Star Asia Investment (TSE:3468): Assessing Valuation Following Semi-Annual Dividend Increase Announcement

Reviewed by Simply Wall St

Star Asia Investment (TSE:3468) has announced a semi-annual dividend of JPY 1,745 per share, payable next April. This move signals management's confidence in the company's earnings outlook and may catch investors’ attention.

See our latest analysis for Star Asia Investment.

Against a backdrop of renewed confidence following the dividend announcement, Star Asia Investment’s share price has delivered a robust 17.4% gain year-to-date. Even more impressive, the total shareholder return over the past year has reached 30.1%, reflecting healthy momentum and a strong recovery view from the market.

If the growing appeal of dividend-focused stocks has your attention, this could be the perfect moment to broaden your search and uncover fast growing stocks with high insider ownership

With dividends on the rise and strong recent gains, investors may wonder whether Star Asia Investment is still trading below its true value or if the current price already reflects expectations for future growth.

Price-to-Earnings of 17.6x: Is it Justified?

Star Asia Investment trades at a price-to-earnings (P/E) ratio of 17.6x. Its last close price of ¥61,400 reflects a valuation below both the JP REITs industry average and peer group. This suggests the market may be undervaluing its current earnings capability relative to others in the sector.

The P/E ratio compares the company’s share price to its earnings per share and is a widely used measure to assess how much investors are paying for each unit of earnings. For real estate investment trusts (REITs), this ratio helps gauge if a stock is priced attractively based on its underlying profitability, especially as earnings tend to be more stable in this sector.

With a P/E well below the JP REITs industry average of 20.1x and the peer average of 20.3x, Star Asia Investment’s shares are trading at a noticeable discount. This lower multiple could attract investors looking for value, particularly as its 30% earnings growth outpaced the industry’s 13.5% over the past year.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 17.6x (UNDERVALUED)

However, investors should note that any slowdown in Japan’s real estate market or unexpected changes in regulation could negatively impact future returns.

Find out about the key risks to this Star Asia Investment narrative.

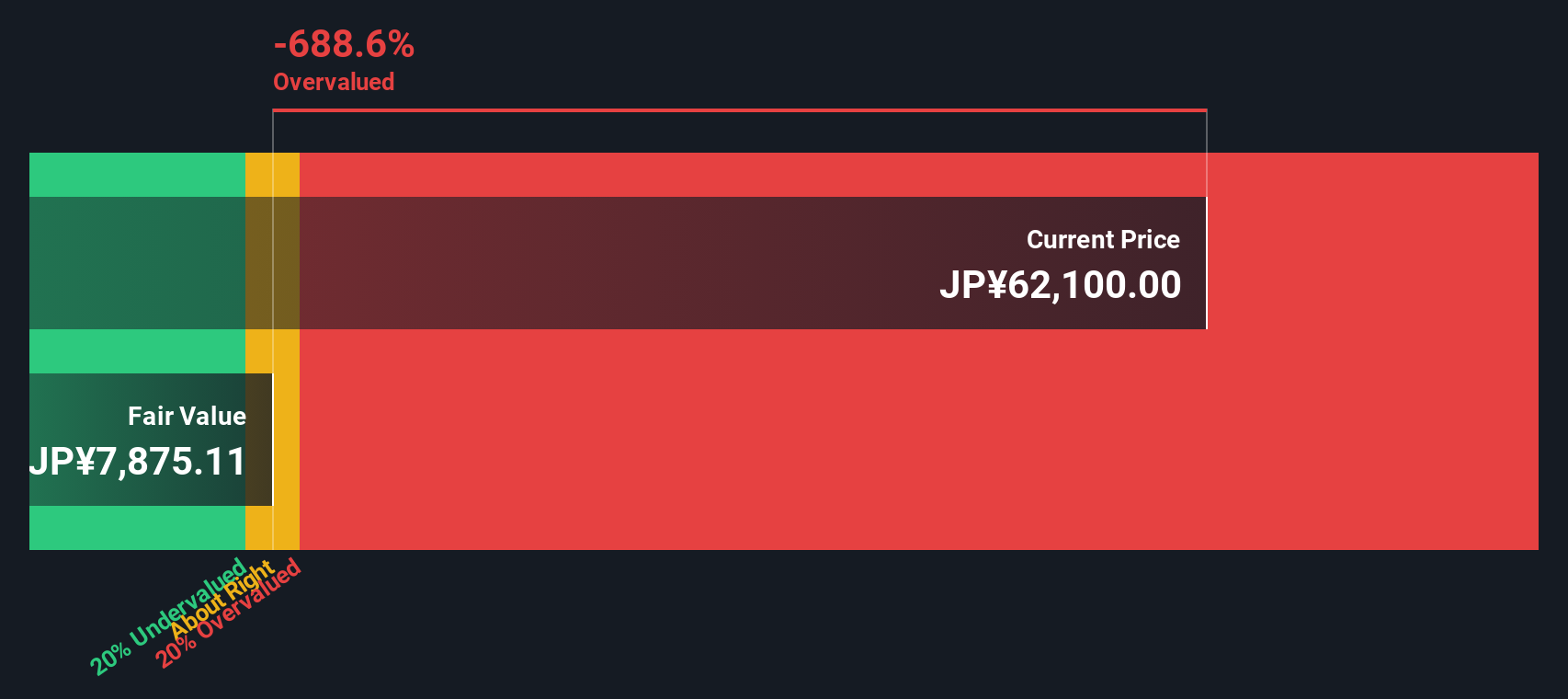

Another View: Discounted Cash Flow Perspective

Looking at Star Asia Investment through the lens of our DCF model, the shares are trading slightly below estimated fair value. The current price of ¥61,400 is about 1.5% under our DCF-derived value of ¥62,335. Could this marginal discount signal a quiet opportunity, or does it simply reflect market caution?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Star Asia Investment for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 900 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Star Asia Investment Narrative

If you see the story differently or would rather dive into the numbers firsthand, creating your own perspective takes just a few minutes, so why not Do it your way

A great starting point for your Star Asia Investment research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Ready for Your Next Investment Opportunity?

Smart investors stay ahead by broadening their horizons, and the best ideas often surface when you look beyond the obvious. Don’t wait for the crowd. Take the lead and spot opportunities before everyone else with these tailored picks:

- Uncover potential market disruptors as you review these 27 AI penny stocks creating real impact in artificial intelligence.

- Boost your income strategy by considering these 18 dividend stocks with yields > 3% offering strong yields and stable returns for your portfolio.

- Capitalize on underappreciated companies and secure hidden value with these 900 undervalued stocks based on cash flows based on robust cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3468

Star Asia Investment

Star Asia Investment Corporation (SAR) was established as a diversified real estate investment trust on December 1, 2015, under the Act on Investment Trusts and Investment Corporations (Act No.

Proven track record and fair value.

Market Insights

Community Narratives