Nxera Pharma (TSE:4565): Losses Worsen 53.9% Annually, Growth Forecasts Challenge Cautious Market Narratives

Reviewed by Simply Wall St

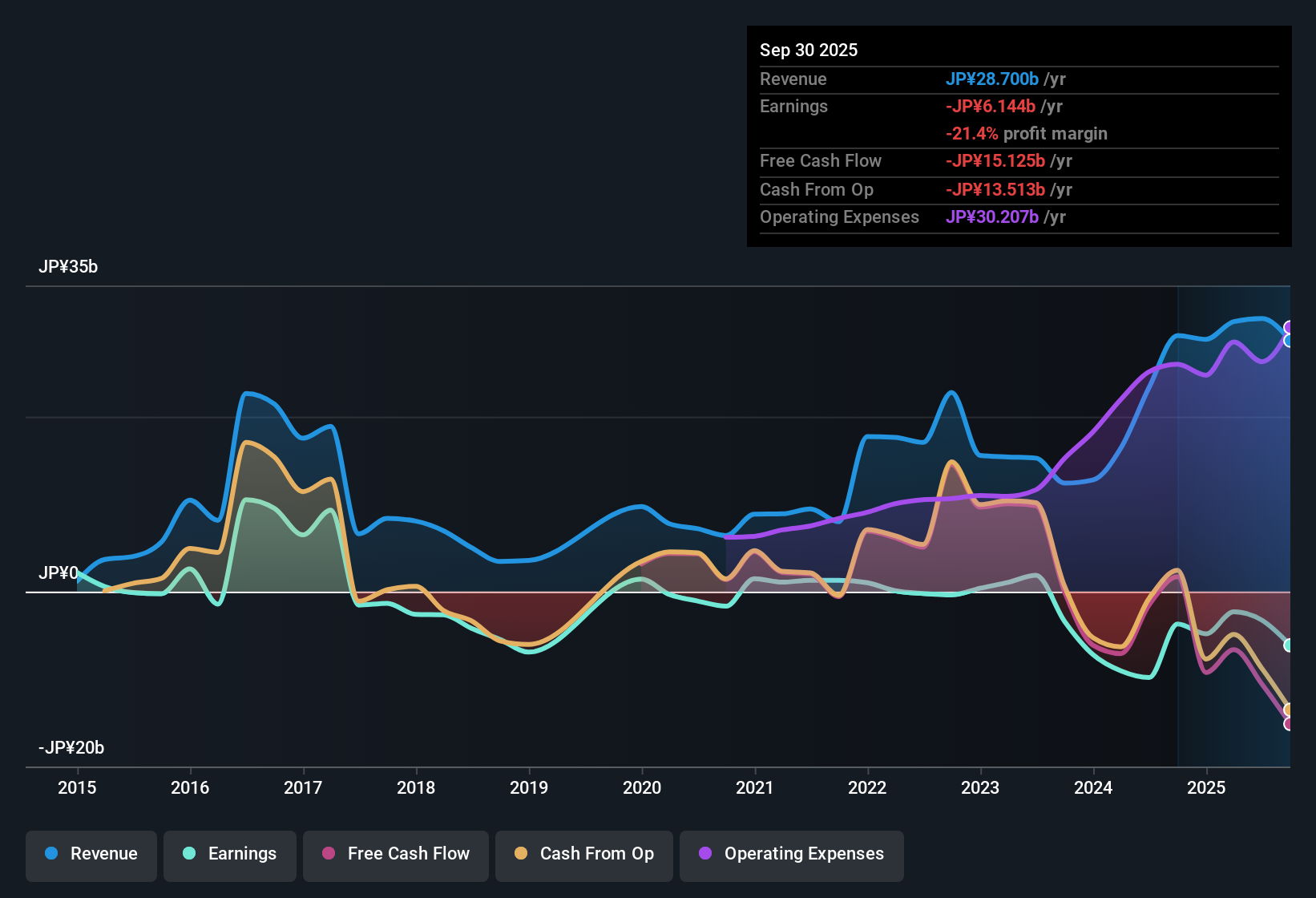

Nxera Pharma (TSE:4565) remains unprofitable, with losses having grown at an annual rate of 53.9% over the past five years. Looking ahead, analysts expect revenue to climb 9.5% per year, outpacing the Japanese market’s 4.5% average. Earnings are projected to increase 53.44% annually, putting the company on track to achieve profitability within the next three years. Despite these robust growth projections, recent net profit margins have not shown improvement, leaving the company firmly in loss-making territory.

See our full analysis for Nxera Pharma.Next, we will set these headline numbers against the most widely followed market narratives to see which perspectives the results support and which ones might be up for debate.

See what the community is saying about Nxera Pharma

R&D Spend Outpaces Revenue Gains

- Recent losses have grown at a steep annual pace of 53.9% over the past five years, with operating profit especially impacted as rising R&D expenses have outpaced revenue growth.

- Analysts' consensus view highlights both the strength and risks in this trend:

- The consensus narrative notes that Nxera Pharma is aggressively investing in clinical-stage compounds, which affects profits but could drive long-term value by expanding its pipeline in high-growth markets such as obesity and neuropsychiatric disorders.

- What is surprising is that despite heavy R&D outlays, revenue is still expected to outgrow the broader market. This underlines market confidence in future asset launches even though short-term losses weigh on margins.

Premium Valuation Versus Industry

- Nxera Pharma's Price-to-Sales Ratio of 2.8x stands well above both the Japanese pharmaceuticals industry average of 1.6x and the peer average of 0.8x. Its shares at ¥896.00 are trading notably above the DCF fair value of ¥793.83.

- Analysts' consensus view contends that this premium reflects anticipated rapid growth and a differentiated pipeline, but the valuation creates pressure:

- The consensus narrative points out that, should earnings reach the expected ¥3.1 billion by 2028 and be valued at a PE of 60.5x, investors are paying forward for future success, especially since the current industry PE is only 16.3x.

- It is worth noting that analyst price targets average ¥1,794.44, which is almost double the current market price. This supports optimism but also signals that any setbacks in profitability or delays in pipeline milestones could significantly impact the shares.

Revenue Reliance on Key Drugs

- The company’s current revenues heavily depend on two commercialized products, PIVLAZ and QUVIVIQ. This raises concentration risk and leaves growth closely tied to late-stage asset development.

- According to the analysts' consensus view, this revenue reliance introduces both opportunity and vulnerability:

- The consensus narrative underscores that while strategic partnerships and new licensing deals are broadening the pipeline and supporting top-line stability, near-term margin pressure persists as supply profits from QUVIVIQ are only expected from 2027 onward.

- What is unexpected is that, despite these bottlenecks, forecasts still see overall profit margins moving from -10.5% today to 7.3% in three years, assuming key pipeline assets succeed and diversify the earnings base.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Nxera Pharma on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a distinct take on these figures? In just a few minutes, you can create and share your own narrative and highlight what you see. Do it your way

A great starting point for your Nxera Pharma research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Although Nxera Pharma’s revenue trajectory is strong, ongoing steep losses, heavy R&D outlays, and premium valuation put pressure on consistent profitability.

If you want greater confidence in a fair price and more downside protection, search for opportunities among these 831 undervalued stocks based on cash flows with more attractive risk-reward profiles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nxera Pharma might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4565

Nxera Pharma

Develops and sells pharmaceutical products in Japan, the United States, Germany, Switzerland, Bermuda, and the United Kingdom.

Reasonable growth potential with imperfect balance sheet.

Market Insights

Community Narratives