- Japan

- /

- Real Estate

- /

- TSE:8923

Tosei (TSE:8923) Trades Below Peers on 10.8x P/E, Reinforcing Value Narrative

Reviewed by Simply Wall St

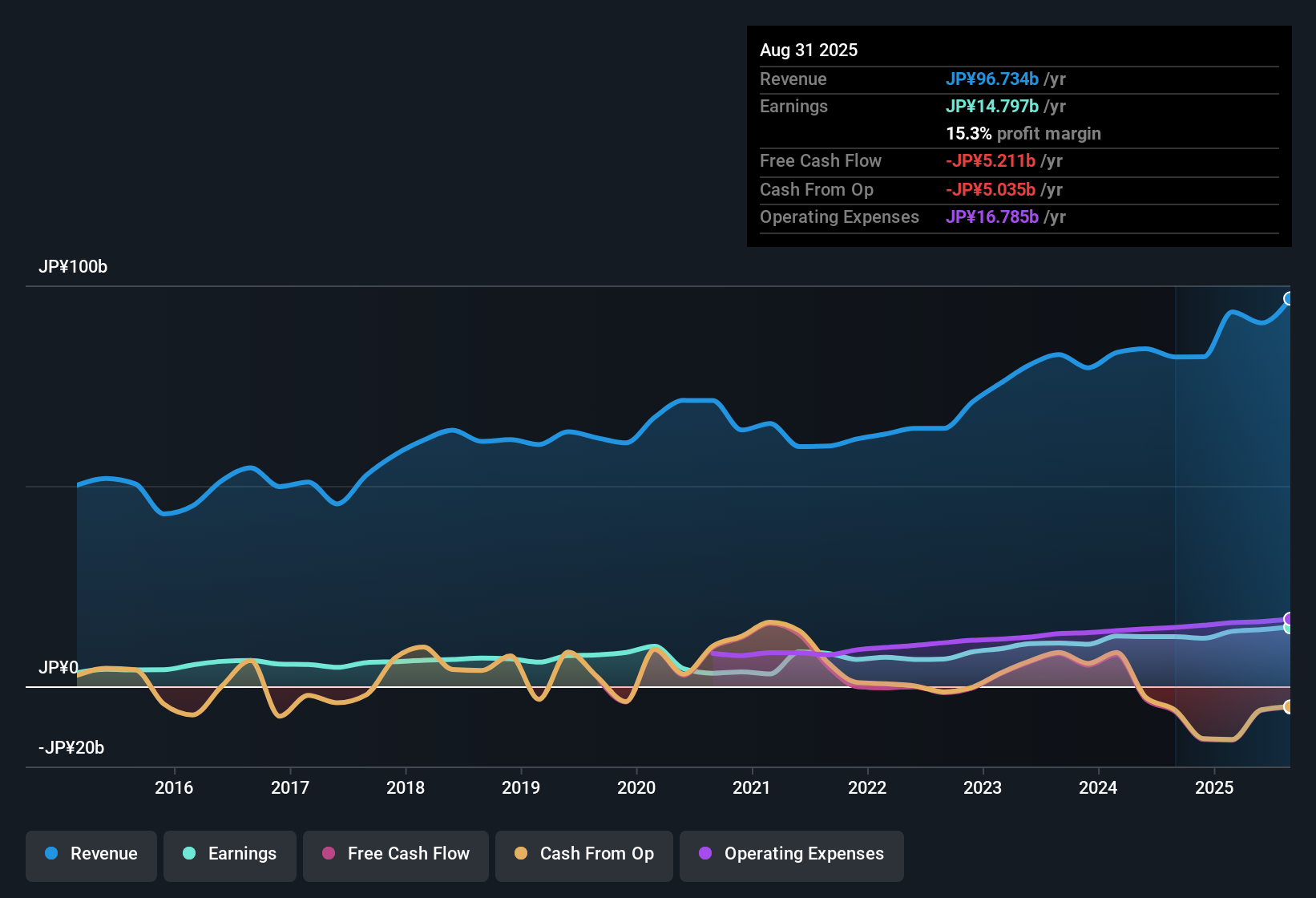

Tosei (TSE:8923) delivered another year of robust performance, with earnings forecast to grow 5.35% per year and revenue projected to expand at an impressive 12.8% annually. This outpaces the broader Japanese market’s 4.4% growth rate. The company reported a net profit margin of 15.3%, a slight uptick from last year’s 15.1%, and its earnings have increased at a 23.1% annual rate over the last five years. However, recent annual growth of 19.5% fell just shy of that pace. Investors are weighing these strong historical results and healthy margins against flagged concerns around financial position and dividend sustainability.

See our full analysis for Tosei.The next section will put these headline numbers in context by comparing them to the key market narratives. This will reveal where the current story has support and where it might be put to the test.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Margin Creeps Up to 15.3%

- Net profit margin improved slightly to 15.3% compared to 15.1% last year, indicating that Tosei is squeezing more profit out of each dollar of sales even as top-line growth accelerates.

- Tosei's solid profitability aligns with the view that stable real estate operators are attracting capital, especially during periods of tepid growth sector-wide.

- The company's ability to maintain and modestly expand margins supports the thesis that operational stability is now as prized as aggressive expansion.

- Still, caution is warranted as even a small dip in margin could quickly test investor patience given the moderate sector-wide growth of just 4.4% in Japan.

Five-Year Earnings Climb: 23.1% Growth

- Earnings have expanded at a 23.1% annual clip over the past five years, though the most recent annual increase of 19.5% falls a bit short of this longer-term pace.

- This trajectory highlights how Tosei’s reputation as a defensive play with reliable growth is supported by its strong historical record.

- Market watchers often cite the high-quality earnings and consistent expansion as a reason to prefer names like Tosei over flashier, less proven peers.

- The slower most recent growth compared to the five-year average could add fuel to debates about whether the best is now behind the company.

Trading at 10.8x Earnings, A Discount to Peers

- Tosei’s price-to-earnings ratio of 10.8x is lower than both the peer average of 16.3x and the Japanese Real Estate industry average of 11.4x, yet the stock trades above its DCF fair value of 134.52.

- This valuation detail emphasizes the tension between Tosei’s market positioning as a “value” play and a more cautious interpretation of its true intrinsic value.

- On one hand, the current market price looks like a bargain next to sector and peer multiples, a point often championed by value-oriented investors.

- On the other, trading above DCF fair value hints at market participants factoring in stability and earnings quality, but perhaps overlooking flagged concerns like financial position and dividend sustainability.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Tosei's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

While Tosei impresses with its steady growth and solid margins, ongoing questions remain about its financial position and how sustainable its dividend really is.

Want companies with stronger balance sheets and healthier cash flows? Use our solid balance sheet and fundamentals stocks screener to identify businesses built for resilience and dependable returns through all market conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tosei might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8923

Tosei

Operates in the revitalization, development, rental, fund and consulting, property management, and hotel businesses in Japan.

Fair value with acceptable track record.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026