Daiichi Sankyo (TSE:4568): Valuation Update After Enhertu’s Health Canada Approval Expands Market Potential

Reviewed by Simply Wall St

Daiichi Sankyo (TSE:4568) shares drew attention after the company, together with AstraZeneca Canada, secured Health Canada's approval for Enhertu as a treatment for specific advanced breast cancer types. This approval followed strong phase III trial results.

See our latest analysis for Daiichi Sankyo Company.

This pivotal news comes after a difficult stretch for Daiichi Sankyo’s stock, which has seen its share price drop over 20% year-to-date and a one-year total shareholder return of -28.5%. Even so, fresh regulatory approvals and pipeline progress could help revive momentum as investors look for signs the business is starting to turn a corner.

If you’re interested in companies pushing the boundaries in medicine, it is a perfect moment to seek out new opportunities with our See the full list for free.

With a steep share price decline and a compelling discount to analyst price targets, investors now face a crucial question: is Daiichi Sankyo undervalued after recent developments, or is future growth already reflected in the stock?

Most Popular Narrative: 38.2% Undervalued

Analysts now see a significant gap between Daiichi Sankyo’s fair value and its last closing price, suggesting notable upside if key business drivers hold. The latest narrative points to robust sales growth, pipeline progress, and major regulatory advances as important catalysts investors are watching closely.

• Sustained global demand for oncology treatments, driven by aging populations in developed markets and increased healthcare access in emerging markets, is supporting strong sales growth across Daiichi Sankyo's core franchises, particularly ENHERTU and Datroway; this is likely to continue expanding top-line revenue and international revenue diversification.

Curious about the logic behind that bullish price gap? Discover which aggressive assumptions about earnings, margins, and future market share give this narrative its shine. The full story hints at a financial forecast that could reshuffle Daiichi Sankyo’s investment case and uncover the numbers that matter.

Result: Fair Value of ¥5,517 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heavy reliance on a few blockbuster drugs and rising R&D costs could jeopardize Daiichi Sankyo’s outlook if new challenges emerge.

Find out about the key risks to this Daiichi Sankyo Company narrative.

Another View: Taking a Closer Look with Multiples

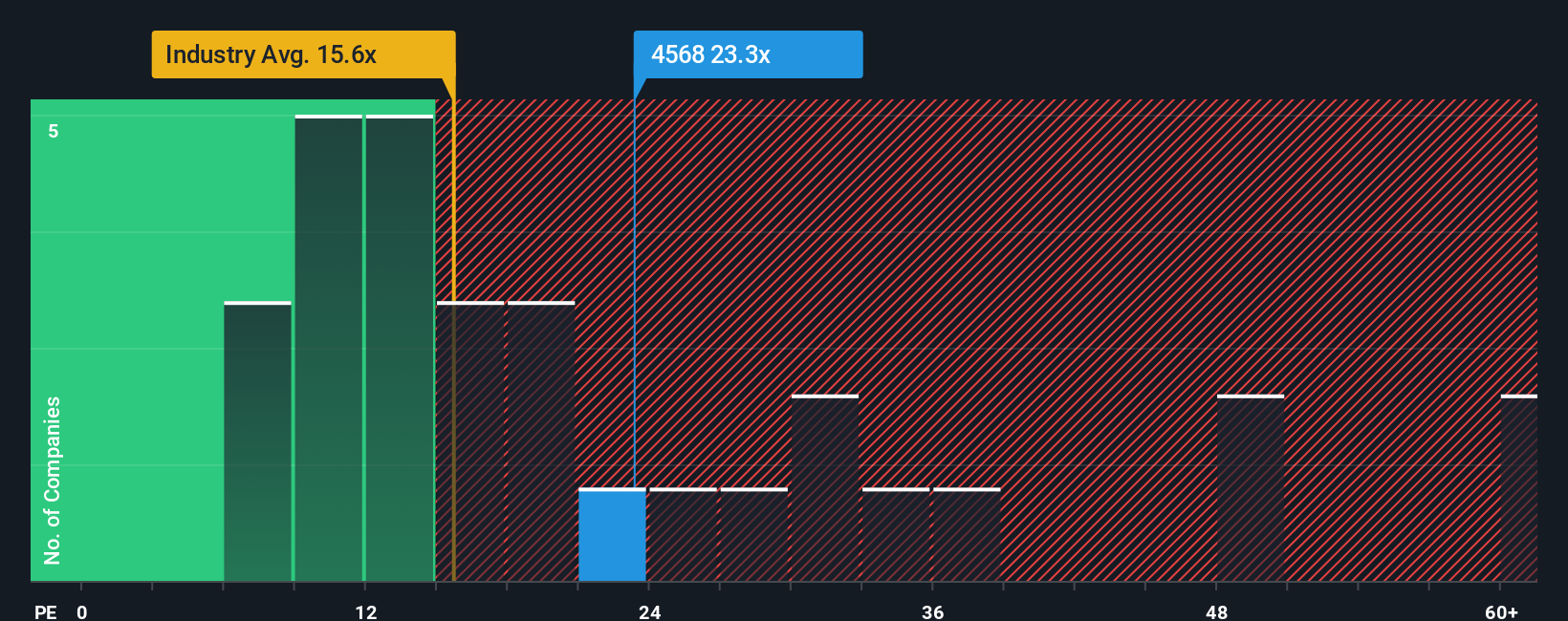

While the fair value points to an undervalued stock, the price-to-earnings ratio tells a more complicated story. Daiichi Sankyo trades at 22.6 times earnings, higher than the Japanese pharmaceuticals industry average of 13.9 and well below its peer average of 66. The fair ratio sits even higher at 31.2. This gap signals both risk and potential: could the market be slow to reward Daiichi Sankyo, or is optimism simply priced in already?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Daiichi Sankyo Company Narrative

If you have a different perspective or want to dive into Daiichi Sankyo’s numbers yourself, you can craft your own company story in just a few minutes with our Do it your way.

A great starting point for your Daiichi Sankyo Company research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors never settle for yesterday’s winners. Stay ahead by targeting sectors and trends shaping tomorrow’s market. Start with these essential stock ideas:

- Catch the momentum of tomorrow’s breakthroughs by scoping out these 25 AI penny stocks shaking up industries and changing how business gets done.

- Capture hidden value with these 848 undervalued stocks based on cash flows that appear poised for a re-rating as the market spots their unrealized financial potential.

- Boost your income stream by considering these 18 dividend stocks with yields > 3% offering attractive yields backed by strong business fundamentals and reliable cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4568

Daiichi Sankyo Company

Manufactures and sells pharmaceutical products in Japan, the United States, Europe, and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives