Daiichi Sankyo (TSE:4568) Earnings Growth Reinforces Bullish Narratives on Consistent Outperformance and Valuation

Reviewed by Simply Wall St

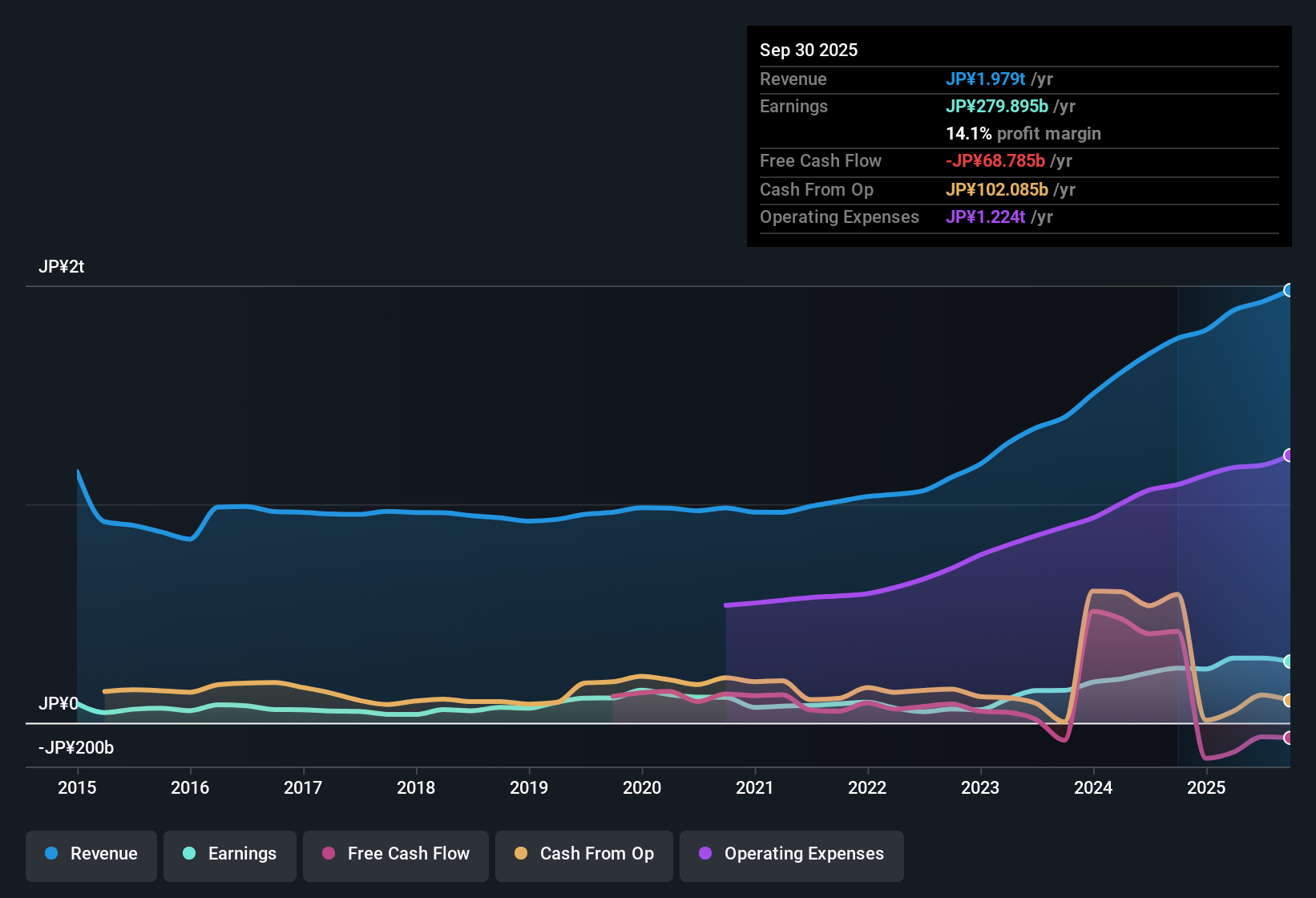

Daiichi Sankyo (TSE:4568) posted a 32.7% annual earnings growth over the last five years, with the most recent period showing an 11.8% rise in earnings. Looking ahead, earnings are forecast to grow by 14.05% per year alongside an expected 9.6% increase in revenue. This would notably outpace the broader Japanese market’s 4.5% annual revenue growth rate. With current net profit margins at 14.1% and a price-to-earnings ratio of 24.3x, investors find themselves weighing healthy profit growth against a valuation that sits attractively below peer averages.

See our full analysis for Daiichi Sankyo Company.The next section puts these headline numbers next to widely watched narratives in the market, revealing where investor sentiment matches the data and where the stories might diverge.

See what the community is saying about Daiichi Sankyo Company

Profit Margins Edge Lower as R&D Spending Rises

- Net profit margin ticked down slightly to 14.1% from 14.2% last year, as elevated research and development costs continue to weigh on overall profitability.

- Analysts' consensus view highlights that despite a squeeze on margins, ongoing investment in new antibody-drug conjugate therapies underpins Daiichi Sankyo’s competitive edge:

- Active R&D is expected to support long-term expansion in both revenue and margins through launches in targeted oncology areas.

- There is tension, however, as heavier expenses now raise the risk of below-expectation profitability if late-stage drugs don’t clear pivotal milestones.

Blockbuster Drugs Drive Revenue Concentration Risk

- Sales growth remains closely linked to a limited set of oncology drugs, exposing the company to significant concentration risk if competitors enter the market or regulatory issues arise.

- Analysts' consensus view warns that Daiichi Sankyo is particularly vulnerable to revenue shocks given its heavy reliance on ENHERTU and Datroway:

- Should patent, competitive, or safety challenges hit these lead drugs, both future growth and net margins could be significantly affected.

- Potential for rising industry competition or new drug pricing policies amplifies the need for successful pipeline diversification.

Valuation Discount Versus Peers, But Premium to Industry

- The current price-to-earnings ratio of 24.3x sits below the peer group average of 65.1x, implying a market discount, but remains higher than the Japanese pharmaceutical sector average of 15.2x.

- Analysts' consensus view underscores the mixed signals: while valuation appears attractive against direct peers and the share price of ¥3,669.0 trades below the analyst target of ¥5,470.0, the premium versus the broader industry may temper upside.

- The strength of Daiichi Sankyo's growth outlook and innovation pipeline must be balanced against potential risks from increased R&D spending and revenue concentration.

- Despite the market discount, investors should monitor how margin trends and competitive threats evolve over the medium term.

- Results reinforce a nuanced consensus narrative. Analysts remain constructive, but see real risks alongside upside potential.

📊 Read the full Daiichi Sankyo Company Consensus Narrative.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Daiichi Sankyo Company on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have another take on the figures? Put your insights to work and craft a unique perspective in just a few minutes. Do it your way

A great starting point for your Daiichi Sankyo Company research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

See What Else Is Out There

Daiichi Sankyo faces uncertainty from tight profit margins and heavy reliance on a few blockbuster drugs, which leaves growth vulnerable to setbacks or missed milestones.

If you'd rather focus on steadier performers, use stable growth stocks screener (2088 results) to quickly identify companies delivering consistent earnings and revenue no matter the market environment.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4568

Daiichi Sankyo Company

Manufactures and sells pharmaceutical products in Japan, the United States, Europe, and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives