Upgraded Earnings and Dividend Outlook Might Change the Case for Investing in Tsumura (TSE:4540)

Reviewed by Sasha Jovanovic

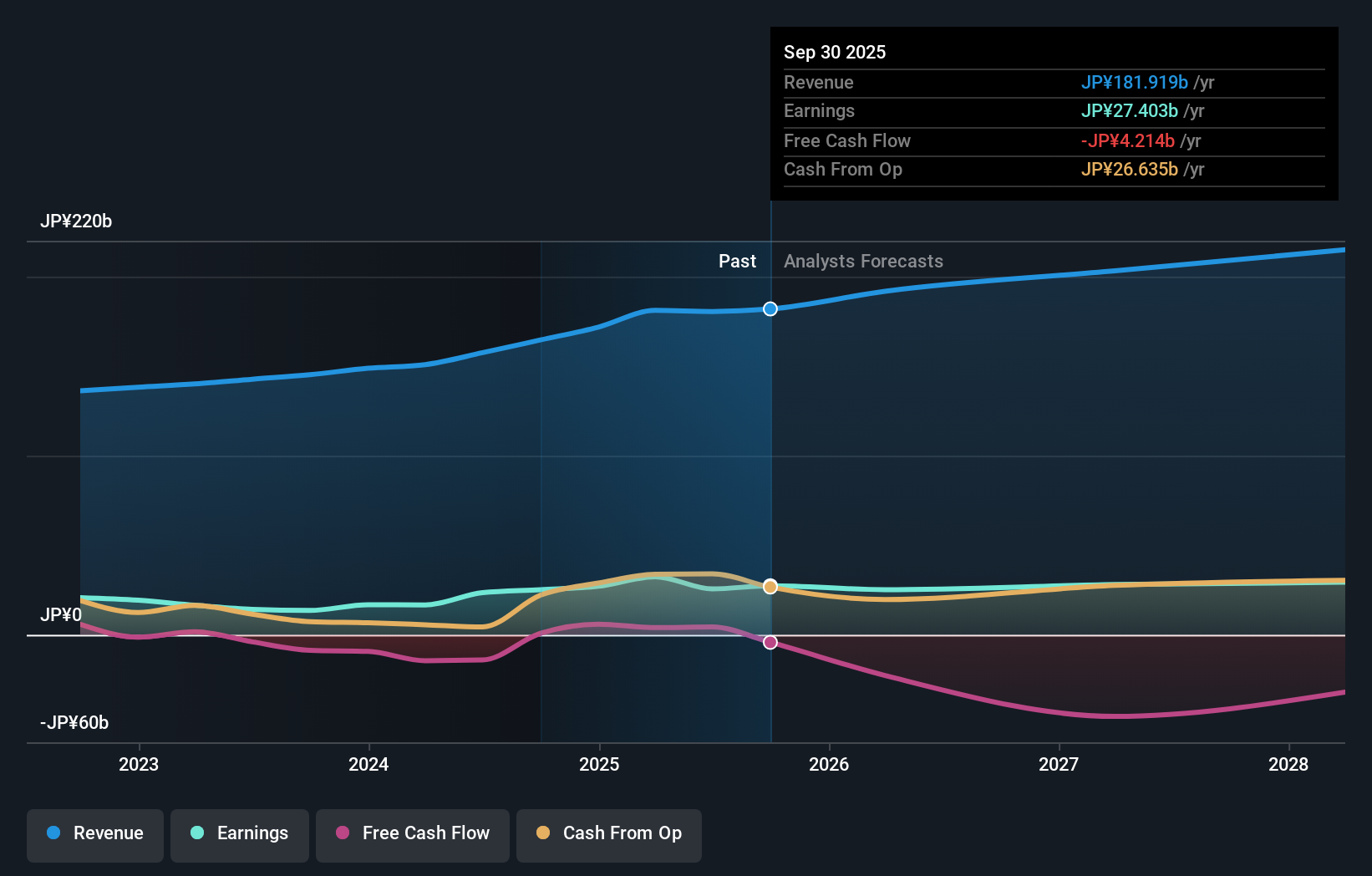

- Tsumura & Co. announced upward revisions to its earnings and dividend guidance for the fiscal years ending March 2026 and 2027, citing the consolidation of subsidiary Shanghai Hongqiao Traditional Chinese Drug Pieces and improved cost management as key drivers for higher projected net sales, profit, and shareholder returns.

- The increase in annual dividend guidance reflects the company’s commitment to shareholder returns alongside expectations of improved profitability following recent acquisition and operational improvements.

- We'll explore how the acquisition-led guidance upgrades and dividend increase shape Tsumura's evolving investment narrative.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is Tsumura's Investment Narrative?

Tsumura appeals to shareholders who believe in steady healthcare demand in Japan and China, plus disciplined cost management even as operating momentum matures. The recent upward revisions to guidance reflect the integration of Hongqiao as a significant near-term catalyst, supporting improved profitability and enabling higher dividends, an encouraging signal after a period of underperformance versus the market and sector. While this acquisition and cost discipline address past hesitancy around margin compression, risks remain, such as the still-fresh management team and exposure to inflation pressures on input costs. The recent news suggests that at least some short-term questions around profit growth and capital returns have become less acute, but investors will want to monitor whether these improvements are sustainable. The re-rating effect may not close return gaps overnight, but the story is evolving quickly.

But with the operational turnaround come new questions about sustainability and leadership stability, investors should stay alert. Tsumura's share price has been on the slide but might be dropping deeper into value territory. Find out whether it's a bargain at this price.Exploring Other Perspectives

Explore another fair value estimate on Tsumura - why the stock might be worth as much as 12% more than the current price!

Build Your Own Tsumura Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Tsumura research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Tsumura research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Tsumura's overall financial health at a glance.

Searching For A Fresh Perspective?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tsumura might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4540

Tsumura

Engages in the production and sale of Kampo extract intermediates and granular Kampo formulations in Japan and internationally.

Excellent balance sheet established dividend payer.

Market Insights

Community Narratives