Stock Analysis

- Japan

- /

- Specialty Stores

- /

- TSE:2769

What Type Of Returns Would Village VanguardLTD's(TYO:2769) Shareholders Have Earned If They Purchased Their SharesFive Years Ago?

In order to justify the effort of selecting individual stocks, it's worth striving to beat the returns from a market index fund. But in any portfolio, there will be mixed results between individual stocks. At this point some shareholders may be questioning their investment in Village Vanguard CO.,LTD. (TYO:2769), since the last five years saw the share price fall 35%.

Check out our latest analysis for Village VanguardLTD

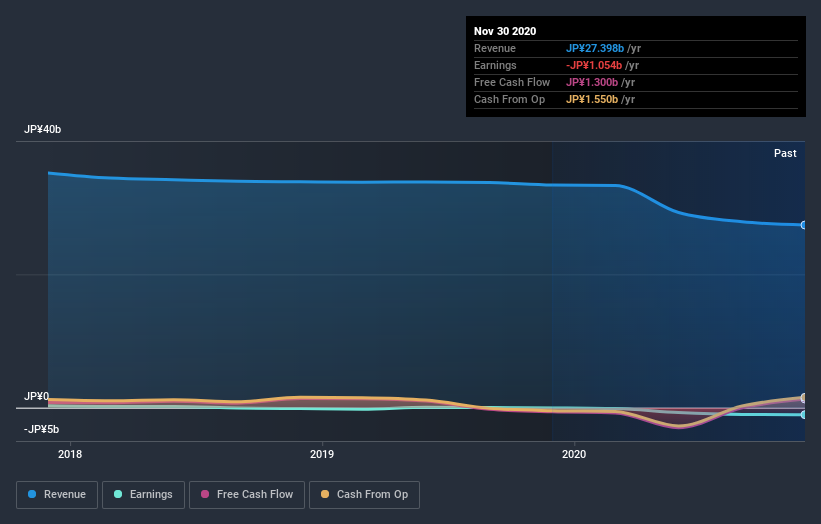

Given that Village VanguardLTD didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

Over half a decade Village VanguardLTD reduced its trailing twelve month revenue by 9.4% for each year. That puts it in an unattractive cohort, to put it mildly. On the face of it we'd posit the share price fall of 6% compound, over five years is well justified by the fundamental deterioration. This loss means the stock shareholders are probably pretty annoyed. Risk averse investors probably wouldn't like this one much.

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

This free interactive report on Village VanguardLTD's balance sheet strength is a great place to start, if you want to investigate the stock further.

What about the Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Village VanguardLTD's total shareholder return (TSR) and its share price return. The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Its history of dividend payouts mean that Village VanguardLTD's TSR, which was a 31% drop over the last 5 years, was not as bad as the share price return.

A Different Perspective

Investors in Village VanguardLTD had a tough year, with a total loss of 3.8%, against a market gain of about 13%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. However, the loss over the last year isn't as bad as the 6% per annum loss investors have suffered over the last half decade. We would want clear information suggesting the company will grow, before taking the view that the share price will stabilize. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For example, we've discovered 1 warning sign for Village VanguardLTD that you should be aware of before investing here.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on JP exchanges.

If you decide to trade Village VanguardLTD, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're helping make it simple.

Find out whether Village VanguardLTD is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSE:2769

Village VanguardLTD

Engages in the retail of books, miscellaneous goods, and CDs and DVDs.

Adequate balance sheet and overvalued.