- Japan

- /

- Oil and Gas

- /

- TSE:8133

Top 3 Dividend Stocks On The Japanese Exchange To Enhance Your Income

Reviewed by Simply Wall St

Japan’s stock markets have recently experienced a strong rebound, with the Nikkei 225 Index gaining 8.7% and the broader TOPIX Index up 7.9%, driven by better-than-expected U.S. economic data and a robust performance in Japan's own economy. This positive momentum provides an opportune backdrop for investors seeking to enhance their income through dividend stocks. When selecting dividend stocks, it is crucial to consider factors such as consistent earnings growth, strong cash flow, and a solid track record of dividend payments—all of which are particularly relevant given the current market optimism and economic resilience in Japan.

Top 10 Dividend Stocks In Japan

| Name | Dividend Yield | Dividend Rating |

| Yamato Kogyo (TSE:5444) | 4.17% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.00% | ★★★★★★ |

| Globeride (TSE:7990) | 4.10% | ★★★★★★ |

| KurimotoLtd (TSE:5602) | 4.92% | ★★★★★★ |

| Innotech (TSE:9880) | 4.61% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.48% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.45% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 4.06% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.39% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.82% | ★★★★★★ |

Click here to see the full list of 448 stocks from our Top Japanese Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

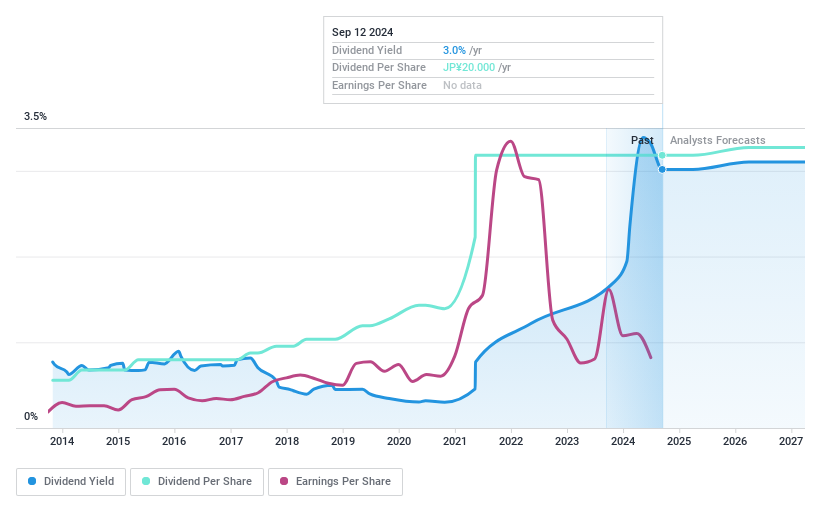

JCR Pharmaceuticals (TSE:4552)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: JCR Pharmaceuticals Co., Ltd. and its subsidiaries are involved in the research, development, manufacture, import and export, and sale of pharmaceutical products, regenerative medicines, and drug substances in Japan with a market cap of ¥71.65 billion.

Operations: JCR Pharmaceuticals Co., Ltd. generates revenue primarily from its Pharmaceuticals Business segment, which accounted for ¥40.21 billion.

Dividend Yield: 3.3%

JCR Pharmaceuticals' dividend payments have been stable and growing over the past decade, with a current yield of 3.31%. The dividends are well-covered by earnings (payout ratio: 60.9%) and cash flows (cash payout ratio: 34.6%). Despite recent setbacks, such as the discontinuation of TEMCELL®HS Inj.'s expanded indication development, JCR continues to advance promising treatments like JR-446 for MPS IIIB, potentially enhancing future corporate value.

- Take a closer look at JCR Pharmaceuticals' potential here in our dividend report.

- Upon reviewing our latest valuation report, JCR Pharmaceuticals' share price might be too pessimistic.

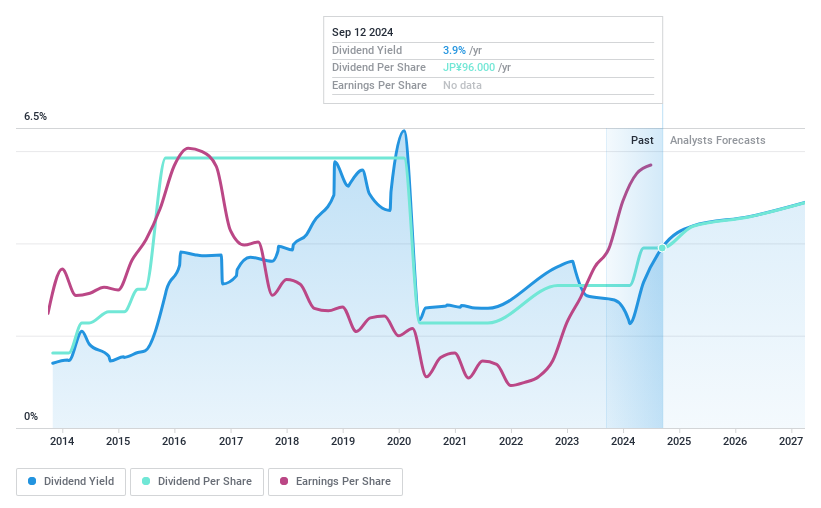

Subaru (TSE:7270)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Subaru Corporation manufactures and sells automobiles and aerospace products across Japan, the rest of Asia, North America, Europe, and internationally, with a market cap of ¥2.01 trillion.

Operations: Subaru Corporation generates revenue primarily from its car segment, which accounts for ¥4.60 billion, and its aerospace segment, contributing ¥111.45 million.

Dividend Yield: 3.5%

Subaru's dividend payments have been volatile over the past decade but have shown growth. The dividends are well covered by both earnings (payout ratio: 16.4%) and cash flows (cash payout ratio: 18.9%). Despite a lower yield compared to top-tier dividend payers in Japan, Subaru trades at a significant discount to its estimated fair value and peers. Recent buybacks, totaling ¥24.15 billion for 7,196,500 shares, indicate strong financial health and shareholder returns focus.

- Click to explore a detailed breakdown of our findings in Subaru's dividend report.

- Our valuation report unveils the possibility Subaru's shares may be trading at a discount.

