Sawai Group Holdings (TSE:4887): Updated Valuation After Guidance Cut on Teriparatide Patent Settlement

Reviewed by Simply Wall St

Sawai Group Holdings (TSE:4887) just adjusted its financial guidance after reaching a settlement in a patent infringement lawsuit for its Teriparatide Subcutaneous Injection, a move that is shaping investor sentiment this quarter.

See our latest analysis for Sawai Group Holdings.

The recent guidance update comes after a challenging patch for Sawai Group Holdings, with its share price down 12.2% year-to-date. However, despite near-term headwinds, the company still boasts an impressive 43% total shareholder return over the past three years. Momentum has slowed recently, but long-term holders have seen solid gains.

If Sawai’s mix of challenges and resilience has you curious, now is a great time to broaden your perspective and discover fast growing stocks with high insider ownership

With guidance now reset and shares trading around a 27% discount to analyst targets, investors are left to wonder: does Sawai Group Holdings offer genuine value at these levels, or is future growth already reflected in the price?

Price-to-Sales of 1.1x: Is it justified?

At a last close price of ¥1,882, Sawai Group Holdings is trading at a price-to-sales ratio of 1.1x, which appears attractive relative to both peers and the wider pharmaceutical industry.

The price-to-sales ratio compares the company’s market capitalization to its revenue, helping investors assess how much they are paying for each yen of sales. For pharmaceutical companies like Sawai, this multiple is especially relevant given the fluctuating profit margins due to R&D and regulatory environments.

Sawai’s 1.1x price-to-sales multiple is significantly below the Japanese pharmaceutical industry’s average of 1.7x, and it is also lower than the peer average. When compared to its estimated fair price-to-sales ratio of 1.2x, the stock still trades at a discount, suggesting the market is undervaluing its sales potential and future revenue streams.

Explore the SWS fair ratio for Sawai Group Holdings

Result: Price-to-Sales of 1.1x (UNDERVALUED)

However, revenue growth remains modest, and any further legal setbacks could challenge the recovery story for Sawai Group Holdings.

Find out about the key risks to this Sawai Group Holdings narrative.

Another View: What Does Our DCF Model Say?

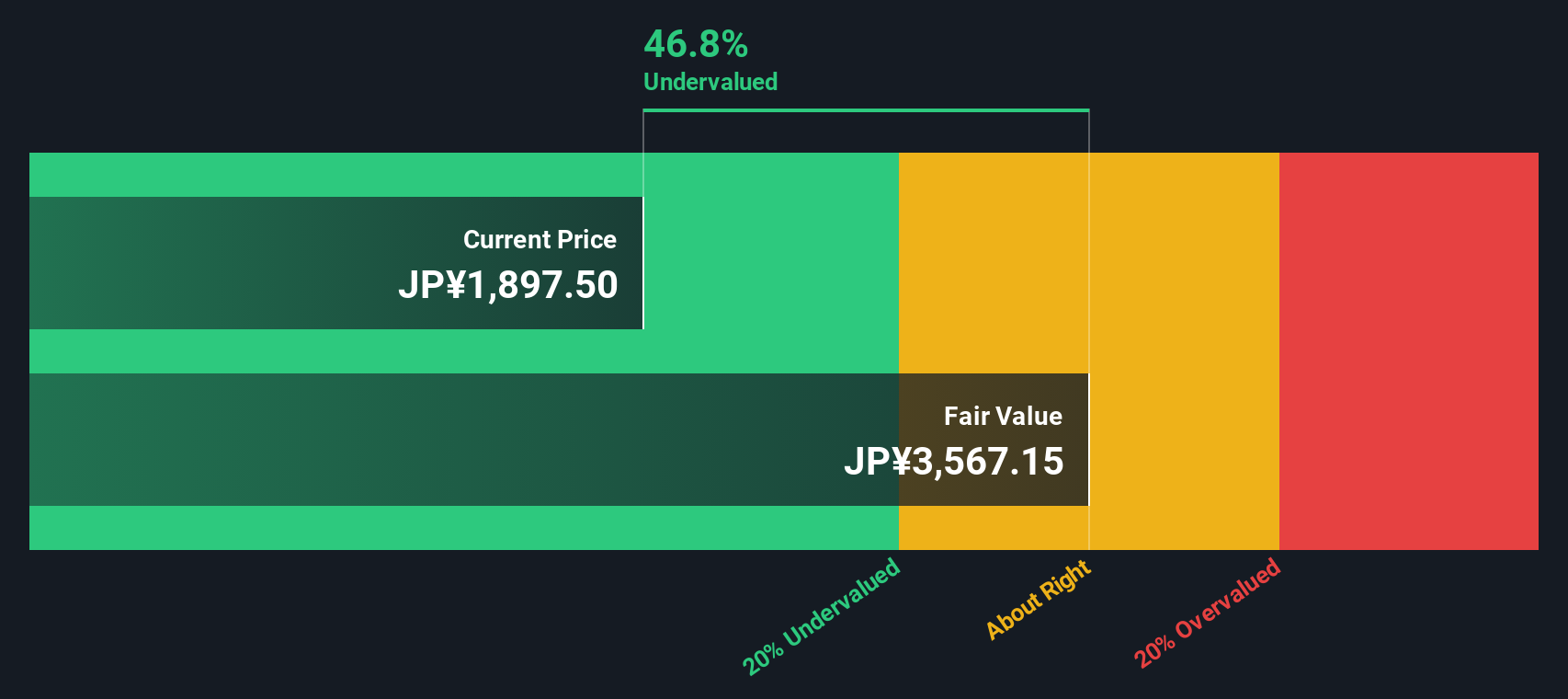

Looking through the lens of our SWS DCF model, Sawai Group Holdings also appears undervalued. The shares are trading around 47% below our DCF-based estimate of fair value, which suggests the market may be overlooking the company’s future cash flow potential. Could an earnings turnaround unlock this hidden value, or are persistent risks holding the stock back?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Sawai Group Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 895 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Sawai Group Holdings Narrative

If you want to reach your own conclusion or dive deeper into the data, you can quickly build your unique perspective in just a few minutes. Do it your way

A great starting point for your Sawai Group Holdings research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors know the best opportunities rarely wait around. Expand your watchlist now with these unique screens that could highlight your next potential stock:

- Capture steady cash flow and potential yield increases by starting with these 15 dividend stocks with yields > 3%, which offers attractive payouts and financial resilience in today's market.

- Take advantage of the AI trend and position yourself for sector-defining changes by exploring these 27 AI penny stocks, which are transforming industries with intelligent automation.

- Stay ahead as the next generation of digital finance develops, identifying opportunities in these 81 cryptocurrency and blockchain stocks at the forefront of innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4887

Sawai Group Holdings

Together with subsidiaries, engages in the research and development, manufacture, and marketing of generic pharmaceuticals.

Undervalued with reasonable growth potential.

Market Insights

Community Narratives