- Japan

- /

- Real Estate

- /

- TSE:8850

Starts (TSE:8850) Valuation in Focus After Announcing Higher Dividend for Fiscal 2026

Reviewed by Simply Wall St

Starts (TSE:8850) just unveiled a higher interim dividend for the fiscal year ending March 2026, announcing JPY 65 per share, up from JPY 55 the previous year. This signals management’s optimism about their recent performance.

See our latest analysis for Starts.

Starts’ latest dividend boost comes after a solid run, with the shares up 22.65% year-to-date and a standout 28.57% total shareholder return over the last twelve months. While momentum slowed slightly in recent weeks, long-term holders have seen strong gains approaching 95% over five years. This has helped support confidence in the company’s trajectory.

If this kind of sustained growth has you looking for what else might be building momentum, now is a great time to broaden your search and discover fast growing stocks with high insider ownership

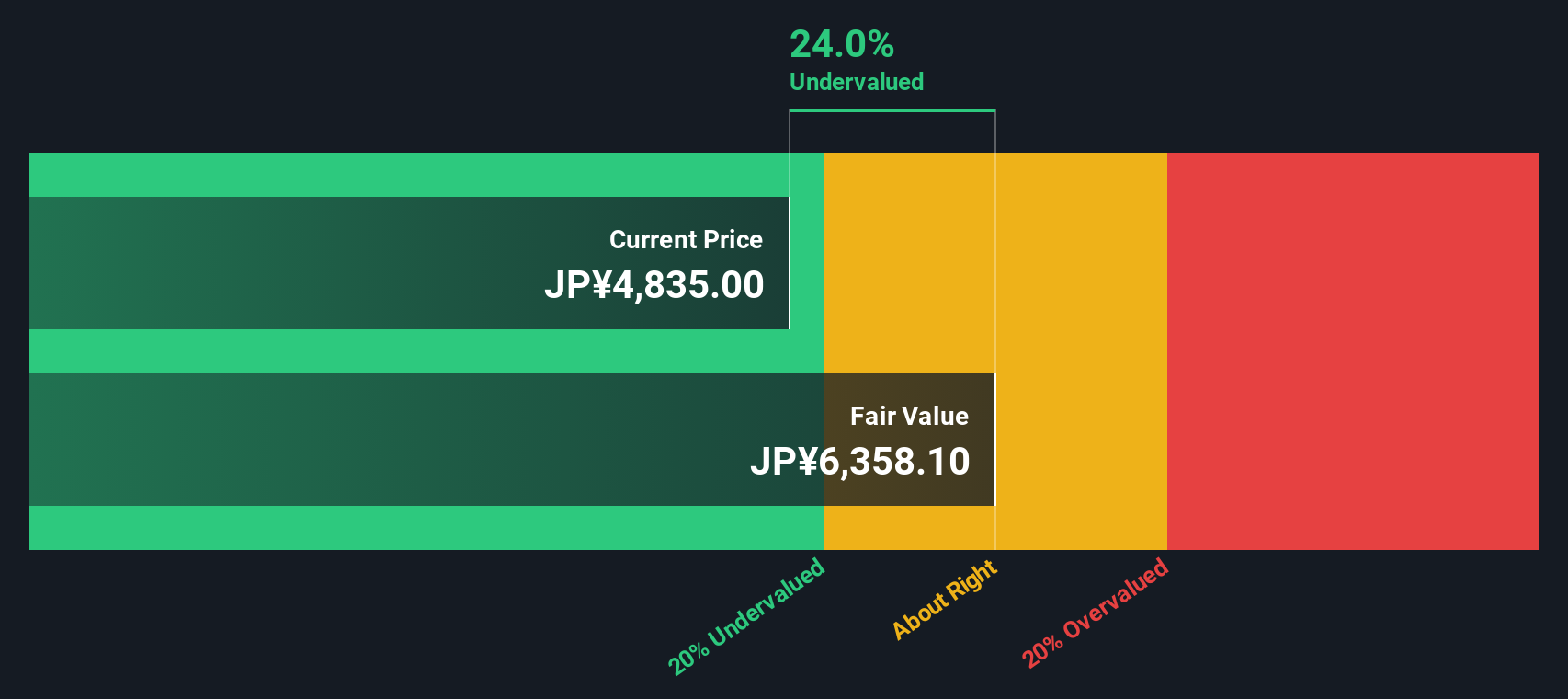

But with shares now trading just shy of analyst targets and a sizeable 26% discount to intrinsic value, the question for investors is whether Starts remains undervalued or if the market has already priced in its future growth potential.

Price-to-Earnings of 9.7x: Is it justified?

Starts currently trades at a price-to-earnings (P/E) ratio of 9.7x, below both industry and peer averages, based on the latest close of ¥4,630 per share. This suggests the market may be undervaluing the company's earnings relative to its sector.

The price-to-earnings ratio compares a company’s current share price to its per-share earnings, offering a direct measure of how much investors are willing to pay today for future profit. For real estate management and development companies like Starts, the P/E can be especially relevant because it reflects both growth expectations and perceived risk in a sector sensitive to economic cycles.

With the industry and peer averages at 11.3x, Starts appears attractively valued. Even more compelling, its P/E of 9.7x remains meaningfully below the estimated fair P/E of 15.6x. This positions the company as a strong relative value play and indicates the market could be underestimating its future earnings potential.

Explore the SWS fair ratio for Starts

Result: Price-to-Earnings of 9.7x (UNDERVALUED)

However, despite strong fundamentals, any slowdown in Japan’s property market or sudden shifts in economic conditions could quickly reverse Starts’ recent gains.

Find out about the key risks to this Starts narrative.

Another View: Discounted Cash Flow Model

Taking a different angle, our SWS DCF model values Starts at ¥6,295 per share, which is about 26% above the current price. This approach supports the idea that the shares remain fundamentally undervalued. The real question is which outlook the market will trust going forward.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Starts for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 901 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Starts Narrative

If you see things differently, or want to develop your own perspective, you can quickly put together your own analysis in just a few minutes with Do it your way.

A great starting point for your Starts research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Confident investors stay ahead by seeking unique opportunities before the crowd catches on. Take a moment now to spot tomorrow’s winners using these power screens.

- Capitalize on untapped growth by targeting these 26 quantum computing stocks at the forefront of transformative computing breakthroughs.

- Boost your income strategy as you sift through these 18 dividend stocks with yields > 3% with impressive yields above 3% and solid fundamentals.

- Ride the next innovation wave by scouting these 27 AI penny stocks with high potential in artificial intelligence-driven industries.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8850

Starts

Engages in the construction, real estate management, and tenant recruitment in Japan and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Community Narratives