- Japan

- /

- Hospitality

- /

- TSE:6412

3 Reliable Dividend Stocks Yielding Up To 4.6%

Reviewed by Simply Wall St

In the wake of recent global market developments, where U.S. stocks have surged to record highs on hopes of growth and tax reforms following a significant political shift, investors are keenly observing how these changes might impact their portfolios. Amidst this backdrop, dividend stocks continue to be a focal point for those seeking stable income streams, as they offer potential for consistent returns even in fluctuating economic climates. A good dividend stock typically combines reliable payouts with solid financial health and resilience to market volatility, making them attractive options in today's dynamic environment.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.51% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 6.83% | ★★★★★★ |

| Allianz (XTRA:ALV) | 4.88% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.57% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.37% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.68% | ★★★★★★ |

| James Latham (AIM:LTHM) | 6.15% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.36% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.37% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.90% | ★★★★★★ |

Click here to see the full list of 1946 stocks from our Top Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

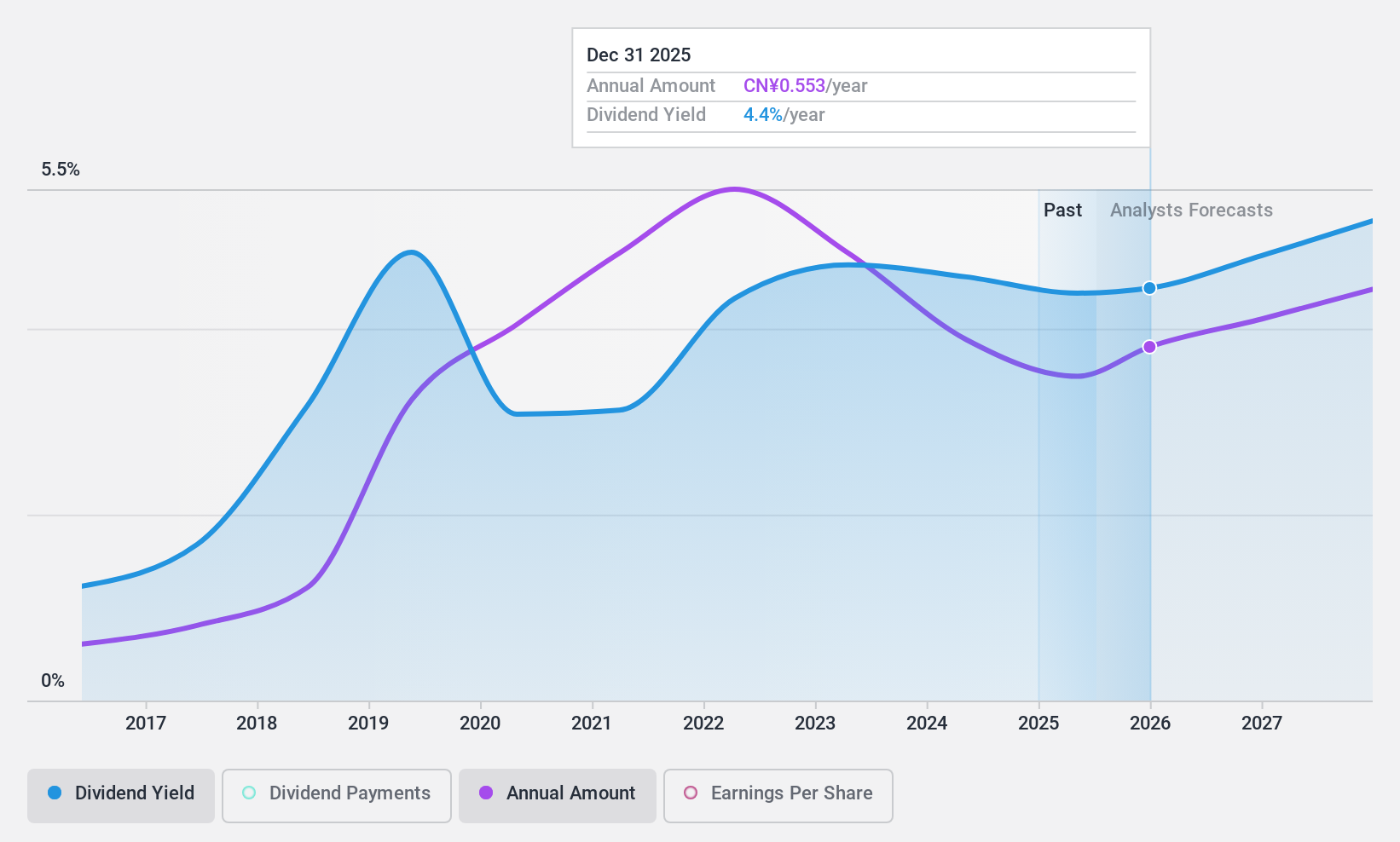

Citic Pacific Special Steel Group (SZSE:000708)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: CITIC Pacific Special Steel Group Co., Ltd is a Chinese company that manufactures and sells steel materials, with a market cap of CN¥64.05 billion.

