Why SanBio (TSE:4592) Is Down 23.0% After Approval Progress for Regenerative Brain Therapy AKUUGO

Reviewed by Sasha Jovanovic

- SanBio recently announced that the Japanese Ministry of Health's regulatory subcommittee found its proposal for a partial change in marketing authorization and approval conditions for AKUUGO, the world's first regenerative brain therapy, acceptable, with formal approval anticipated soon and product launch planned after NHI price listing.

- This marks a significant milestone, as SanBio prepares to launch AKUUGO in Japan and advances late-stage clinical trial plans in the U.S. for traumatic brain injury.

- We'll consider how regulatory progress and the anticipated launch of AKUUGO influence SanBio's investment narrative in regenerative medicine.

We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is SanBio's Investment Narrative?

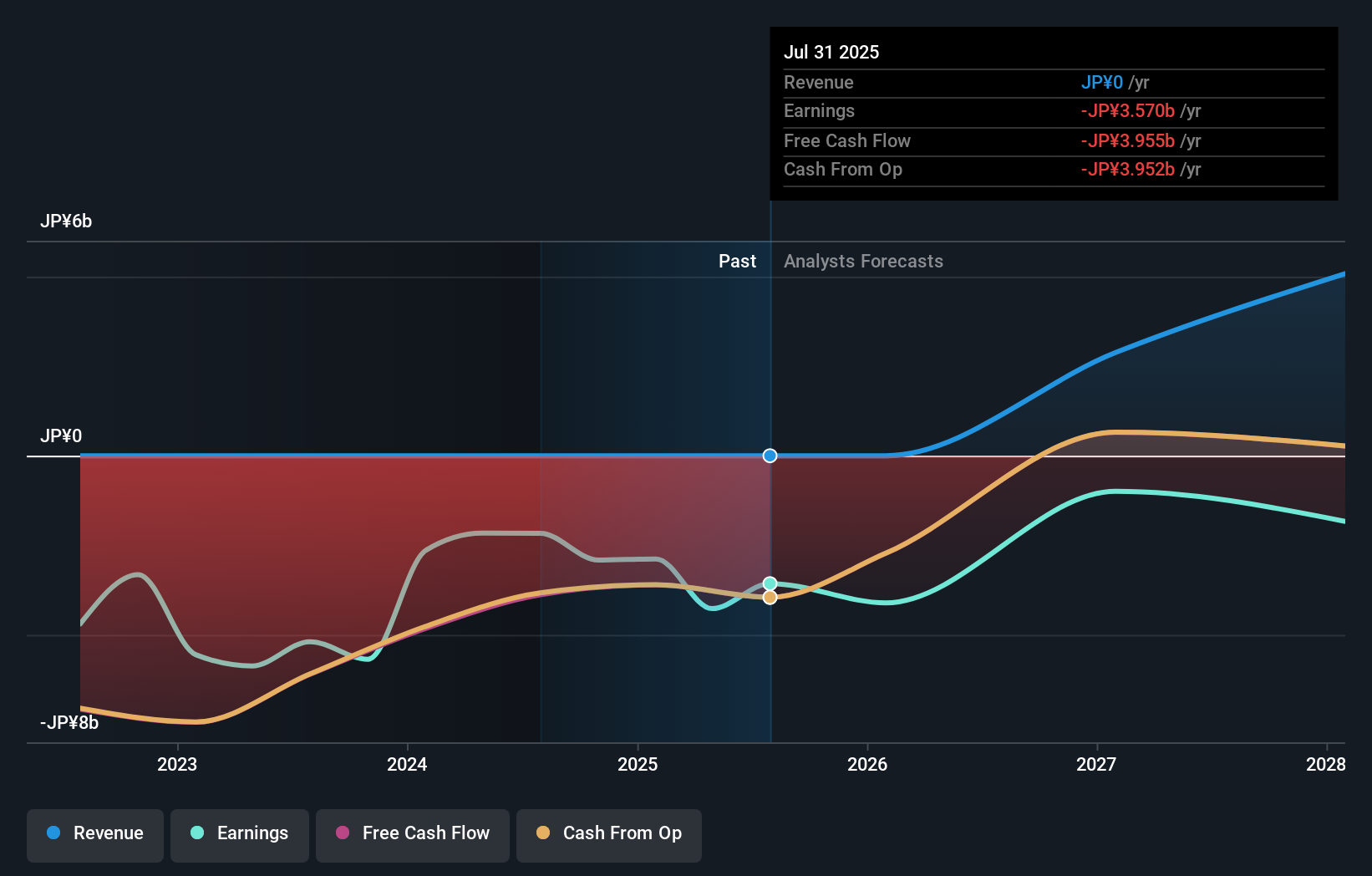

To be a SanBio shareholder right now means believing in the potential of regenerative medicine, and specifically, in the commercial prospects for AKUUGO, its flagship therapy for traumatic brain injury. With the Japanese Ministry of Health’s subcommittee endorsing SanBio’s proposal for the partial change in marketing approval and formal approval expected soon, the regulatory risk overhang on the Japanese launch appears to be easing. This announcement may accelerate near-term catalysts, as AKUUGO’s commercial rollout could begin after the NHI price listing, pulling forward potential revenue and market validation. However, the requirement for use in specialized centers and ongoing post-marketing evaluation keeps some uncertainty around adoption and scale. The financial position remains tight with ongoing losses and less than a year of cash runway, making execution and successful market entry especially important after this positive regulatory news. On the flip side, the path from approval to profitable sales is never straightforward.

SanBio's share price has been on the slide but might be dropping deeper into value territory. Find out whether it's a bargain at this price.Exploring Other Perspectives

Explore another fair value estimate on SanBio - why the stock might be worth as much as ¥2088!

Build Your Own SanBio Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your SanBio research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

- Our free SanBio research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate SanBio's overall financial health at a glance.

Want Some Alternatives?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4592

SanBio

Develops, produces, and sells regenerative cell medicines for the central nervous system.

Slight risk with mediocre balance sheet.

Market Insights

Community Narratives