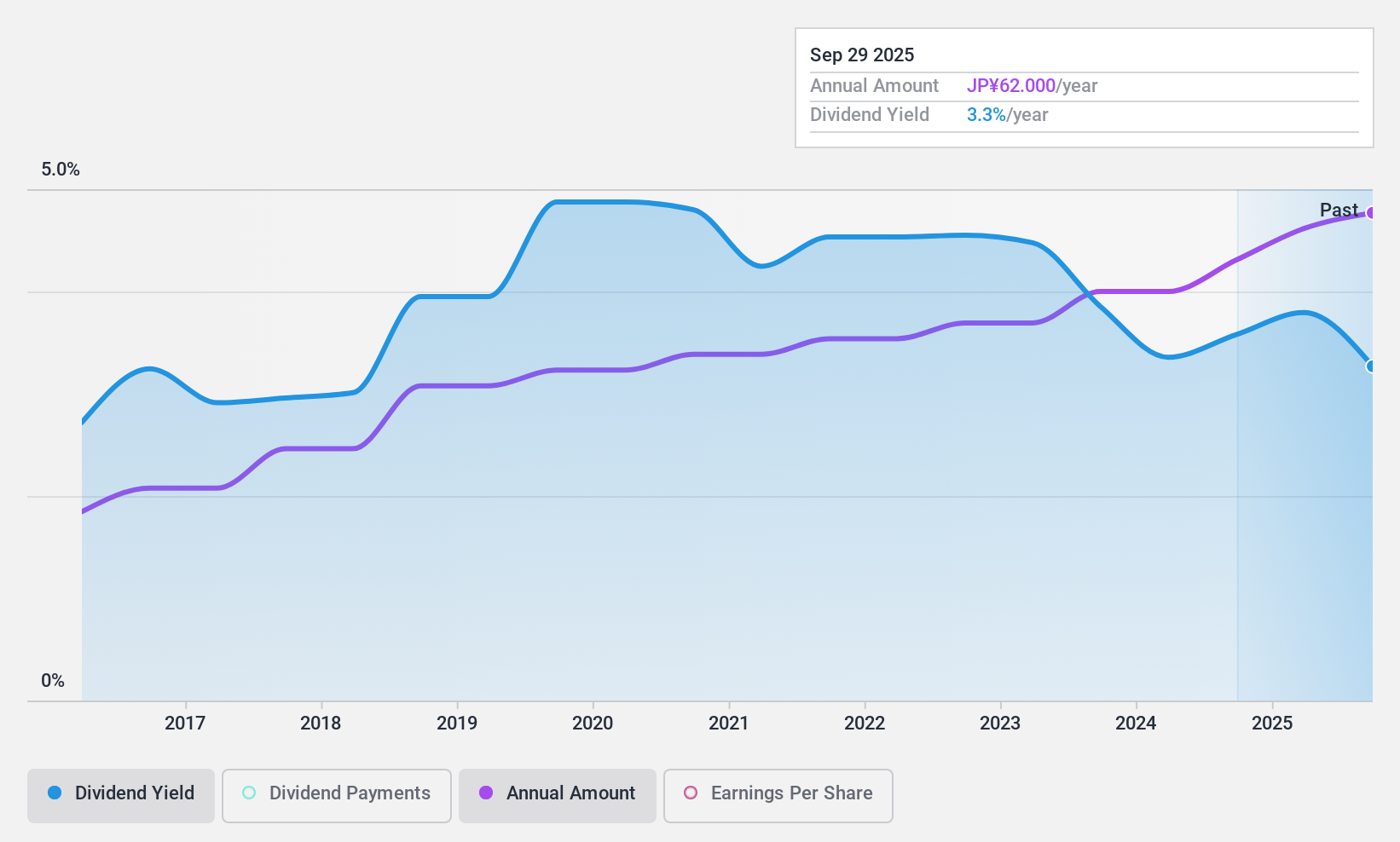

Itochu EnexLtd (TSE:8133)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Itochu Enex Co., Ltd. engages in the sale of petroleum products and liquefied petroleum gas (LPG) in Japan and internationally, with a market cap of ¥169.13 billion.

Operations: Itochu Enex Co., Ltd. generates revenue from various segments, including Car Life Business (¥640.70 billion), Home Life Business (¥78.55 billion), Power and Utility Business (¥109.65 billion), and Industrial Business Division (¥151.16 billion).

Dividend Yield: 3.5%

Itochu Enex Ltd. has demonstrated stable and reliable dividend payments over the past decade, with a current yield of 3.47%. The company's dividends are well-covered by earnings (payout ratio: 49%) and cash flows (cash payout ratio: 67.5%). Although its yield is slightly lower than the top 25% of dividend payers in Japan, the consistent growth in dividends highlights its commitment to shareholder returns. Recent executive changes may influence future strategies.

- Delve into the full analysis dividend report here for a deeper understanding of Itochu EnexLtd.

- Our expertly prepared valuation report Itochu EnexLtd implies its share price may be too high.

Make It Happen

- Unlock more gems! Our Top Japanese Dividend Stocks screener has unearthed 445 more companies for you to explore.Click here to unveil our expertly curated list of 448 Top Japanese Dividend Stocks.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8133

Itochu EnexLtd

Engages in the sale of petroleum products and liquefied petroleum gas (LPG) in Japan and internationally.

Flawless balance sheet established dividend payer.