- Japan

- /

- Hotel and Resort REITs

- /

- TSE:3287

Does Osaka-Kansai Expo Demand Shift the Bull Case for Hoshino Resorts REIT (TSE:3287)?

Reviewed by Sasha Jovanovic

- In August 2025, Hoshino Resorts REIT reported a 9.0 percentage point increase in occupancy rate and a 10.2% rise in RevPAR, largely fueled by demand from the Osaka-Kansai World Expo, despite some Kyushu properties experiencing weaker performance due to natural disasters earlier in the year.

- This performance underscores the REIT’s ability to benefit from large-scale regional events while effectively managing risks from environmental disruptions.

- We’ll examine how Hoshino Resorts REIT’s success in leveraging major event-driven demand shapes its investment narrative going forward.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is Hoshino Resorts REIT's Investment Narrative?

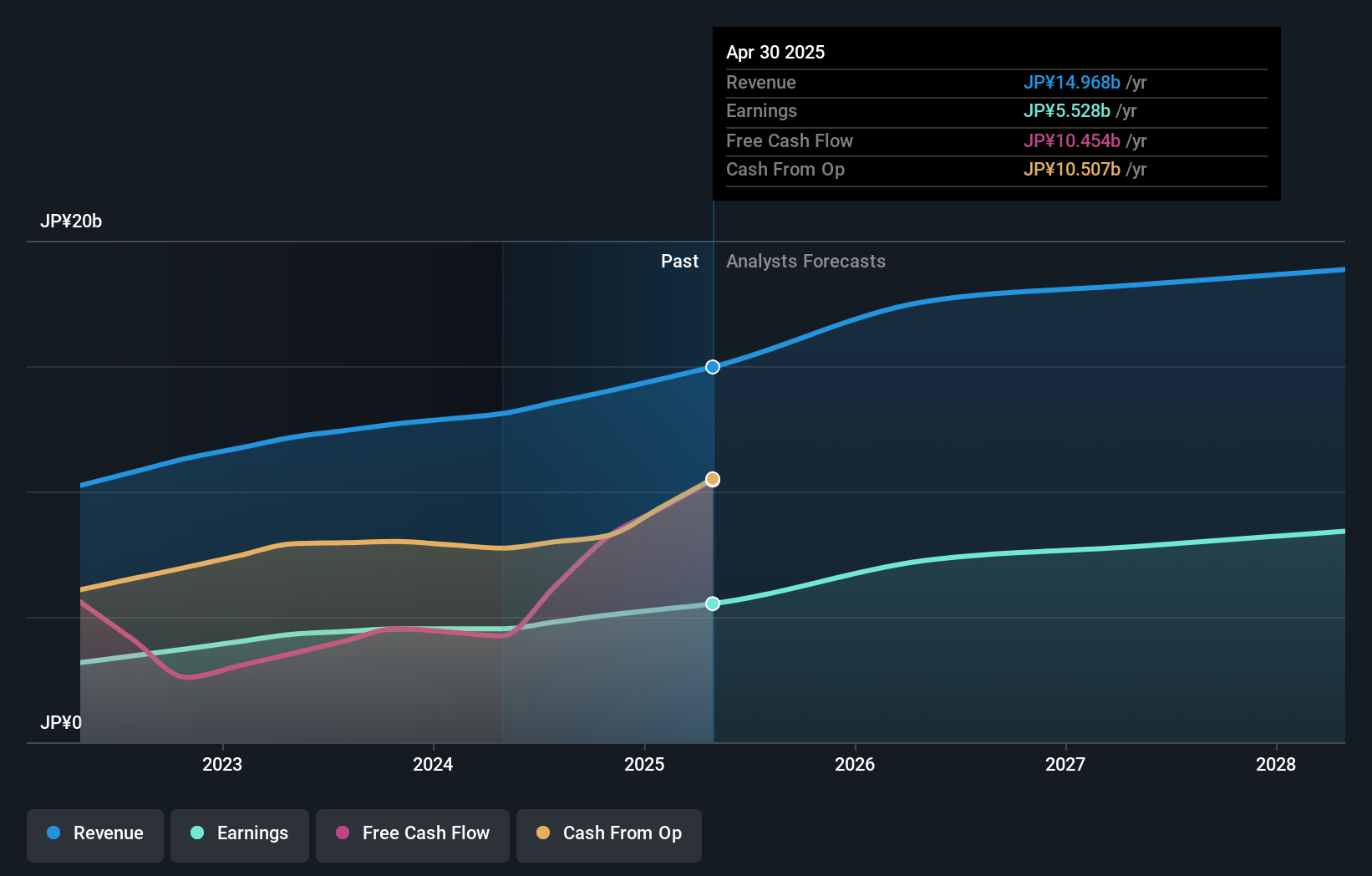

For shareholders in Hoshino Resorts REIT, the story has often revolved around resilience in the face of external pressures and a steady focus on long-term value creation. The recent surge in occupancy and RevPAR thanks to the Osaka-Kansai World Expo underscores how large-scale events can temporarily boost performance and potentially accelerate near-term earnings, likely providing some positive momentum for the coming quarters. However, this uptick also puts a sharper spotlight on a known risk: the REIT’s vulnerability to regional disruptions, like the natural disasters that hit Kyushu, which offset otherwise strong numbers. Looking forward, the ability to sustain these higher levels once the event-driven demand fades will be a key catalyst, especially as previous analysis did not fully incorporate such a strong near-term uplift. It will also be important to watch whether property-level risks or dividend reliability take center stage, given recent dividend fluctuations. Recent news appears to materially alter the short-term outlook, especially for earnings volatility and risk balance.

But weather-related disruptions can quickly change the game for investors in this space. Despite retreating, Hoshino Resorts REIT's shares might still be trading 12% above their fair value. Discover the potential downside here.Exploring Other Perspectives

Explore another fair value estimate on Hoshino Resorts REIT - why the stock might be worth just ¥284600!

Build Your Own Hoshino Resorts REIT Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Hoshino Resorts REIT research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Hoshino Resorts REIT research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Hoshino Resorts REIT's overall financial health at a glance.

Contemplating Other Strategies?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hoshino Resorts REIT might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3287

Hoshino Resorts REIT

Hoshino Resorts REIT, Inc. (hereinafter, “HRR”) invests in hotels, ryokans (Japanese-style inns) and ancillary facilities that serve at the core of the tourism industry and for which stable use is expected for the medium to long term.

Proven track record average dividend payer.

Market Insights

Community Narratives