value territory. Find out whether it's a bargain at this price.Exploring Other Perspectives

Explore another fair value estimate on J. Front Retailing - why the stock might be worth 8% less than the current price!

Build Your Own J. Front Retailing Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your J. Front Retailing research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free J. Front Retailing research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate J. Front Retailing's overall financial health at a glance.

Contemplating Other Strategies?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3086

Adequate balance sheet average dividend payer.

Market Insights

Community Narratives