Santen Pharmaceutical (TSE:4536) Valuation Spotlight After Treasury Share Disposal for Performance-Linked Management Plan

Reviewed by Simply Wall St

Santen Pharmaceutical (TSE:4536) has completed the disposal of treasury shares through a post-delivery performance-linked stock remuneration plan. This move, approved by its Board, is aimed at better aligning management incentives with business performance.

See our latest analysis for Santen Pharmaceutical.

Santen’s latest move comes after a year marked by a steady decline in momentum, with a 1-year total shareholder return of -13.16% and a 30-day share price return of -8.07%. While its 3-year total shareholder return of nearly 65% shows that long-term holders have still seen meaningful gains, recent price softness may reflect shifting sentiment as investors weigh the new governance initiatives in relation to performance pressures.

If governance changes like this spark your curiosity about what’s next in healthcare, it’s a great time to check out our See the full list for free.

With recent governance reforms and a notable discount to analyst price targets, investors might wonder whether Santen’s current valuation offers the beginnings of a rebound or if the market is already accounting for any future upside.

Price-to-Earnings of 15.5x: Is it justified?

Santen Pharmaceutical's shares are priced at a price-to-earnings (P/E) ratio of 15.5x, notably higher than both peer and industry averages. At a last close of ¥1,509, this suggests investors are paying a premium relative to similar companies in the Japanese pharmaceuticals sector.

The price-to-earnings ratio is a widely used metric that compares a company's share price to its earnings per share. This helps investors assess valuation relative to profits. For pharmaceuticals, where earnings stability and growth potential matter, a higher P/E can indicate either stronger expected growth or an overvalued stock.

Santen's P/E of 15.5x surpasses the industry average of 14.8x, and is well above the peer group average of 11.8x. However, when benchmarked against the estimated fair value P/E of 18.9x, there appears to be room for the market to recalibrate. This gap could potentially close if Santen delivers on its projected growth trajectory.

Explore the SWS fair ratio for Santen Pharmaceutical

Result: Price-to-Earnings of 15.5x (OVERVALUED)

However, weaker revenue growth or continued share price pressure could challenge optimism and limit the pace of any potential share price rebound.

Find out about the key risks to this Santen Pharmaceutical narrative.

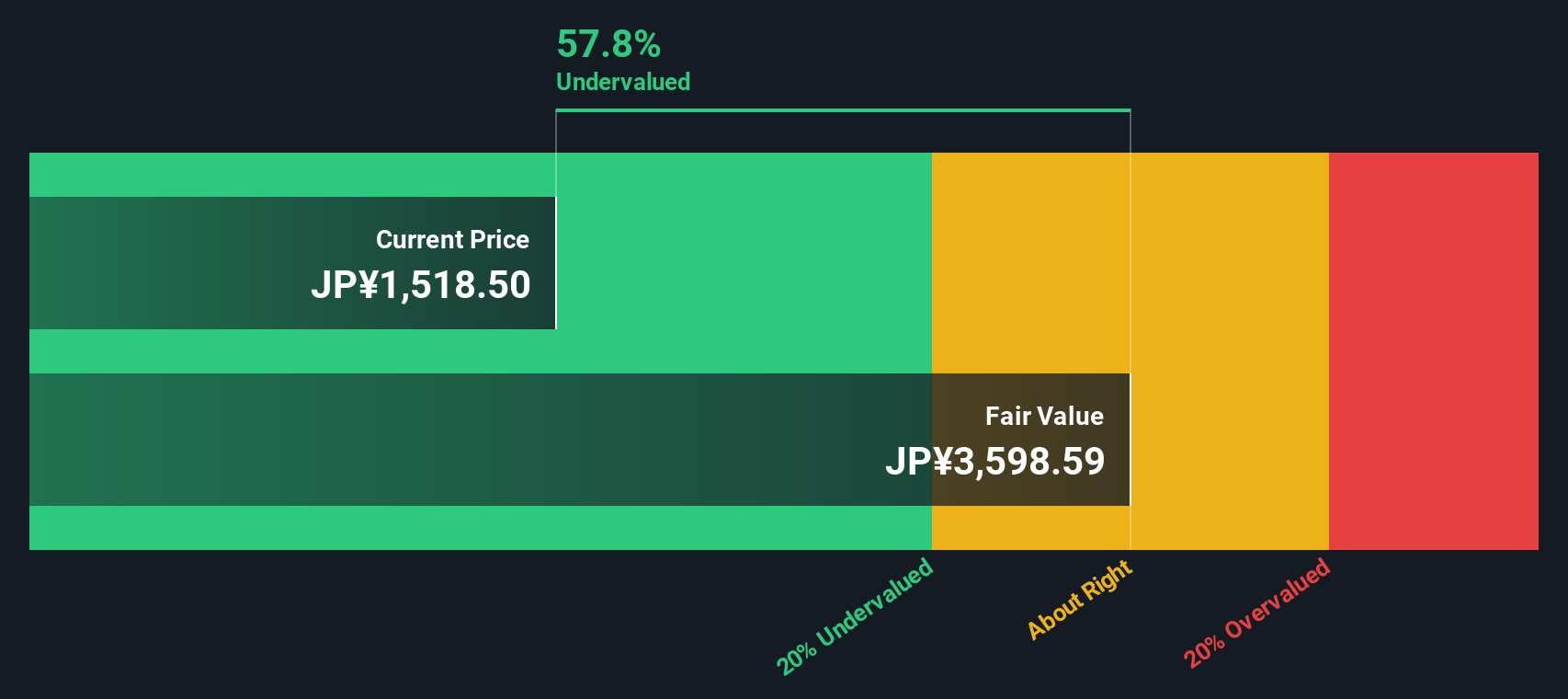

Another View: Discounted Cash Flow Tells a Different Story

While Santen Pharmaceutical looks expensive using the price-to-earnings ratio, our DCF model suggests the stock could be significantly undervalued, trading at 58% below its estimated fair value. This method relies on future cash flow projections rather than past profits and may reveal hidden upside. Could the market be underestimating Santen's future growth potential?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Santen Pharmaceutical for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 840 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Santen Pharmaceutical Narrative

If you see things differently or want to dig into the numbers yourself, you can quickly shape your own perspective using our tools in just a few minutes. So why not Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Santen Pharmaceutical.

Looking for More Investment Ideas?

Stop waiting for the perfect stock and broaden your strategy with new opportunities cropping up across the market. Get ahead and access unique investment insights now:

- Capture impressive yields by targeting income growth with these 22 dividend stocks with yields > 3%, offering attractive returns from reliable companies.

- Join the AI revolution and tap into cutting-edge potential by reviewing these 27 AI penny stocks, reshaping industries with intelligent innovation.

- Strengthen your portfolio’s potential for high returns by searching through these 840 undervalued stocks based on cash flows, which may be trading below their true worth right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4536

Santen Pharmaceutical

Engages in the research and development, manufacturing, and marketing of pharmaceuticals and medical devices in Japan, China, Asia, Europe, the Middle East, Africa, and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives