- Japan

- /

- Real Estate

- /

- TSE:1925

Upgraded Earnings and Higher Dividends Could Be a Game Changer for Daiwa House Industry (TSE:1925)

Reviewed by Sasha Jovanovic

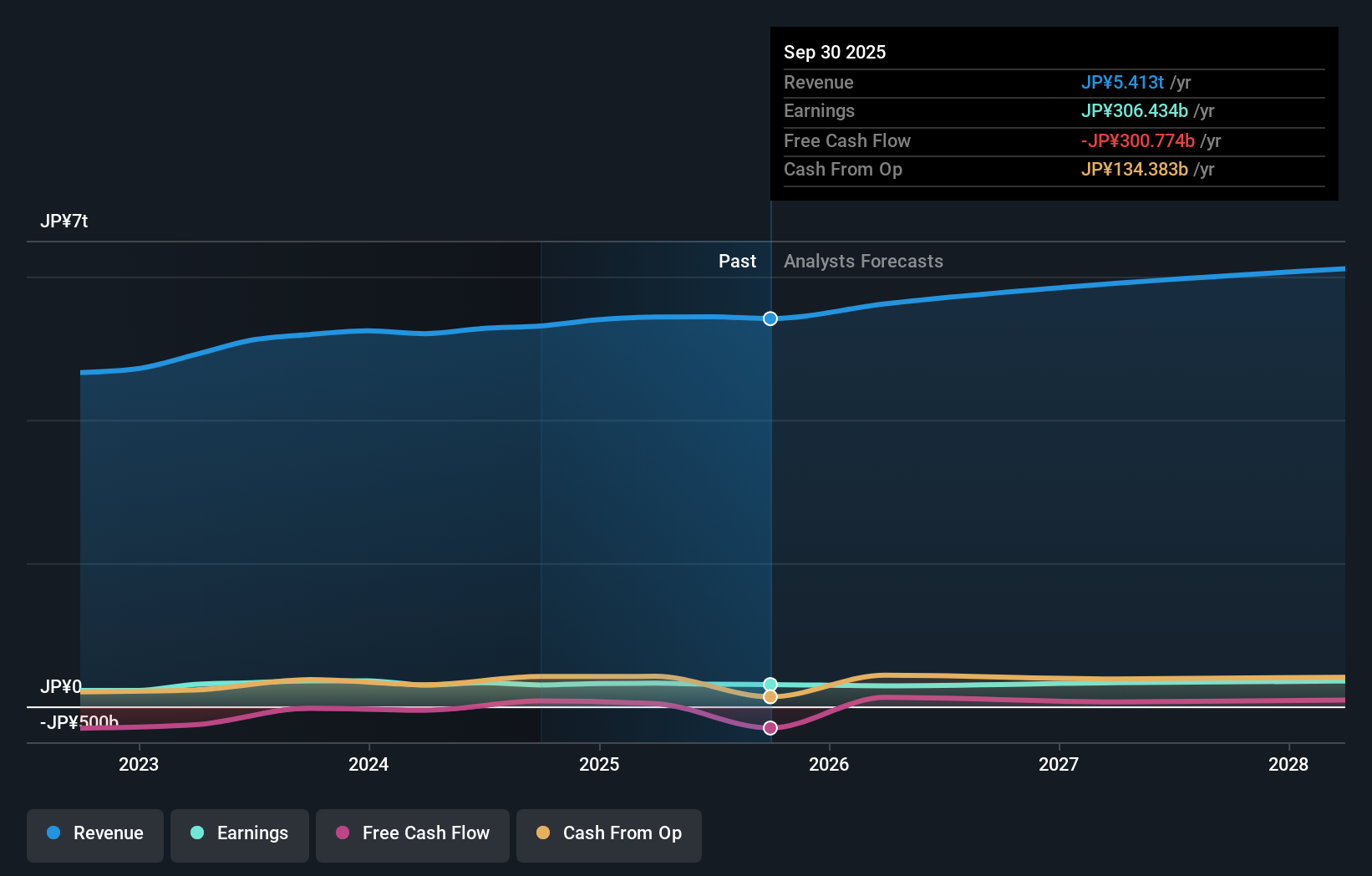

- Daiwa House Industry recently raised its full-year earnings forecast for the fiscal year ending March 31, 2026, and announced increased interim and year-end dividends, following strong performance driven by a large land sale in its U.S. subsidiary and robust real estate sales.

- This upward revision reflects the company's ongoing execution of its medium-term plan to focus on an evolving revenue model, management efficiency, and strengthening of its financial base.

- We’ll explore how the commitment to higher dividends and improved earnings guidance shapes Daiwa House Industry’s investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is Daiwa House Industry's Investment Narrative?

To be a Daiwa House Industry shareholder today, you need to believe in the company’s ability to steadily execute on its medium-term plan, balancing disciplined management, capital allocation, and a shift in revenue mix within a changing real estate environment. The recent upgrade in full-year earnings guidance and higher dividend payout represents a clear win for near-term catalysts, directly addressing prior concerns about earnings momentum and rewarding shareholders with higher cash returns. This shift is materially important because it points to tangible progress on improving management efficiency and asset utilization, especially after the outsized contribution from a U.S. land sale. However, it also introduces possible risk: the outsized impact of one-off transactions like this raises questions about the sustainability of go-forward performance, as well as the reliability of forecast improvements. The key issues to keep in mind are whether Daiwa House can convert episodic gains into consistent, operational growth and whether the uplift in payout is truly sustainable if free cash flow remains strained.

On the flip side, there are questions about the repeatability of those U.S. land sale gains that investors should be aware of. Despite retreating, Daiwa House Industry's shares might still be trading above their fair value and there could be some more downside. Discover how much.Exploring Other Perspectives

Explore another fair value estimate on Daiwa House Industry - why the stock might be worth as much as ¥5534!

Build Your Own Daiwa House Industry Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Daiwa House Industry research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Daiwa House Industry research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Daiwa House Industry's overall financial health at a glance.

Seeking Other Investments?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 38 companies in the world exploring or producing it. Find the list for free.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:1925

Daiwa House Industry

Engages in the construction work business in Japan, the United States, and internationally.

Good value with acceptable track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success