Tsumura's (TSE:4540) Promising Earnings May Rest On Soft Foundations

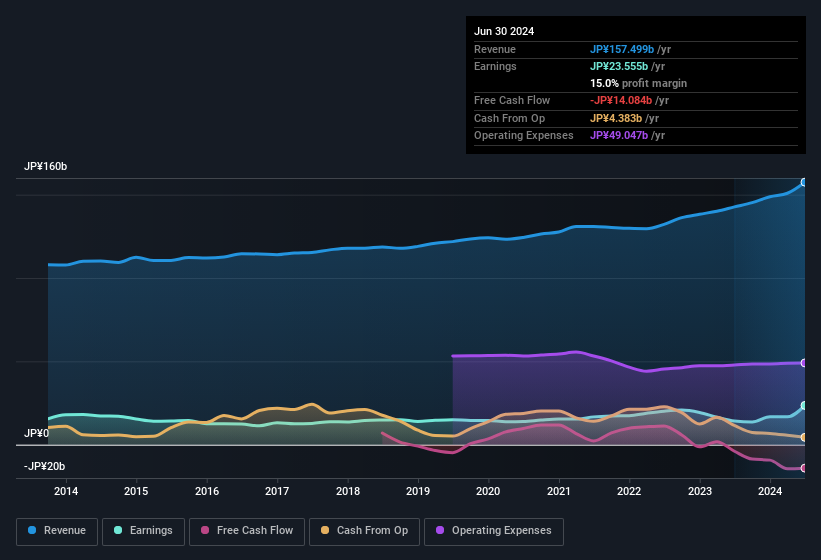

Despite posting some strong earnings, the market for Tsumura & Co.'s (TSE:4540) stock hasn't moved much. Our analysis suggests that shareholders have noticed something concerning in the numbers.

View our latest analysis for Tsumura

The Impact Of Unusual Items On Profit

To properly understand Tsumura's profit results, we need to consider the JP¥2.0b gain attributed to unusual items. We can't deny that higher profits generally leave us optimistic, but we'd prefer it if the profit were to be sustainable. We ran the numbers on most publicly listed companies worldwide, and it's very common for unusual items to be once-off in nature. Which is hardly surprising, given the name. If Tsumura doesn't see that contribution repeat, then all else being equal we'd expect its profit to drop over the current year.

That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

Our Take On Tsumura's Profit Performance

We'd posit that Tsumura's statutory earnings aren't a clean read on ongoing productivity, due to the large unusual item. Therefore, it seems possible to us that Tsumura's true underlying earnings power is actually less than its statutory profit. Nonetheless, it's still worth noting that its earnings per share have grown at 42% over the last three years. At the end of the day, it's essential to consider more than just the factors above, if you want to understand the company properly. In light of this, if you'd like to do more analysis on the company, it's vital to be informed of the risks involved. While conducting our analysis, we found that Tsumura has 1 warning sign and it would be unwise to ignore this.

Today we've zoomed in on a single data point to better understand the nature of Tsumura's profit. But there are plenty of other ways to inform your opinion of a company. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks with significant insider holdings to be useful.

Valuation is complex, but we're here to simplify it.

Discover if Tsumura might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:4540

Tsumura

Engages in the production and sale of Kampo extract intermediates and granular Kampo formulations in Japan and internationally.

Excellent balance sheet established dividend payer.

Market Insights

Community Narratives