- Japan

- /

- Residential REITs

- /

- TSE:3269

Advance Residence Investment (TSE:3269): Assessing Valuation Following Announcement of Reduced April 2026 Dividend

Reviewed by Simply Wall St

Advance Residence Investment (TSE:3269) just announced its semi-annual dividend for April 2026, revealing a reduced payout along with clear details on the ex-date and record date, a move that is already drawing investor attention.

See our latest analysis for Advance Residence Investment.

The news of a reduced dividend arrived after a stretch of solid gains for Advance Residence Investment, with the year-to-date share price return at 14.9% and a one-year total shareholder return of 18.9%. Investors seem to be weighing near-term yield changes in light of steady long-term performance, suggesting the momentum remains positive but more measured as the market reassesses risks and rewards.

If this shift has you thinking beyond yield moves, consider the current market climate and seize the chance to discover fast growing stocks with high insider ownership.

Yet with shares still up year to date and trading close to analyst targets, the key question is whether Advance Residence Investment is undervalued right now or if investors have already priced in all of the future upside.

Most Popular Narrative: 3% Overvalued

Advance Residence Investment’s most popular narrative sets its fair value estimate at ¥164,143, slightly below the recent closing price of ¥169,300. The gap reflects expectations of steady but modest improvement and hints at a key financial driver behind the consensus valuation.

Investment in the remodeling of units is expected to boost profitability in the long term as the project is projected to break even in five years and improve rent rates, positively influencing net margins and future earnings.

Want to see which bold forecasts underlie this valuation? There is a quantitative earnings leap built on expanding profit margins, with future growth assumptions you might not expect from this sector. Prepare for surprises that could challenge your own view of what is next for Advance Residence Investment.

Result: Fair Value of ¥164,143 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising interest rates or a slowdown in the property market could erode margins and serve as catalysts that challenge the current valuation narrative.

Find out about the key risks to this Advance Residence Investment narrative.

Another View: Discounted Cash Flow Says Undervalued

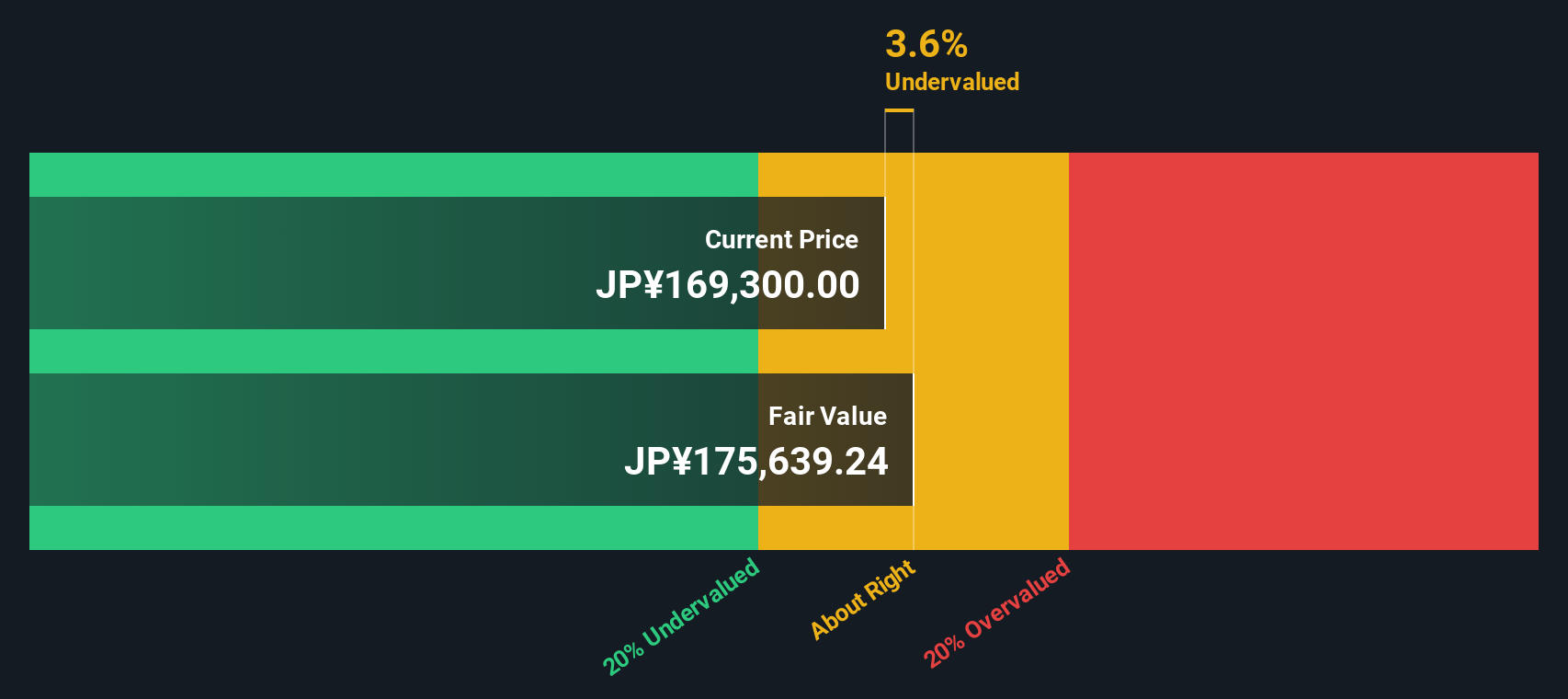

While consensus estimates suggest Advance Residence Investment is just 3% overvalued, our SWS DCF model tells a different story. It finds the shares trading at a 3.6% discount to fair value. This approach, which is based on future cash flows, highlights a subtle value disconnect. Could the market be underestimating longer-term upside?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Advance Residence Investment for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 925 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Advance Residence Investment Narrative

If you see the data in a different light or want to form your own conclusions, it's quick and easy to build your view from scratch. So why not Do it your way.

A great starting point for your Advance Residence Investment research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Broaden your investment strategy and stay one step ahead. There are countless high-potential opportunities beyond just one stock, each with its own exciting story.

- Tap into emerging industries by reviewing market leaders among these 26 AI penny stocks and see how artificial intelligence is reshaping portfolios worldwide.

- Find hidden value by uncovering overlooked gems trading below intrinsic worth by evaluating these 925 undervalued stocks based on cash flows, perfect for value-focused investors.

- Access steady income plays by checking out these 16 dividend stocks with yields > 3% featuring companies with reliable, above-market yields and resilient cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3269

Advance Residence Investment

Advance Residence Investment Corporation is the largest J-REIT specializing in residential properties and is managed by ITOCHU REIT Management Co., Ltd.

Average dividend payer with acceptable track record.

Market Insights

Community Narratives