- Japan

- /

- Real Estate

- /

- TSE:8927

Meiho Enterprise Co., Ltd. (TSE:8927) Stock's 39% Dive Might Signal An Opportunity But It Requires Some Scrutiny

Meiho Enterprise Co., Ltd. (TSE:8927) shareholders won't be pleased to see that the share price has had a very rough month, dropping 39% and undoing the prior period's positive performance. Looking back over the past twelve months the stock has been a solid performer regardless, with a gain of 16%.

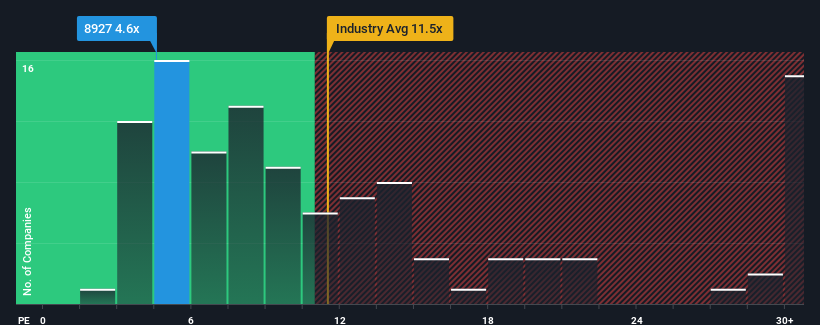

In spite of the heavy fall in price, given about half the companies in Japan have price-to-earnings ratios (or "P/E's") above 14x, you may still consider Meiho Enterprise as a highly attractive investment with its 4.6x P/E ratio. However, the P/E might be quite low for a reason and it requires further investigation to determine if it's justified.

Meiho Enterprise certainly has been doing a great job lately as it's been growing earnings at a really rapid pace. It might be that many expect the strong earnings performance to degrade substantially, which has repressed the P/E. If that doesn't eventuate, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

See our latest analysis for Meiho Enterprise

What Are Growth Metrics Telling Us About The Low P/E?

Meiho Enterprise's P/E ratio would be typical for a company that's expected to deliver very poor growth or even falling earnings, and importantly, perform much worse than the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 55% last year. The latest three year period has also seen an excellent 80% overall rise in EPS, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing earnings over that time.

This is in contrast to the rest of the market, which is expected to grow by 9.8% over the next year, materially lower than the company's recent medium-term annualised growth rates.

In light of this, it's peculiar that Meiho Enterprise's P/E sits below the majority of other companies. It looks like most investors are not convinced the company can maintain its recent growth rates.

The Key Takeaway

Having almost fallen off a cliff, Meiho Enterprise's share price has pulled its P/E way down as well. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Meiho Enterprise currently trades on a much lower than expected P/E since its recent three-year growth is higher than the wider market forecast. When we see strong earnings with faster-than-market growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. At least price risks look to be very low if recent medium-term earnings trends continue, but investors seem to think future earnings could see a lot of volatility.

And what about other risks? Every company has them, and we've spotted 4 warning signs for Meiho Enterprise (of which 2 are significant!) you should know about.

If you're unsure about the strength of Meiho Enterprise's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8927

Meiho Enterprise

Engages in brokerage and rental real estate business in Japan.

Good value with proven track record.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026