- Japan

- /

- Real Estate

- /

- TSE:2980

Why Investors Shouldn't Be Surprised By SRE Holdings Corporation's (TSE:2980) 25% Share Price Surge

SRE Holdings Corporation (TSE:2980) shareholders would be excited to see that the share price has had a great month, posting a 25% gain and recovering from prior weakness. Looking further back, the 14% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

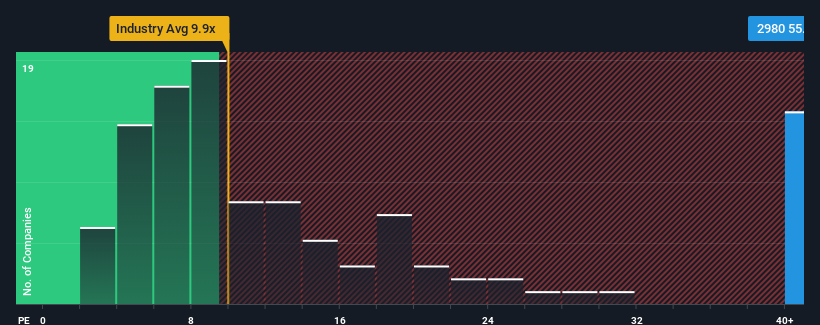

Since its price has surged higher, given close to half the companies in Japan have price-to-earnings ratios (or "P/E's") below 13x, you may consider SRE Holdings as a stock to avoid entirely with its 55.4x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

SRE Holdings hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. It might be that many expect the dour earnings performance to recover substantially, which has kept the P/E from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Check out our latest analysis for SRE Holdings

Is There Enough Growth For SRE Holdings?

The only time you'd be truly comfortable seeing a P/E as steep as SRE Holdings' is when the company's growth is on track to outshine the market decidedly.

Retrospectively, the last year delivered a frustrating 15% decrease to the company's bottom line. This means it has also seen a slide in earnings over the longer-term as EPS is down 2.3% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Looking ahead now, EPS is anticipated to climb by 48% each year during the coming three years according to the three analysts following the company. With the market only predicted to deliver 9.2% per year, the company is positioned for a stronger earnings result.

With this information, we can see why SRE Holdings is trading at such a high P/E compared to the market. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What We Can Learn From SRE Holdings' P/E?

The strong share price surge has got SRE Holdings' P/E rushing to great heights as well. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

As we suspected, our examination of SRE Holdings' analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. Unless these conditions change, they will continue to provide strong support to the share price.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with SRE Holdings (at least 1 which shouldn't be ignored), and understanding these should be part of your investment process.

If you're unsure about the strength of SRE Holdings' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:2980

SRE Holdings

Engages in the AI cloud and consulting, and real estate tech businesses in Japan.

High growth potential with mediocre balance sheet.

Market Insights

Community Narratives