Could Daiichi Sankyo (TSE:4568) and Partner’s Push Into Protein Targets Signal a New R&D Strategy?

Reviewed by Sasha Jovanovic

- General Proximity announced a collaboration with Daiichi Sankyo’s Boston Research Institute to apply its OmniTAC discovery platform to identify new targets in cancer treatment, while also advancing programs in other disease areas.

- This partnership highlights Daiichi Sankyo’s continued investment in next-generation oncology research and its effort to address protein targets previously considered undruggable.

- We’ll examine how this expansion into novel protein targeting could reshape Daiichi Sankyo’s pipeline strength and future growth prospects.

Find companies with promising cash flow potential yet trading below their fair value.

Daiichi Sankyo Company Investment Narrative Recap

For shareholders of Daiichi Sankyo, the investment thesis is built around leadership in next-generation oncology and the potential for its pipeline to offset the risk of blockbuster concentration. The recent General Proximity collaboration signals intent to expand addressable markets in cancer and hard-to-treat diseases, but this early-stage R&D news does not materially alter the near-term catalyst of pivotal regulatory decisions for ENHERTU and DATROWAY, nor mitigate the central risk from their revenue concentration.

Among recent announcements, the first-in-human phase 1 trial launch for DS3610, a new STING agonist antibody drug conjugate, stands out. Like the General Proximity deal, it centers on innovation in oncology, underlining Daiichi Sankyo’s focus on expanding its ADC and immune-oncology franchise, which remains key for maintaining momentum as upcoming data and approvals for core assets are awaited.

Yet for investors, a critical risk remains in the concentration of sales among only a handful of approved therapies, so if new entrants or regulatory hurdles arise…

Read the full narrative on Daiichi Sankyo Company (it's free!)

Daiichi Sankyo Company is projected to achieve ¥2,659.1 billion in revenue and ¥447.9 billion in earnings by 2028. This outlook is based on an annual revenue growth rate of 11.4% and reflects an earnings increase of ¥152.0 billion from current earnings of ¥295.9 billion.

Uncover how Daiichi Sankyo Company's forecasts yield a ¥5517 fair value, a 49% upside to its current price.

Exploring Other Perspectives

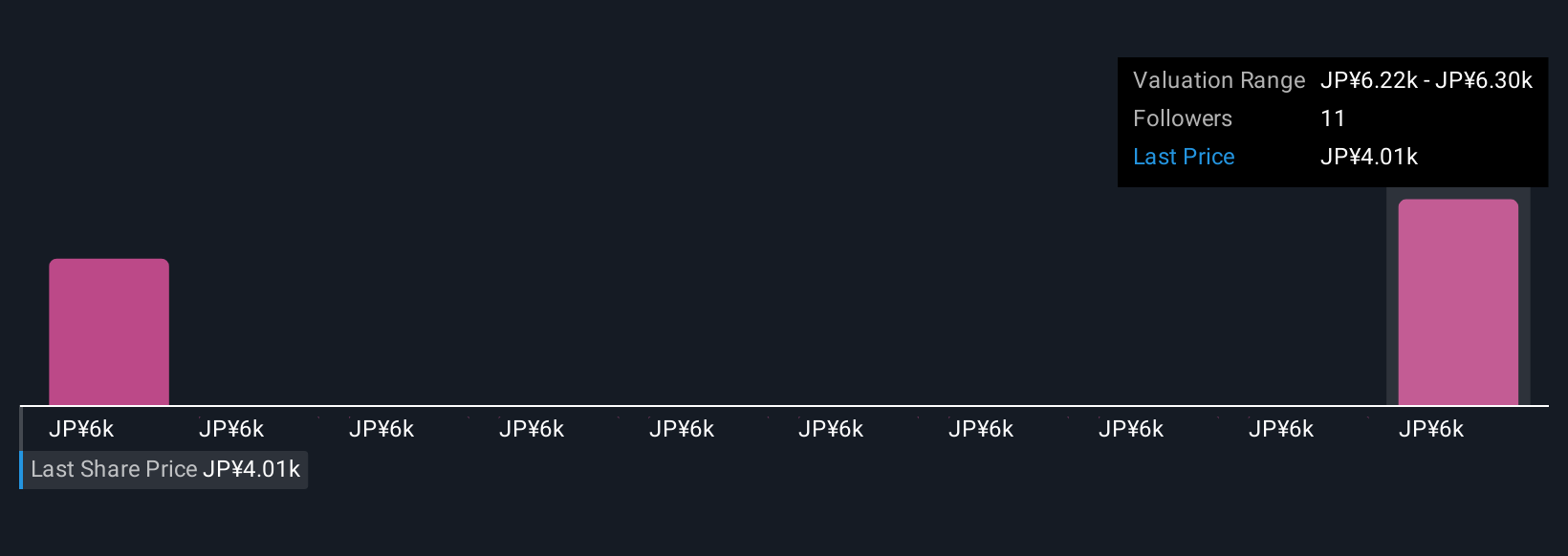

Simply Wall St Community fair value estimates for Daiichi Sankyo span from ¥5,517 to ¥6,441 across two contributors, reflecting sharply different views. As multiple participants weigh near-term product milestones against risks tied to dependency on a few oncology leaders, you can compare these perspectives to inform your own outlook.

Explore 2 other fair value estimates on Daiichi Sankyo Company - why the stock might be worth as much as 74% more than the current price!

Build Your Own Daiichi Sankyo Company Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Daiichi Sankyo Company research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Daiichi Sankyo Company research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Daiichi Sankyo Company's overall financial health at a glance.

Contemplating Other Strategies?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4568

Daiichi Sankyo Company

Manufactures and sells pharmaceutical products in Japan, the United States, Europe, and internationally.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives