- Japan

- /

- Real Estate

- /

- TSE:8801

Is Mitsui Fudosan's (TSE:8801) Share Buyback Pause Hinting at a Broader Strategic Shift?

Reviewed by Sasha Jovanovic

- Mitsui Fudosan announced that it did not repurchase any of its shares from October 1 to October 31, 2025, despite having an active authorization to buy back up to 50 million shares by January 31, 2026.

- This pause in share buybacks may signal a shift in capital allocation priorities, potentially prompting questions about management’s near-term outlook.

- We will explore how the lack of share repurchases may alter Mitsui Fudosan’s investment narrative and management focus.

Find companies with promising cash flow potential yet trading below their fair value.

Mitsui Fudosan Investment Narrative Recap

Shareholders in Mitsui Fudosan typically believe in the enduring demand for premium real estate and the company's ability to deliver value through high-occupancy projects in Tokyo's prime locations. The recent pause in share buybacks does not materially impact the near-term catalyst, solid demand and price realization in residential and office segments, though it may heighten awareness of balance sheet management as Mitsui Fudosan carries elevated debt levels, exposing it to interest rate and refinancing risks. Among recent corporate developments, Mitsui Fudosan’s announcement of increased dividend forecasts for FY2026 stands out. This move reinforces the company's ongoing commitment to shareholder returns and aligns with the bullish catalyst of strong underlying operating performance and continued growth in high-value real estate, helping offset any potential disappointment from slower buyback activity. Yet, in contrast to upbeat growth signals, there remains the question of how Mitsui Fudosan could be affected if interest rates move higher and...

Read the full narrative on Mitsui Fudosan (it's free!)

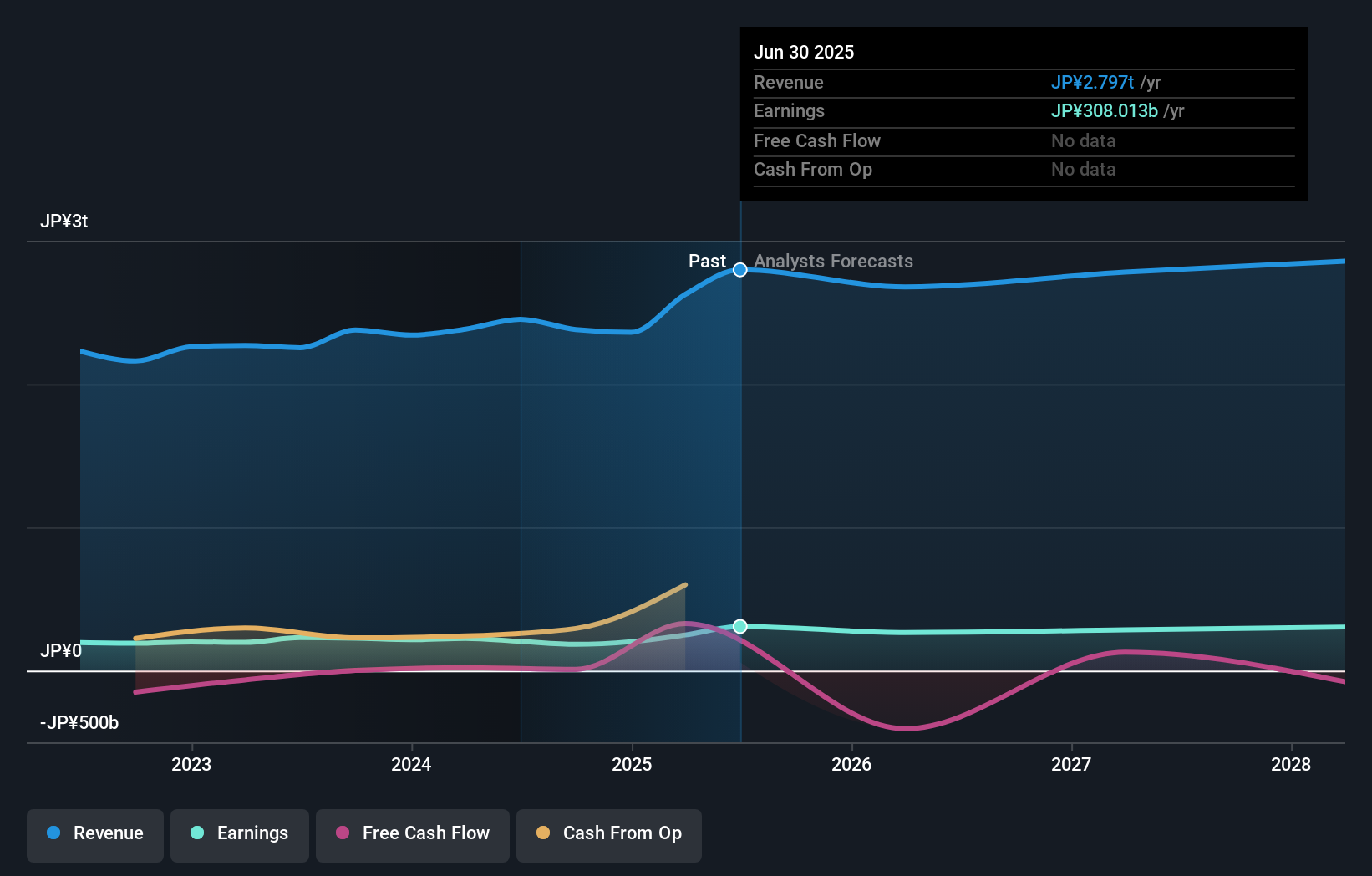

Mitsui Fudosan is projected to have revenues of ¥2,872.2 billion and earnings of ¥304.4 billion by 2028. This outlook assumes an annual revenue decline of 0.9% and a decrease in earnings of ¥3.6 billion from the current ¥308.0 billion.

Uncover how Mitsui Fudosan's forecasts yield a ¥1805 fair value, a 13% upside to its current price.

Exploring Other Perspectives

Investor fair value estimates from the Simply Wall St Community show just one perspective at ¥1,804.55 per share. With sustained earnings growth but high debt remaining front of mind, readers may want to see how sentiment varies and review a spectrum of opinions.

Explore another fair value estimate on Mitsui Fudosan - why the stock might be worth as much as 13% more than the current price!

Build Your Own Mitsui Fudosan Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Mitsui Fudosan research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Mitsui Fudosan research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Mitsui Fudosan's overall financial health at a glance.

Ready For A Different Approach?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8801

Established dividend payer with proven track record.

Similar Companies

Market Insights

Community Narratives