MHRA Approval of Ryjunea® Could Be a Game Changer for Santen Pharmaceutical (TSE:4536)

Reviewed by Sasha Jovanovic

- In the past week, Santen Pharmaceutical announced that the UK Medicines and Healthcare products Regulatory Agency (MHRA) approved Ryjunea® (low-dose atropine 0.1 mg/ml) as the first licensed treatment to slow the progression of myopia in children, following earlier European Commission approval and launches in Europe.

- This milestone offers Santen a new opportunity to address the rising prevalence of childhood myopia in the UK and further strengthens its international presence in paediatric eye health.

- We'll explore how the MHRA approval of Ryjunea® as a pioneering treatment for childhood myopia shapes Santen Pharmaceutical's investment narrative.

Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

What Is Santen Pharmaceutical's Investment Narrative?

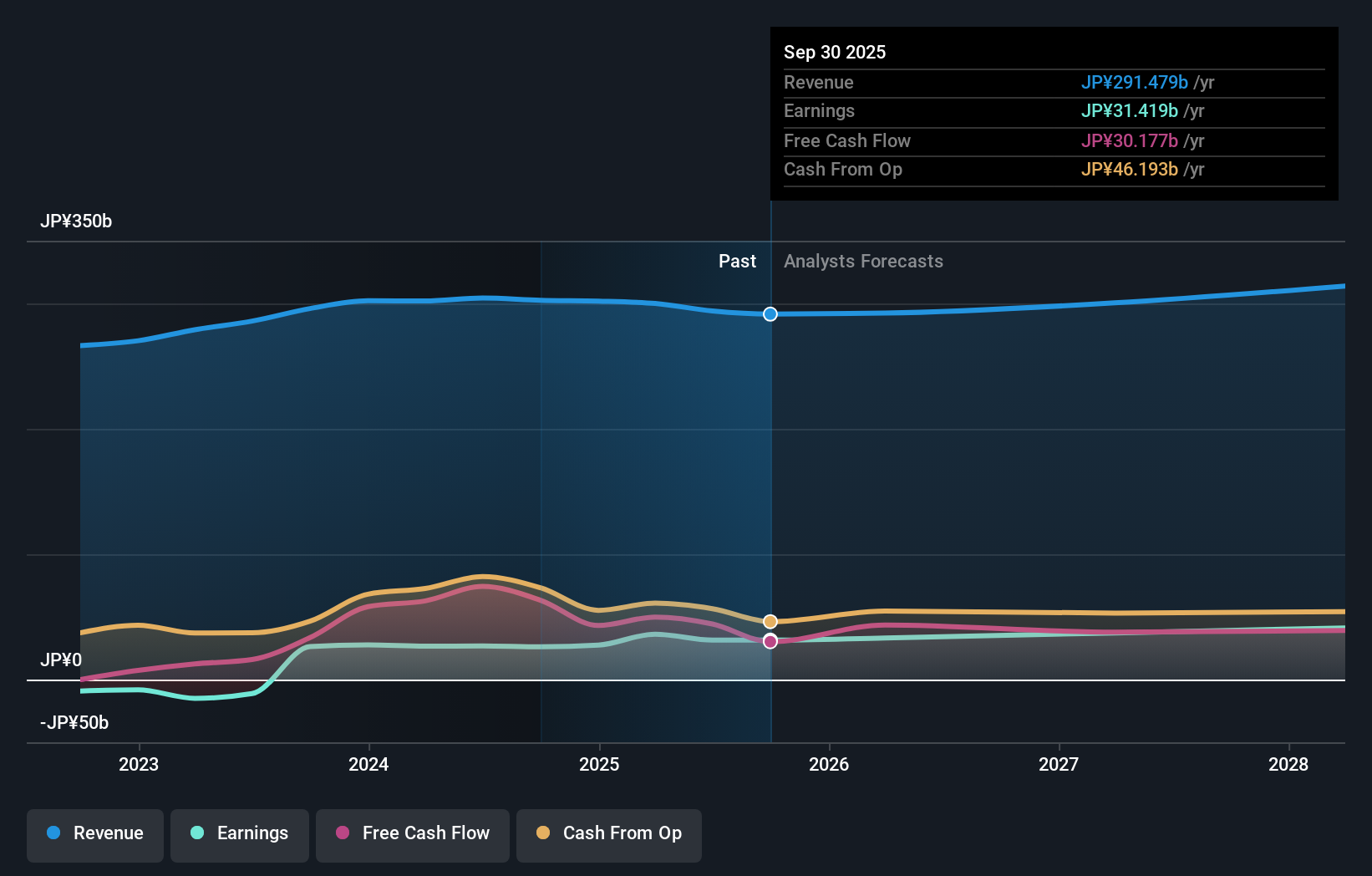

For Santen Pharmaceutical, the investment case centers around its positioning as a specialist in eye health with a steady earnings outlook, reliable dividends, and recent initiatives to boost shareholder value, such as the extensive share buyback program. The major short-term catalyst has quickly become the MHRA’s approval of Ryjunea® in the UK, the first such licensing locally for childhood myopia, which may accelerate Santen’s European growth strategy and should now matter more in near-term market attention than previously expected. With a forecast earnings growth outpacing the Japanese market and price targets still well above current trading levels, momentum may shift if Ryjunea® adoption meets expectations. That said, persistent risks include slower revenue growth than the overall market, board turnover, and the potential overvaluation relative to peers, so investors will be keeping a close watch given recent share price underperformance.

Yet, Santen’s board changes remain an important detail that investors should watch.

Exploring Other Perspectives

Explore another fair value estimate on Santen Pharmaceutical - why the stock might be worth just ¥3584!

Build Your Own Santen Pharmaceutical Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Santen Pharmaceutical research is our analysis highlighting 5 key rewards that could impact your investment decision.

- Our free Santen Pharmaceutical research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Santen Pharmaceutical's overall financial health at a glance.

Seeking Other Investments?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4536

Santen Pharmaceutical

Engages in the research and development, manufacturing, and marketing of pharmaceuticals and medical devices in Japan, China, Asia, Europe, the Middle East, Africa, and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives