Japan Tissue Engineering (TSE:7774): Shares Trade 67% Below DCF Fair Value, Growth Outlook Ignites Bull Case

Reviewed by Simply Wall St

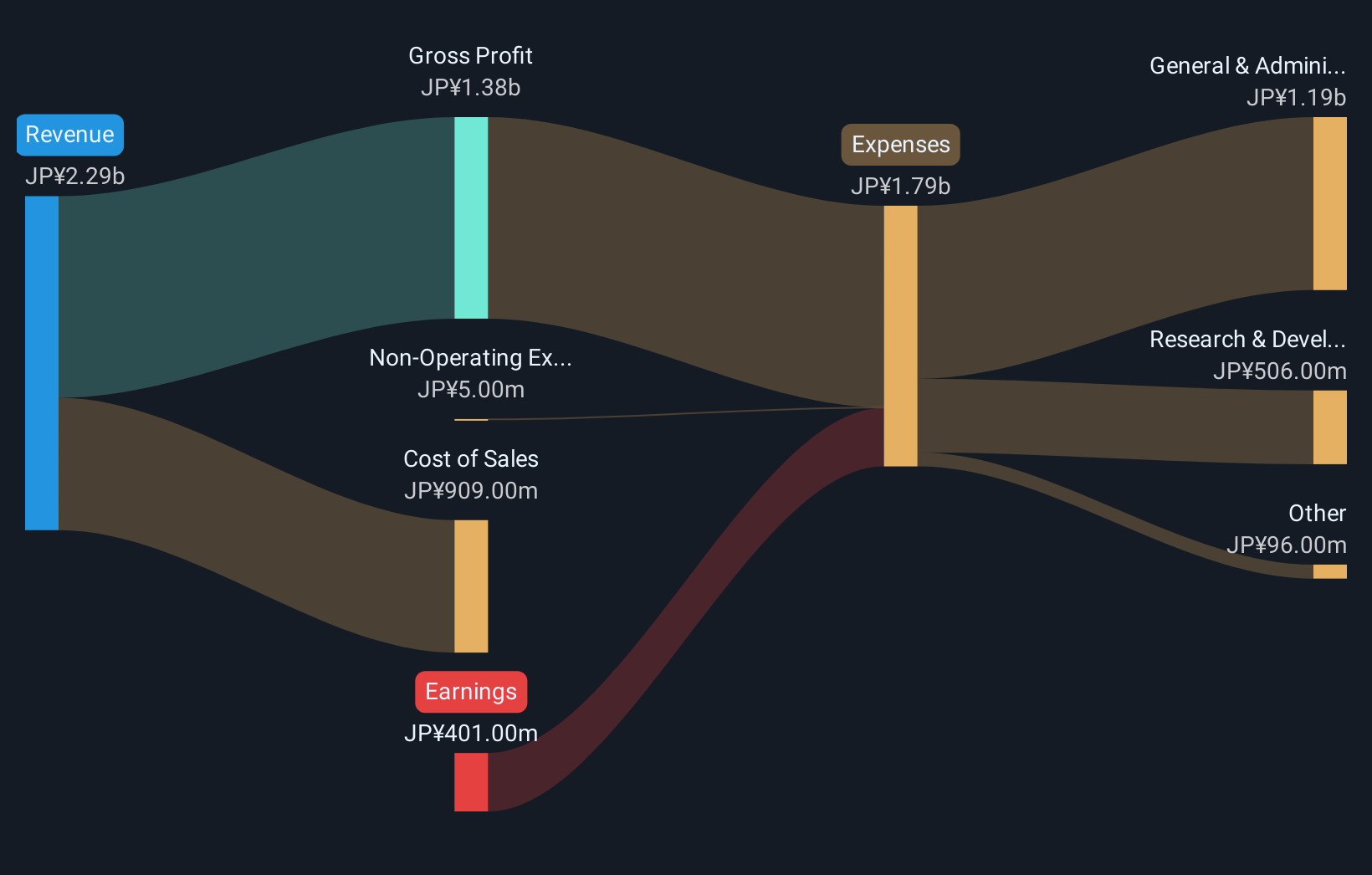

Japan Tissue Engineering (TSE:7774) reported that revenue is forecast to grow by an impressive 22.6% per year, far outpacing the Japanese market average of 4.5%. Earnings are expected to jump 40.83% annually, and shares currently trade at ¥471, well below the estimated fair value of ¥1,432.88. While the company remains unprofitable for now, it has steadily reduced losses at a 16.1% annual rate over the past five years and is anticipated to achieve profitability within three years.

See our full analysis for Japan Tissue Engineering.Next up, we will see how these headline numbers compare with the most widely held narratives in the Simply Wall St community, and whether the latest earnings strengthen or challenge those stories.

Curious how numbers become stories that shape markets? Explore Community Narratives

Loss Reduction Accelerates Toward Profitability

- Japan Tissue Engineering has managed to cut its losses at a pace of 16.1% per year over the last five years, showing significant progress even though it remains unprofitable for now.

- Strong growth prospects, enhanced by this steady reduction in losses, make for a compelling storyline, especially as the company is forecast to achieve profitability within the next three years.

- Investors watching for sustained improvements may be encouraged by this trend. A clear path to profitability could support further share price upside.

- With annual earnings projected to grow by 40.83%, the outlook aligns with expectations for a swift turnaround compared to peers in the Japanese biotech space.

Sales Multiple Sits Between Peers and Industry

- The current Price-To-Sales Ratio stands at 8.3x, lower than the Japanese biotech industry average of 15x but higher than the peer group average of 5.8x.

- This in-between valuation signals that investors are paying a premium for future growth, even as the share price still falls well below DCF fair value.

- The stock's position in the middle of these benchmarks illustrates how optimism around rapid revenue growth may be balanced by a lack of current profits versus peers.

- As the company narrows losses and growth materializes, the premium could seem justified. Any stalling of progress may leave the shares appearing expensive compared to closer competitors.

Share Price Discount Versus DCF Fair Value

- At ¥471, the share price trades at a substantial discount to the ¥1,432.88 DCF fair value calculated from fundamentals.

- The gap between share price and DCF fair value, paired with strong revenue and profit forecasts, heavily supports optimism that the market could re-rate the stock upward as execution continues.

- No major risks are flagged in the data. Investors looking for deep value in the biotech sector may see this as a standout opportunity.

- The future action, however, hinges on whether Japan Tissue Engineering can move past historical unprofitability and deliver on high growth expectations embedded in its valuation metrics.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Japan Tissue Engineering's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite robust growth forecasts, Japan Tissue Engineering remains unprofitable and lags peers in achieving consistent, stable earnings and revenue expansion.

If steady performance is critical for you, check out companies showing reliable growth and resilience by using our stable growth stocks screener (2091 results) to identify stronger alternatives now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7774

Japan Tissue Engineering

Engages in the regenerative medicine business in Japan.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives