- Japan

- /

- Industrial REITs

- /

- TSE:3249

Assessing Industrial & Infrastructure Fund Investment (TSE:3249) Valuation Following Upgraded Earnings and Dividend Forecasts

Reviewed by Kshitija Bhandaru

Industrial & Infrastructure Fund Investment (TSE:3249) just gave investors a reason to look twice, announcing an increase to both its earnings and dividend forecasts for the upcoming fiscal period. It is not every day that a company signals greater financial momentum and higher payouts at the same time. For shareholders and those keeping an eye on the stock, it is the kind of update that can nudge confidence higher, especially coming after a series of steady business developments this past quarter.

The latest guidance upgrades follow a respectable run for the stock over the past year, with a total return of 18% and positive momentum building especially in recent months. Buybacks and refinancings have also made headlines, but the focus now is squarely on the improved outlook. Despite a multi-year performance that has lagged, the recent shift in sentiment suggests that investors are starting to re-evaluate the company’s growth prospects and risk profile.

After the runup this year, is Industrial & Infrastructure Fund Investment trading at a bargain for its long-term potential, or has the market already priced in its brighter outlook?

Most Popular Narrative: 0.4% Undervalued

According to the most widely followed narrative, Industrial & Infrastructure Fund Investment is currently trading just below its estimated fair value, with a cautious margin suggesting the stock may have slight upside potential.

IIF's focus on acquiring inflation-resistant assets and incorporating CPI-linked rent clauses at new and existing properties is expected to strengthen revenue and potentially enhance net margins by maintaining rental income in real terms. The ongoing and planned redevelopment projects, including IIF Narashino Logistics Center 2, aim to boost the asset's intrinsic value and may contribute to revenue growth and higher net asset value (NAV).

Curious about the key drivers behind this fair value estimate? The analyst consensus is built on ambitious projections about future rent growth, portfolio diversification and financial performance metrics that most investors never see. Want to uncover the high-conviction numbers and bold strategic assumptions that underpin this target? The narrative breaks down the crucial variables and reveals why the valuation case might be stronger than it appears at first glance.

Result: Fair Value of ¥136,857 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, challenges such as rising interest rates or tenant pushback on CPI-linked rents could quickly shift the outlook and dampen growth expectations.

Find out about the key risks to this Industrial & Infrastructure Fund Investment narrative.Another View: SWS DCF Model Has a Different Take

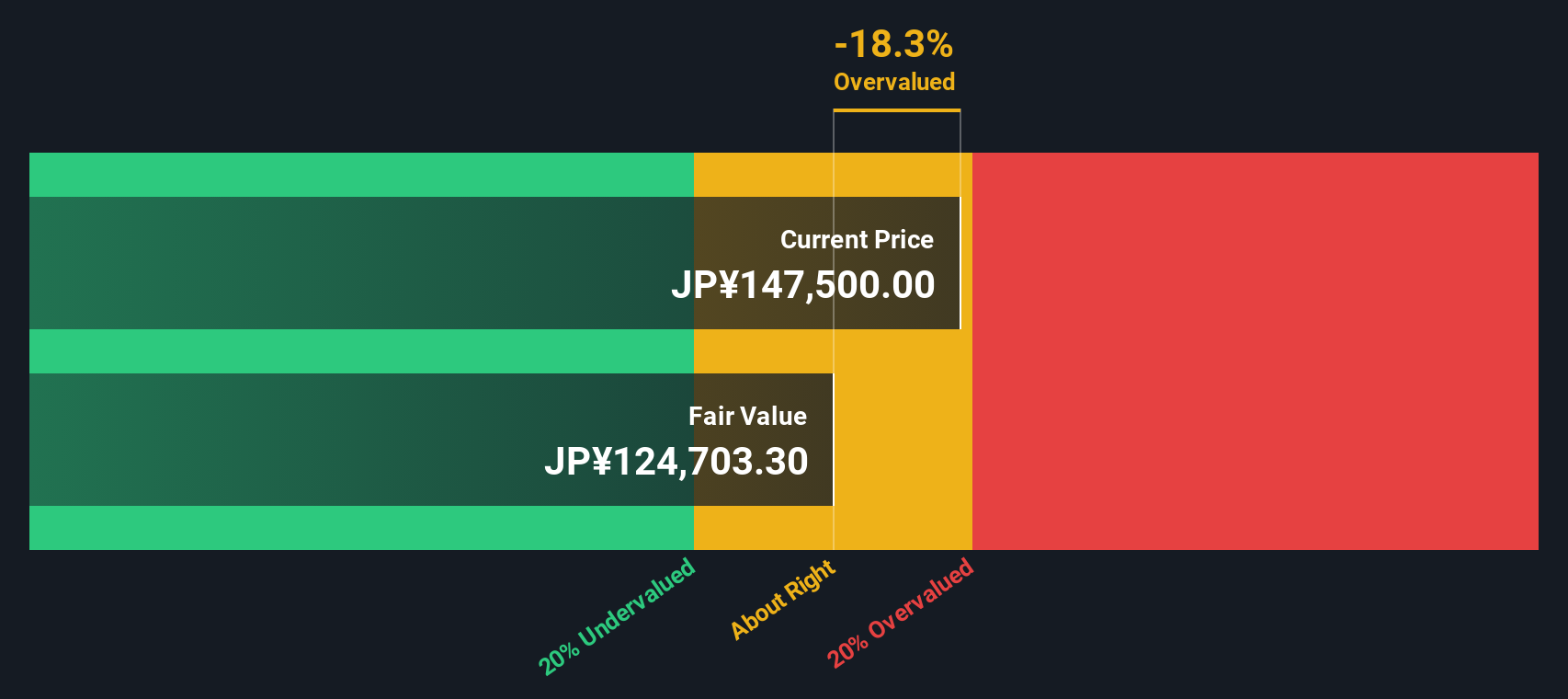

While multiples suggest the stock is reasonably valued compared to its sector, our SWS DCF model paints a more cautious picture and indicates the shares may be trading above fair value. Which approach wins out?

Look into how the SWS DCF model arrives at its fair value.

Stay updated when valuation signals shift by adding Industrial & Infrastructure Fund Investment to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Industrial & Infrastructure Fund Investment Narrative

If you would rather chart your own course or have a different interpretation, you can assemble your own perspective in just a few minutes. Do it your way.

A great starting point for your Industrial & Infrastructure Fund Investment research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Angles?

Don’t let new opportunities slip by. Get ahead of market trends and uncover hidden standouts using the Simply Wall Street screener. Here are three timely ways you can spot your next potential winner:

- Unlock steady income by targeting companies with reliable payouts when you check out dividend stocks with yields > 3%.

- Catalyze your portfolio’s growth by scouting out the most promising names in artificial intelligence through AI penny stocks.

- Zero in on value gems the market has overlooked with opportunities waiting in undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3249

Industrial & Infrastructure Fund Investment

IIF was established on March 26, 2007 based on “Act on Investment Trust and Investment Corporation” (hereinafter referred to as “Investment Trust Law”) and became listed on the J-REIT market of the Tokyo Stock Exchange on October 18, 2007 (ticker code: 3249).

6 star dividend payer with proven track record.

Market Insights

Community Narratives