Could Nomura Real Estate Master Fund’s Leadership Shift (TSE:3462) Signal a New Era in Overseas Strategy?

Reviewed by Sasha Jovanovic

- Nomura Real Estate Master Fund recently announced corrections to its 19th and 20th fiscal period financial results and implemented leadership changes within its asset management company, aiming to enhance accuracy and operational focus.

- These initiatives reflect the company’s emphasis on transparent governance and a strengthened approach to international operations and private fund management.

- We’ll explore how leadership changes designed to boost overseas business may shape the fund’s broader investment narrative going forward.

We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is Nomura Real Estate Master Fund's Investment Narrative?

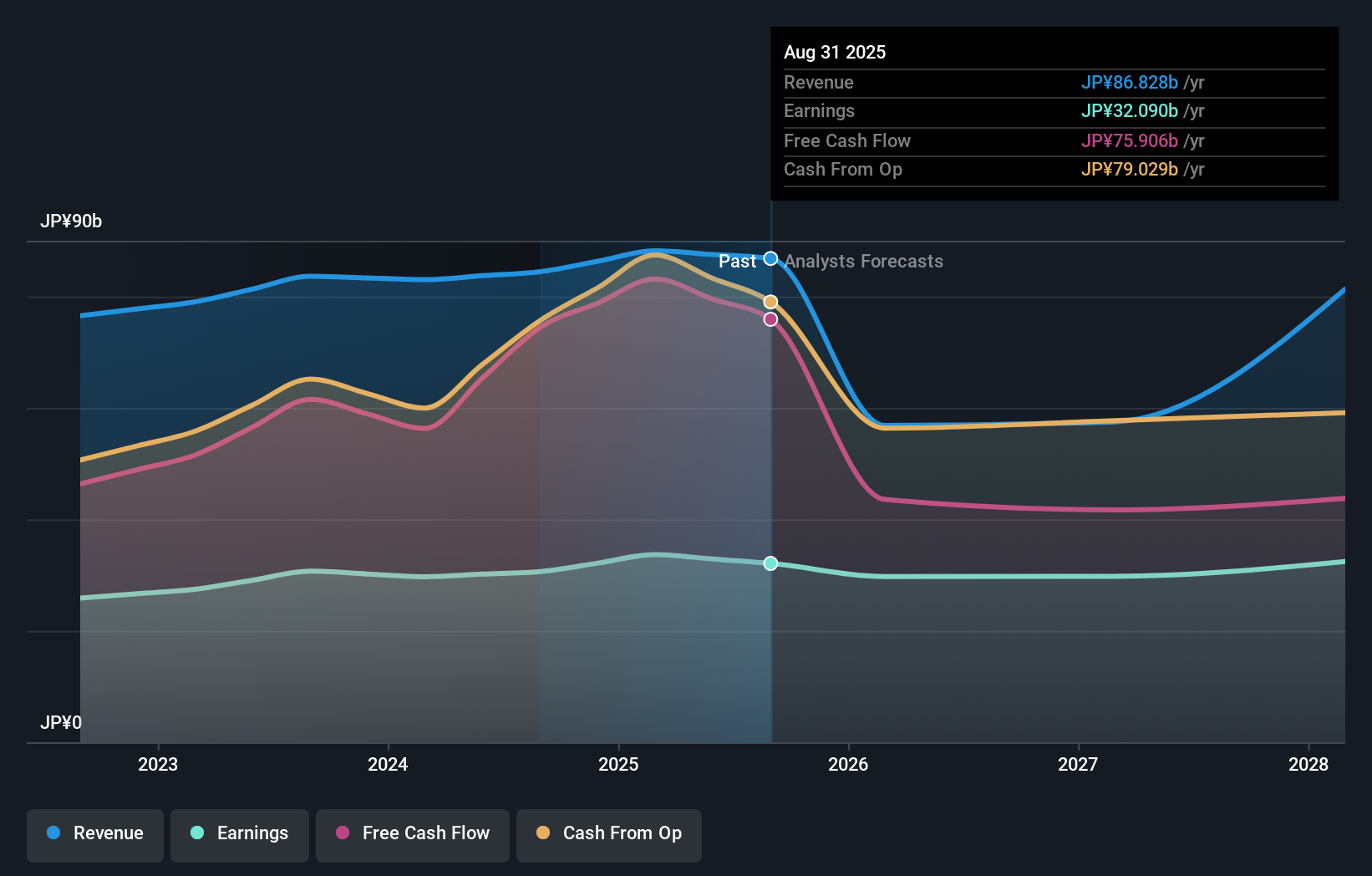

To be a shareholder in Nomura Real Estate Master Fund right now, you need to believe that the fund’s efforts at financial transparency, governance, and steady operations can keep delivering reliable income, despite muted growth prospects. Recent corrections to previous financial results and leadership changes may actually underline management’s willingness to address potential issues quickly rather than signal persistent problems. The refinancings announced are not expected to change forecasts or materially raise risk, suggesting that near-term debt obligations remain under control. The main short-term catalyst likely continues to be the stability and yield of distributions, while the chief risk remains slow earnings and revenue growth relative to peers, especially with the latest dividend guidance pointing to near-flat or slightly weaker payouts ahead. If the new focus on private fund management and international business translates to tangible growth, it could offer an upside, but the company’s risk-reward profile remains steady for now, with little change to the main investment drivers after these updates.

On the flip side, investors should keep an eye on how slower profit growth could impact future payouts. Nomura Real Estate Master Fund's shares are on the way up, but they could be overextended by 18%. Uncover the fair value now.Exploring Other Perspectives

Explore another fair value estimate on Nomura Real Estate Master Fund - why the stock might be worth just ¥170440!

Build Your Own Nomura Real Estate Master Fund Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Nomura Real Estate Master Fund research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Nomura Real Estate Master Fund research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Nomura Real Estate Master Fund's overall financial health at a glance.

Ready For A Different Approach?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nomura Real Estate Master Fund might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3462

Nomura Real Estate Master Fund

Nomura Real Estate Master Fund, Inc. (NMF) is a wholly owned subsidiary of the former Nomura Real Estate Master Fund Corporation (hereinafter referred to as the "Former NMF") and Nomura Real Estate Office Fund Investment Corporation (hereinafter referred to as "NOF") and Nomura Real Estate Residential Investment Corporation (hereinafter referred to as "NRF") will be the dissolved corporations in the consolidation-type merger.

6 star dividend payer with acceptable track record.

Market Insights

Community Narratives