Asian Market Gems: Uncovering 3 Stocks Estimated Below Intrinsic Value

Reviewed by Simply Wall St

Amidst global concerns over AI valuations and fluctuating market sentiments, Asian markets have also experienced volatility, with notable declines in key indices like Japan's Nikkei 225 and China's CSI 300. In this environment of uncertainty, identifying stocks that are potentially undervalued can be an attractive strategy for investors seeking opportunities; these stocks may offer value by trading below their intrinsic worth despite broader market challenges.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Zhejiang Jolly PharmaceuticalLTD (SZSE:300181) | CN¥16.85 | CN¥32.50 | 48.1% |

| Xi'an NovaStar Tech (SZSE:301589) | CN¥155.90 | CN¥305.62 | 49% |

| TLB (KOSDAQ:A356860) | ₩62400.00 | ₩120421.20 | 48.2% |

| SRE Holdings (TSE:2980) | ¥3120.00 | ¥6130.72 | 49.1% |

| Samyang Foods (KOSE:A003230) | ₩1380000.00 | ₩2799114.46 | 50.7% |

| Raksul (TSE:4384) | ¥1148.00 | ¥2276.91 | 49.6% |

| Nippon Thompson (TSE:6480) | ¥706.00 | ¥1407.35 | 49.8% |

| Nanjing COSMOS Chemical (SZSE:300856) | CN¥15.12 | CN¥29.44 | 48.6% |

| IDEC (TSE:6652) | ¥2566.00 | ¥4975.59 | 48.4% |

| Cowell e Holdings (SEHK:1415) | HK$26.42 | HK$51.85 | 49% |

Let's uncover some gems from our specialized screener.

Zhejiang Cfmoto PowerLtd (SHSE:603129)

Overview: Zhejiang Cfmoto Power Co., Ltd, with a market cap of CN¥37.85 billion, develops, manufactures, markets, and delivers motorcycles, off-road vehicles, engines, frames, parts, apparel, and accessories across various global regions including China.

Operations: Zhejiang Cfmoto Power Co., Ltd generates revenue through its diverse operations in the development, production, and distribution of motorcycles, off-road vehicles, engines, frames, parts, apparel, and accessories across China and international markets such as Asia, North America, Oceania, Africa, South America, and Europe.