Operations: The company generates revenue of CN¥111.11 billion from its Steel Products Business segment.

Dividend Yield: 4.4%

Citic Pacific Special Steel Group's dividend payments are well-supported by earnings and cash flows, with a payout ratio of 55% and a cash payout ratio of 34.5%. Despite trading at good value, the company has an unstable dividend track record with past volatility. Recent earnings showed a decline in net income to CNY 3.84 billion for nine months ending September 2024 from CNY 4.37 billion last year, impacting dividend reliability perceptions despite growth over ten years.

- Delve into the full analysis dividend report here for a deeper understanding of Citic Pacific Special Steel Group.

- Our valuation report unveils the possibility Citic Pacific Special Steel Group's shares may be trading at a discount.

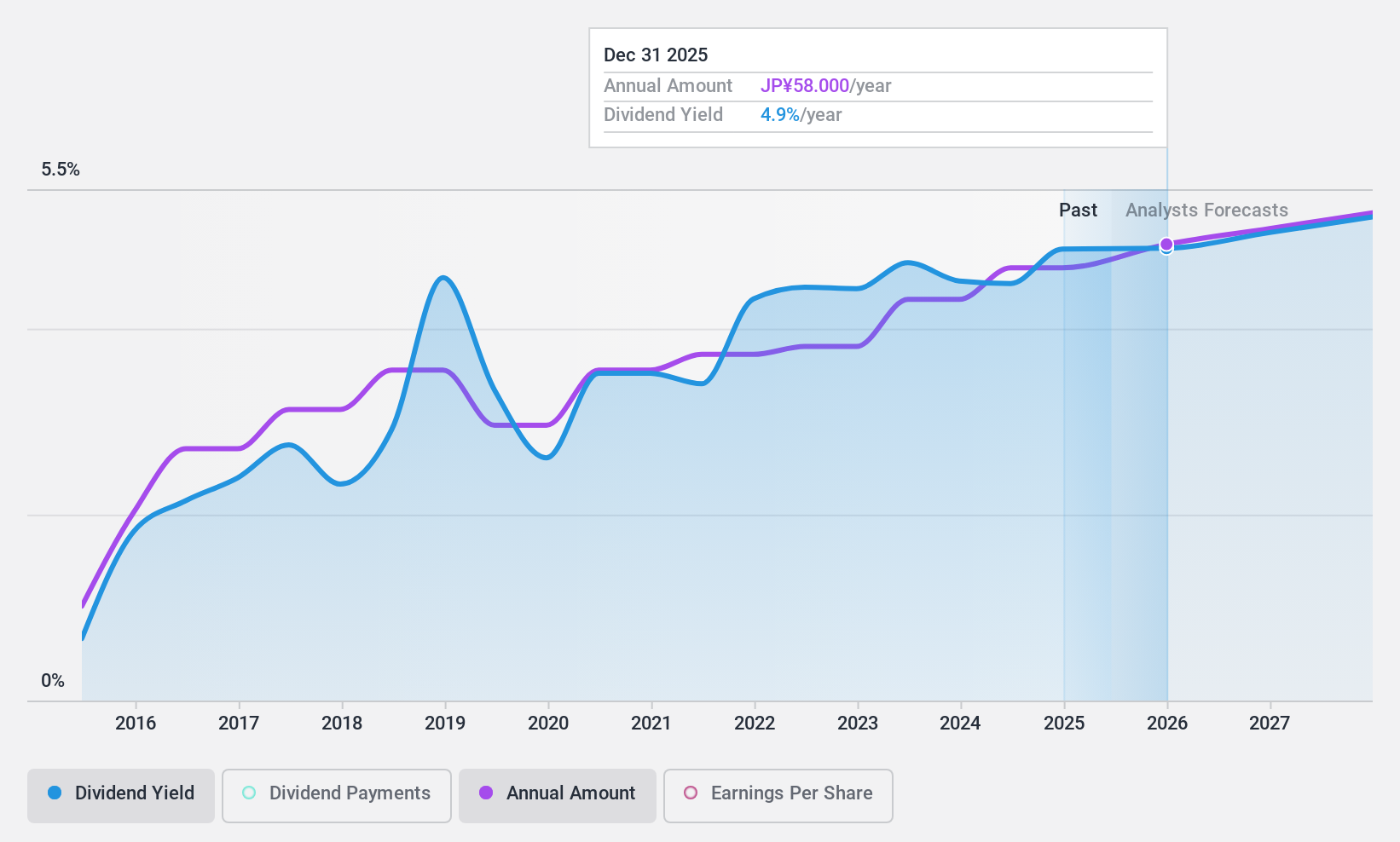

Japan Property Management CenterLtd (TSE:3276)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Japan Property Management Center Co., Ltd. operates in Japan through its rental housing management agency and bulk leasing businesses, with a market capitalization of ¥20.51 billion.

Operations: The company generates revenue primarily from its Property Management Business and its Ancillary Businesses, totaling ¥58 billion.

Dividend Yield: 4.6%

Japan Property Management Center Ltd. offers a dividend yield of 4.65%, placing it among the top 25% of dividend payers in Japan. The dividends are well-covered by earnings and cash flows, with payout ratios around 54%. However, the dividend history is unstable and has seen volatility over the past decade. Recent completion of a share buyback for ¥287.5 million aims to enhance shareholder returns and capital efficiency, potentially supporting future dividend stability.

- Dive into the specifics of Japan Property Management CenterLtd here with our thorough dividend report.

- Insights from our recent valuation report point to the potential overvaluation of Japan Property Management CenterLtd shares in the market.

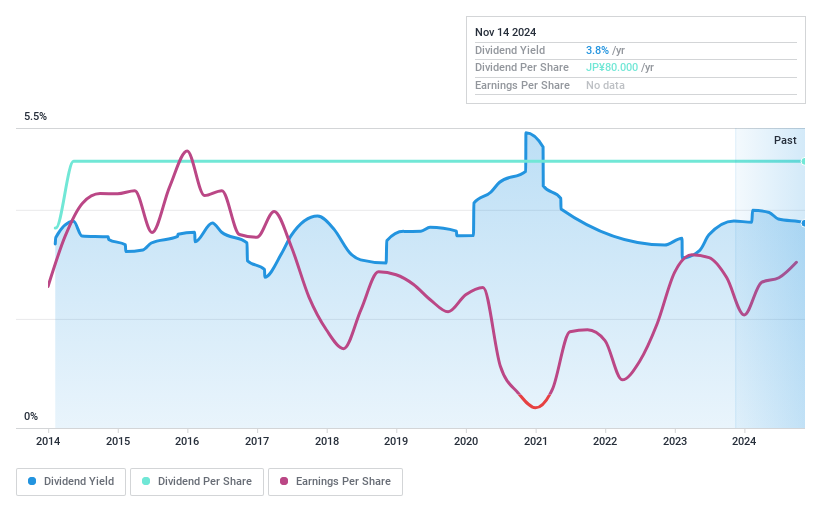

Heiwa (TSE:6412)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Heiwa Corporation develops, manufactures, and sells pachinko and pachislot machines in Japan, with a market cap of ¥210.18 billion.

Operations: Heiwa Corporation's revenue primarily comes from its development, manufacturing, and sales of pachinko and pachislot machines in Japan.

Dividend Yield: 3.7%

Heiwa offers a dividend yield of 3.72%, slightly below the top tier in Japan, and while dividends have been stable and growing over the past decade, they are not well covered by free cash flows. The payout ratio is low at 20.1%, indicating earnings cover dividends comfortably, but sustainability concerns persist due to lack of free cash flow coverage. Its price-to-earnings ratio of 10.8x suggests it may be undervalued compared to the market average.

- Unlock comprehensive insights into our analysis of Heiwa stock in this dividend report.

- Our expertly prepared valuation report Heiwa implies its share price may be too high.

Key Takeaways

- Embark on your investment journey to our 1946 Top Dividend Stocks selection here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Heiwa might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6412

Heiwa

Develops, manufactures, and sells pachinko and pachislot machines in Japan.

Adequate balance sheet average dividend payer.