- Japan

- /

- Real Estate

- /

- TSE:3231

Nomura Real Estate Holdings (TSE:3231): Valuation Insights Following Q2 Earnings and Upbeat Revenue Forecast

Reviewed by Simply Wall St

Nomura Real Estate Holdings (TSE:3231) just held its Q2 2026 earnings call, reporting revenue growth for the first half of the year, though profits slipped. The company projects operating revenue to rise sharply next year, reflecting management’s positive outlook.

See our latest analysis for Nomura Real Estate Holdings.

Nomura Real Estate Holdings has seen its share price climb 15.95% year-to-date, while its total shareholder return over the past year stands at an impressive 25.92%. That kind of momentum, especially alongside upbeat revenue forecasts, suggests that investors are eyeing renewed growth potential. Over the longer term, total shareholder returns have outpaced the market, with the stock more than doubling over five years. Recent volatility, such as this week’s pullback, seems more like a breather rather than a reversal in the bigger picture.

If you’re interested in uncovering other opportunities with strong track records and accelerating growth, now’s the perfect time to discover fast growing stocks with high insider ownership

But with recent gains and upbeat forecasts, is Nomura Real Estate Holdings still trading below its true value? Or has the stock’s strong performance already caught up to future growth expectations? Is there more upside ahead?

Most Popular Narrative: 8.2% Undervalued

Compared to the last close of ¥922.7, the narrative estimates Nomura Real Estate Holdings has notable upside, suggesting the market has not yet fully recognized its long-term growth catalysts. This perspective is driven by specific urban development moves and overseas expansion plans that set the company apart in a competitive landscape.

The company has secured a multi-year land bank for housing sales, with a significant focus on the Tokyo 23 wards. This positions it to capitalize on continued urban concentration and population growth in key metropolitan areas, an advantage likely to support robust future revenues and stable occupancy rates.

What big assumptions power this optimism? The secret sauce behind that fair value: bold bets on urban growth, long-term land holdings, and a revenue path that is anything but ordinary. Don’t miss the unexpected details that underlie this market-beating valuation.

Result: Fair Value of ¥1,004.89 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, key risks remain, including Japan’s declining population and a significant reliance on Tokyo developments. Both of these factors could limit long-term growth potential.

Find out about the key risks to this Nomura Real Estate Holdings narrative.

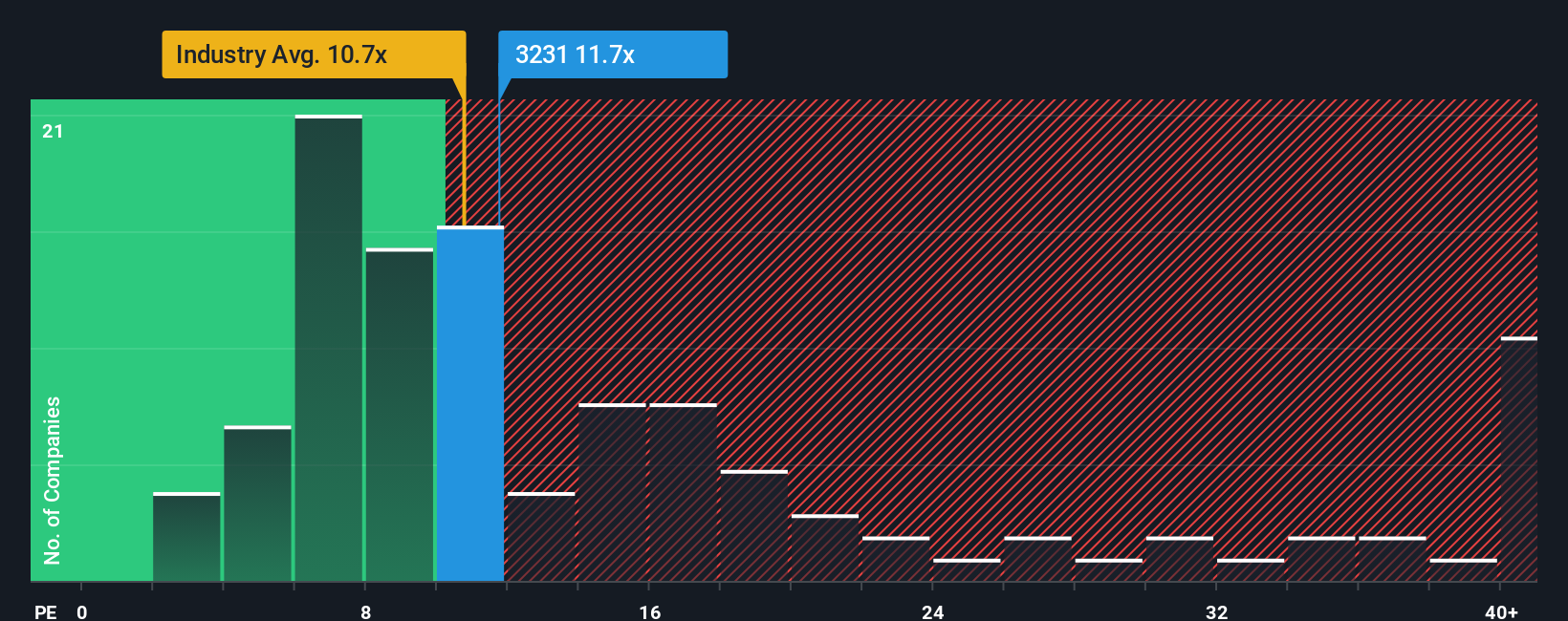

Another View: What Do Earnings Ratios Say?

Looking at Nomura Real Estate Holdings through the lens of its earnings ratio, the stock trades at 10.8 times earnings, which is slightly above its peer average of 10.5 but equal to the broader JP Real Estate industry at 10.8. Yet, the fair ratio our models suggest is 17.9, offering potential upside if the market’s outlook grows more positive. The narrow gap versus peers hints at limited valuation risk, but will the market recognize its bigger growth story?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Nomura Real Estate Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 848 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Nomura Real Estate Holdings Narrative

If our narrative doesn’t match your perspective, or you’re eager to dive deeper yourself, you can build your own view of Nomura Real Estate Holdings in just a few minutes. Do it your way

A great starting point for your Nomura Real Estate Holdings research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let strong opportunities slip past you. Get ahead of market trends and shortlist companies with outstanding potential using these tailored ideas:

- Tap into future-defining sectors by checking out these 26 AI penny stocks, positioned to benefit from the surge in artificial intelligence adoption.

- Lock in consistent income streams with these 24 dividend stocks with yields > 3%, spotlighting companies boasting attractive yields above 3%.

- Ride powerful valuation tailwinds by seeking out these 848 undervalued stocks based on cash flows, identified as trading below their intrinsic worth based on real cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nomura Real Estate Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3231

Nomura Real Estate Holdings

Operates as a real estate company in Japan and internationally.

Average dividend payer with acceptable track record.

Similar Companies

Market Insights

Community Narratives