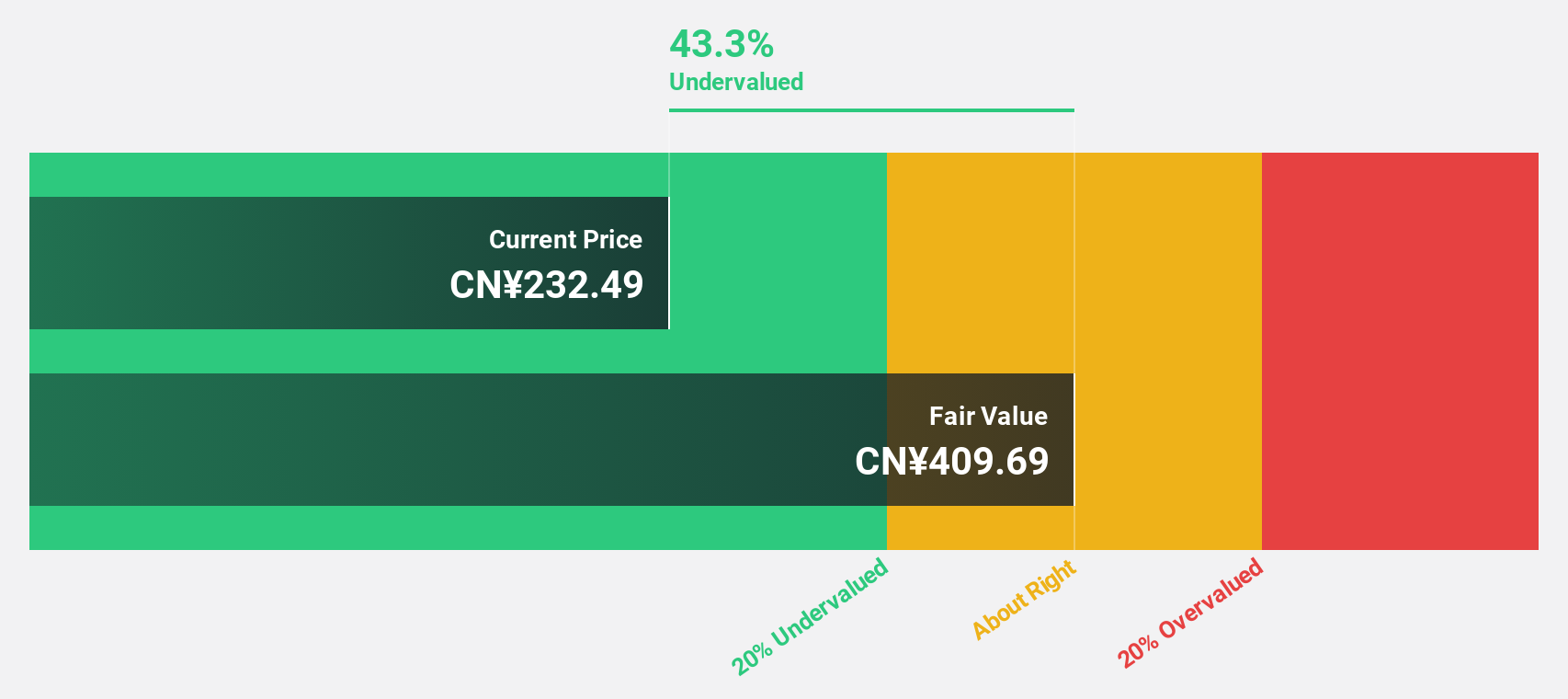

Estimated Discount To Fair Value: 37.2%

Zhejiang Cfmoto Power Ltd. appears undervalued based on cash flows, trading at approximately 37.2% below its estimated fair value of CNY 395.18. Recent earnings results show strong performance with sales reaching CNY 14.90 billion and net income of CNY 1.42 billion for the nine months ending September 2025, reflecting robust growth from the previous year. The company's revenue and earnings are forecast to grow significantly, outpacing market averages, highlighting its potential as an investment opportunity in Asia's undervalued stock segment.

- The analysis detailed in our Zhejiang Cfmoto PowerLtd growth report hints at robust future financial performance.

- Delve into the full analysis health report here for a deeper understanding of Zhejiang Cfmoto PowerLtd.

Lifedrink Company (TSE:2585)

Overview: Lifedrink Company, Inc. manufactures and sells soft drinks in Japan with a market cap of ¥111.66 billion.

Operations: Revenue Segments (in millions of ¥): The company's revenue is derived from the manufacturing and sale of soft drinks in Japan.

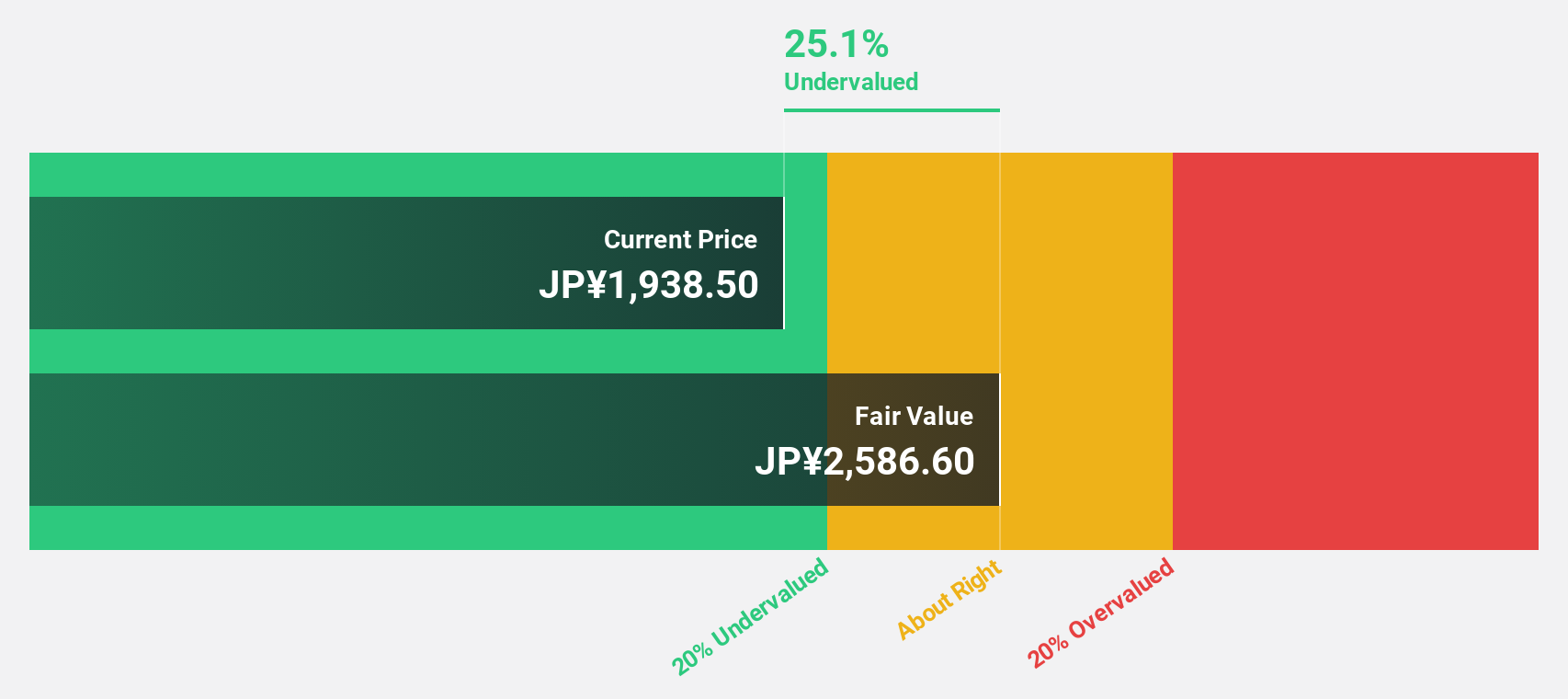

Estimated Discount To Fair Value: 17.1%

Lifedrink Company is trading at ¥2,153, below its estimated fair value of ¥2,596.81, suggesting it may be undervalued based on cash flows. Earnings are projected to grow at 14.9% annually, surpassing the JP market average of 8.1%. Despite a high debt level and volatile share price recently, Lifedrink's buyback program aims to enhance shareholder returns and capital efficiency by repurchasing shares worth ¥491.87 million as of September 2025.

- Our comprehensive growth report raises the possibility that Lifedrink Company is poised for substantial financial growth.

- Click here and access our complete balance sheet health report to understand the dynamics of Lifedrink Company.

Sawai Group Holdings (TSE:4887)

Overview: Sawai Group Holdings Co., Ltd. operates in the research, development, manufacture, and marketing of generic pharmaceuticals and has a market capitalization of approximately ¥219.83 billion.

Operations: The company generates revenue through its involvement in the research, development, production, and distribution of generic pharmaceuticals.

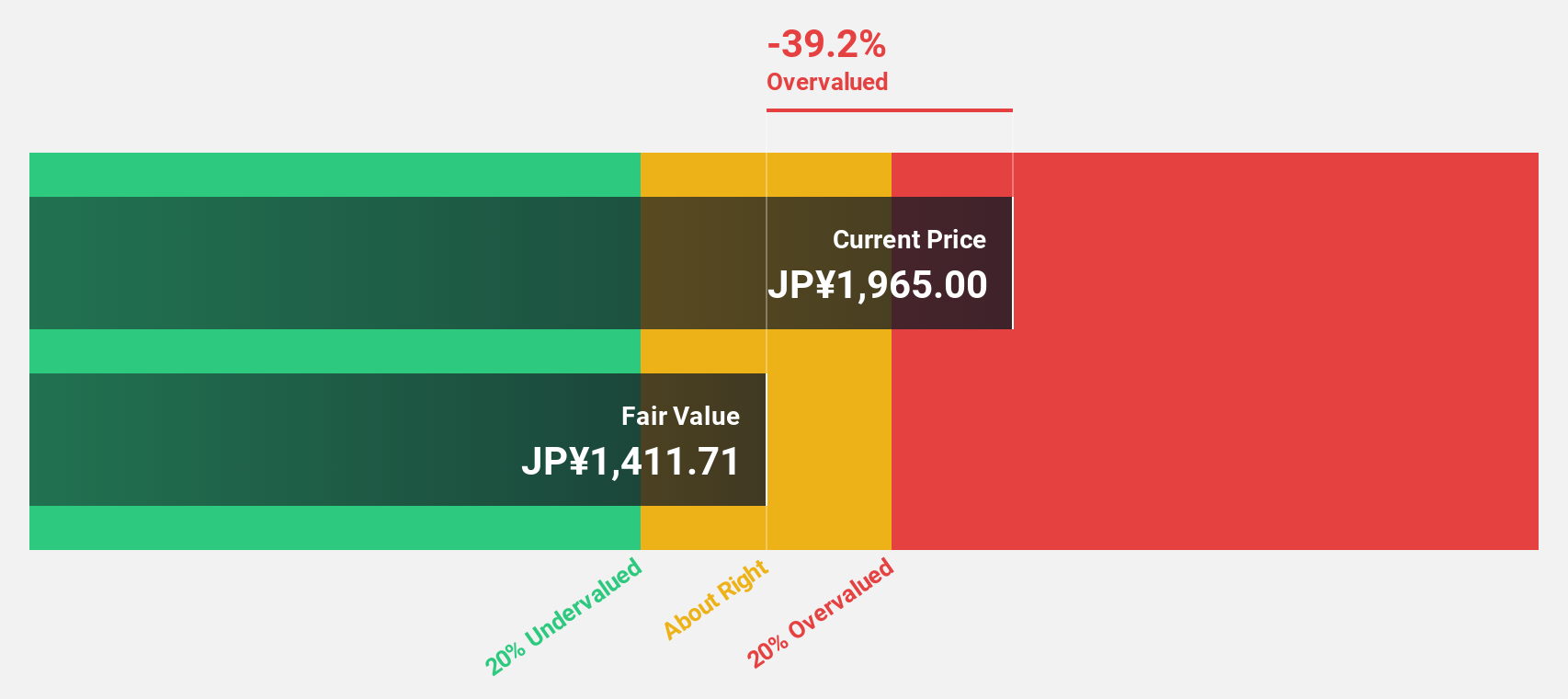

Estimated Discount To Fair Value: 45.6%

Sawai Group Holdings is trading at ¥1,903.5, significantly below its estimated fair value of ¥3,497.48, indicating potential undervaluation based on cash flows. Despite a forecasted annual earnings growth of 27.64%, the company faces challenges such as lower profit margins and a dividend not well covered by earnings or free cash flows. Recent legal settlements have impacted financial forecasts, with revised guidance showing reduced operating profits and revenue for the fiscal year ending March 2026.

- Our expertly prepared growth report on Sawai Group Holdings implies its future financial outlook may be stronger than recent results.

- Unlock comprehensive insights into our analysis of Sawai Group Holdings stock in this financial health report.

Where To Now?

- Investigate our full lineup of 276 Undervalued Asian Stocks Based On Cash Flows right here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4887

Sawai Group Holdings

Together with subsidiaries, engages in the research and development, manufacture, and marketing of generic pharmaceuticals.

Undervalued with reasonable growth potential.

Market Insights

Community Narratives