- Japan

- /

- Specialty Stores

- /

- TSE:3046

JINS HOLDINGS (TSE:3046) Valuation Spotlight After Dividend Proposal and Governance Flexibility Update

Reviewed by Simply Wall St

JINS HOLDINGS (TSE:3046) has proposed a year-end dividend of 59 yen per share for the fiscal year ending August 2025, together with a plan to update its Articles of Incorporation to allow for greater leadership flexibility.

See our latest analysis for JINS HOLDINGS.

After a strong run earlier this year, JINS HOLDINGS’ share price has pulled back recently, declining 12.2% over the past month. It still boasts a robust 22.3% year-to-date share price return. Looking further out, its 1-year total shareholder return of 24.5% and impressive 82.7% over three years suggest that momentum has rewarded patient investors even as near-term volatility picks up around governance changes and dividend news.

If this kind of performance and boardroom activity has you curious about what else is shaping the market, now’s a great time to broaden your horizons and discover fast growing stocks with high insider ownership

With the stock recently pulling back after a multi-year rally and shares still trading below analyst targets, investors may wonder whether JINS HOLDINGS is trading at a bargain or if the market is already factoring in strong growth ahead.

Price-to-Earnings of 21.8x: Is it justified?

JINS HOLDINGS is currently trading at a price-to-earnings (P/E) ratio of 21.8x, making its shares notably more expensive than both direct peers and the broader sector. With a last close price of ¥7,780, this P/E multiple places the stock ahead of the JP Specialty Retail industry average and its peer group.

The price-to-earnings ratio tells investors how much they are paying for each yen of the company's earnings. In sectors like specialty retail, a higher P/E might reflect expectations for growing profits, brand strength, or operational momentum. However, premium multiples require ongoing earnings performance to remain justified in the eyes of the market.

Compared to the industry P/E average of 13.6x and a peer average of 15.7x, JINS HOLDINGS appears richly valued. The SWS model also estimates a fair P/E ratio of 18.6x, further suggesting that the market is pricing in a strong growth outlook. If the company struggles to maintain its impressive earnings or deliver on growth forecasts, there is potential for a reversion toward the fair ratio level.

Explore the SWS fair ratio for JINS HOLDINGS

Result: Price-to-Earnings of 21.8x (OVERVALUED)

However, slowing annual revenue and net income growth could signal headwinds if JINS HOLDINGS cannot deliver on current profit expectations.

Find out about the key risks to this JINS HOLDINGS narrative.

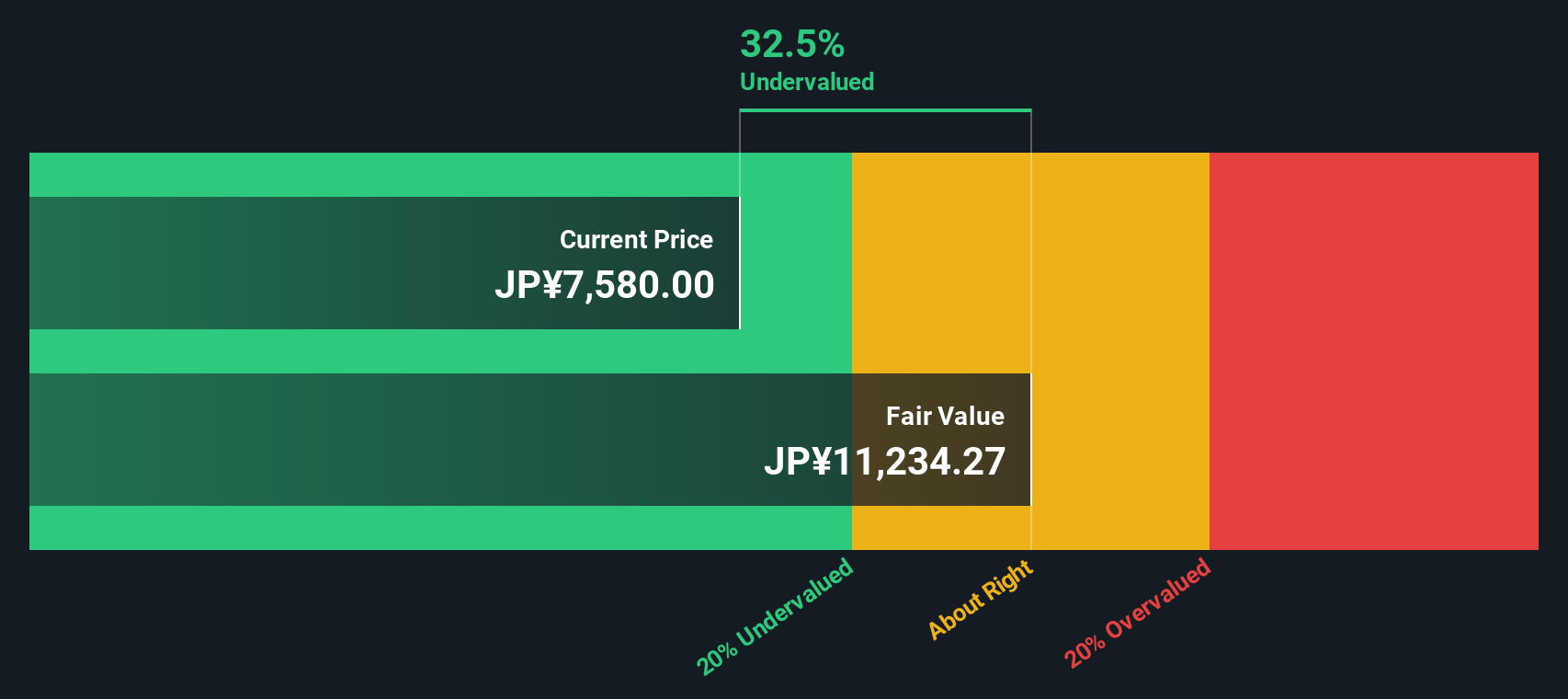

Another View: Discounted Cash Flow Suggests Undervaluation

While the current share price looks expensive relative to earnings-based metrics, our SWS DCF model sees things differently. It estimates JINS HOLDINGS’ fair value at ¥11,397, about 32% above the current price. This suggests the stock might actually be undervalued based on future cash flows. Could the market be missing something?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out JINS HOLDINGS for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 835 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own JINS HOLDINGS Narrative

Keep in mind, you can always take the numbers into your own hands and uncover your personal investment story in just a few minutes with Do it your way

A great starting point for your JINS HOLDINGS research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors know that opportunity rarely comes knocking twice. Make the most of your research by tapping into fresh stock ideas tailored for bold action-seekers.

- Unlock high-yield potential and prioritize steady returns by sizing up these 22 dividend stocks with yields > 3% with payouts exceeding 3%.

- Ride the wave of digital disruption as you zero in on companies revolutionizing healthcare with these 33 healthcare AI stocks in diagnostics, patient care, and beyond.

- Capitalize on rapid innovation and future-forward companies by checking out these 28 quantum computing stocks, which are leading the charge in quantum computing breakthroughs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3046

JINS HOLDINGS

Through its subsidiaries, engages in the planning, manufacturing, sales, and import/export of eyewear in Japan and internationally.

Outstanding track record with flawless balance sheet.

Market Insights

Community Narratives