Sekisui House Reit (TSE:3309): Valuation Insights Following Landmark Sustainability Linked Loan Initiative

Reviewed by Simply Wall St

Sekisui House Reit (TSE:3309) is taking a meaningful step forward by securing a JPY 9,200 million Sustainability Linked Loan, its first financing tied directly to environmental performance goals. This innovative approach highlights the company’s focus on climate-conscious growth.

See our latest analysis for Sekisui House Reit.

Sekisui House Reit’s latest sustainability-linked loan follows a stable run in the market, with its share price holding close to flat since the start of the year. The real story, though, is its building momentum: investors who have stuck with the REIT have seen a one-year total shareholder return of 14.2%, and gains continue to compound over the longer term.

If this focus on sustainable growth has you curious about other movers, now is a great moment to broaden your search and discover fast growing stocks with high insider ownership

With strong recent returns and sustainable initiatives in focus, the question now is whether Sekisui House Reit is trading at an attractive entry point, or if the market has already priced in all of its future growth potential.

Price-to-Earnings of 15.5x: Is it justified?

Sekisui House Reit trades at a price-to-earnings (P/E) ratio of 15.5x, below both its peer and industry averages. This suggests it may be modestly undervalued at its current share price of ¥79,200.

The P/E ratio measures how much investors are willing to pay for each yen of earnings and is a core valuation metric for REITs. Because these companies distribute the majority of their profits as dividends, the P/E helps compare their relative attractiveness and market confidence in future earnings stability.

The current multiple is significantly lower than the Japanese REITs industry average of 20.1x and the peer average of 22.4x. Regression analysis suggests the fair P/E should be closer to 19.3x, indicating further room for upside if the market reassesses the company’s earnings trajectory.

Explore the SWS fair ratio for Sekisui House Reit

Result: Price-to-Earnings of 15.5x (UNDERVALUED)

However, weak revenue and net income growth may limit upside potential if these trends persist, even with Sekisui House Reit's current valuation discount.

Find out about the key risks to this Sekisui House Reit narrative.

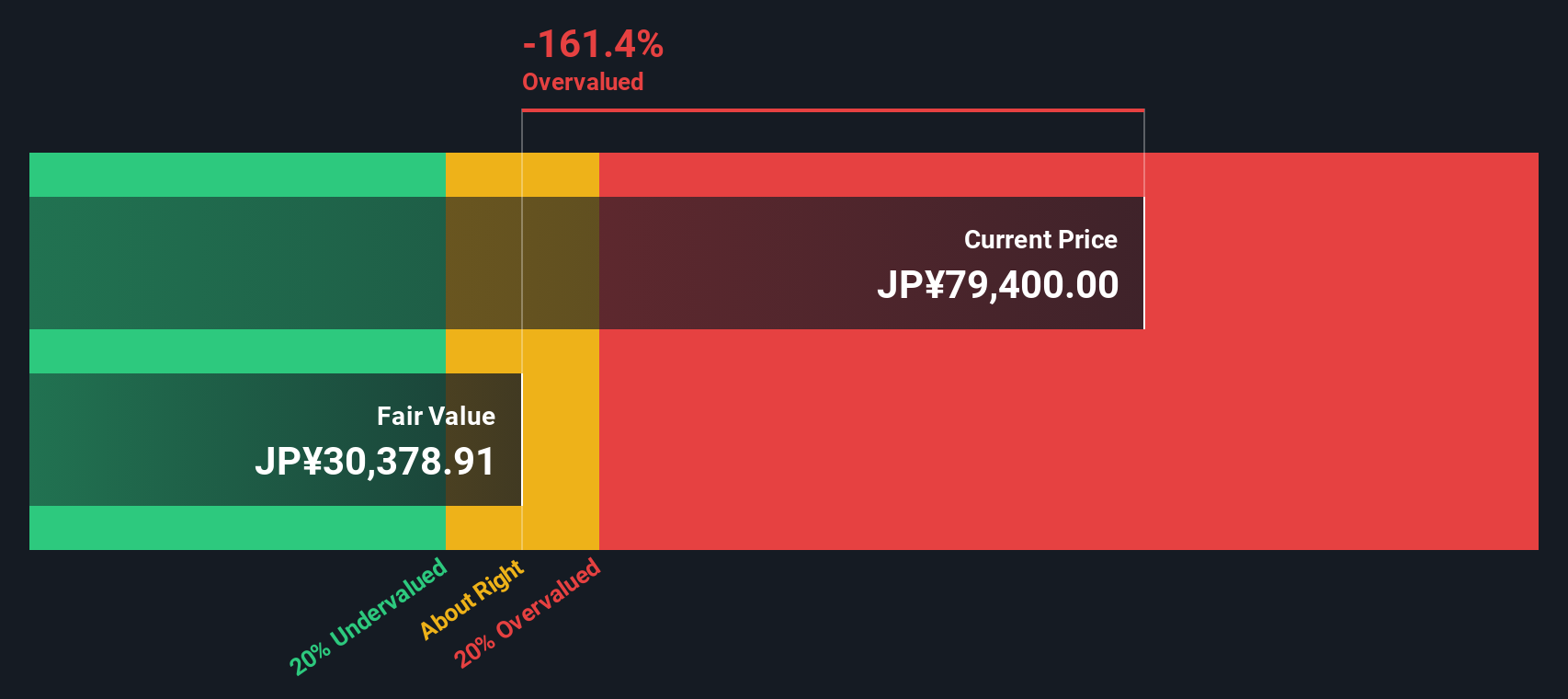

Another View: Discounted Cash Flow Tells a Different Story

While the price-to-earnings ratio suggests Sekisui House Reit may be undervalued, our DCF model arrives at a much lower fair value, about ¥31,800 versus today’s ¥79,200 price. This would mean the stock trades well above its possible intrinsic worth. Which valuation ultimately matters most for investors?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Sekisui House Reit for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 919 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Sekisui House Reit Narrative

If you want to put your own perspective to the test or dig deeper into the findings here, it only takes a few minutes to build your own viewpoint and see where the evidence leads. Do it your way

A great starting point for your Sekisui House Reit research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors never settle for just one opportunity. If you want to stay ahead, these unique stock picks could give your portfolio the edge it needs.

- Unlock future growth by targeting income with these 16 dividend stocks with yields > 3%, which offers yields above 3 percent and proven payout stability.

- Take advantage of innovation by identifying early movers with these 25 AI penny stocks, positioned to transform entire industries using artificial intelligence.

- Strengthen your strategy with smart value plays by tapping into these 919 undervalued stocks based on cash flows, which is primed for potential upside based on real cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3309

Sekisui House Reit

Sekisui House Reit, Inc. ("SHR") was established on September 8, 2014 as an investment corporation investing primarily in commercial properties including office buildings, hotels and retail and other properties, sponsored by Sekisui House, Ltd.

6 star dividend payer with solid track record.

Market Insights

Community Narratives