Mochida Pharmaceutical (TSE:4534) Net Margin Rebound Reinforces Bullish Quality Earnings Narrative

Reviewed by Simply Wall St

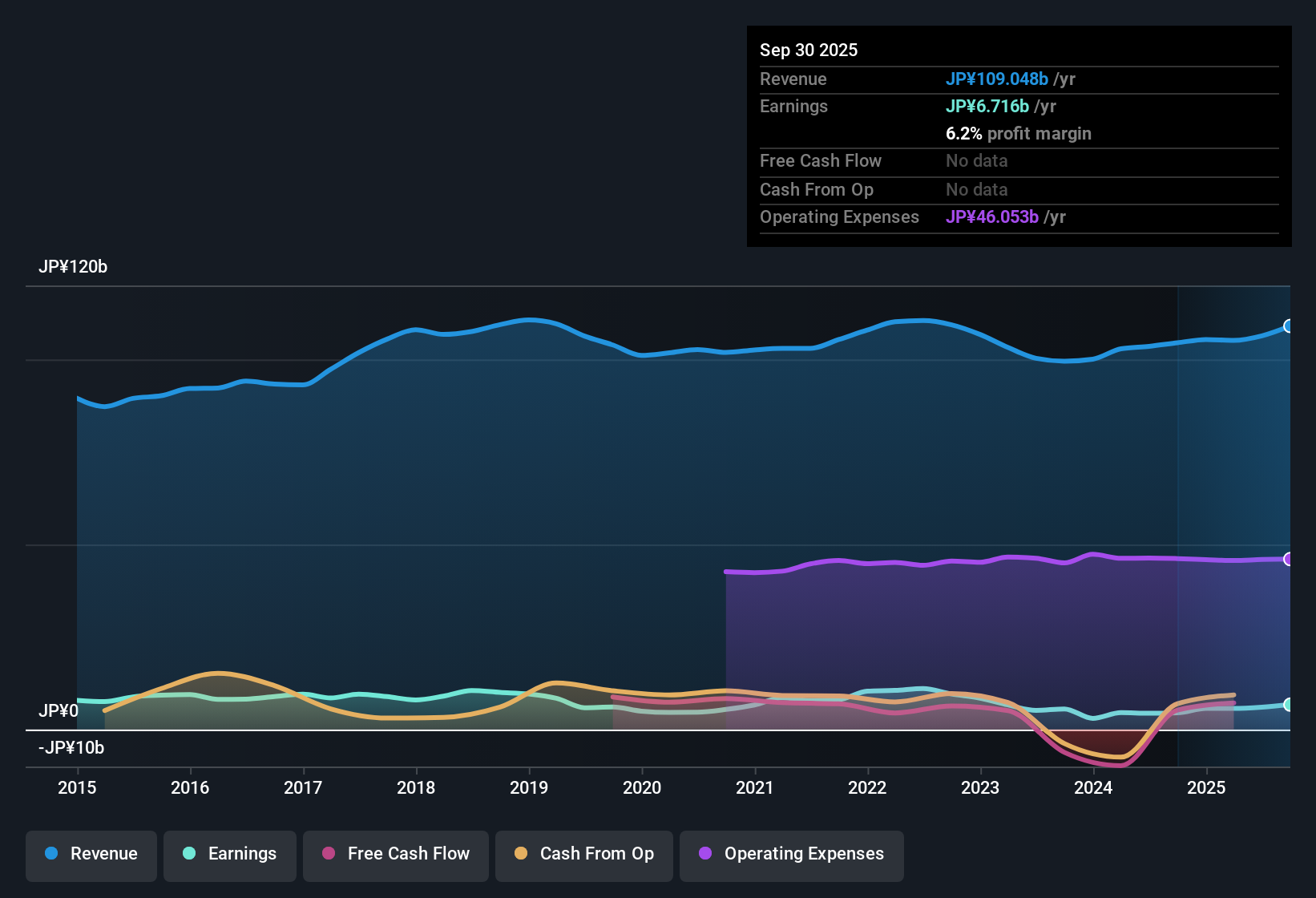

Mochida Pharmaceutical (TSE:4534) posted a sharp increase in net profit margin to 5.7%, up from 4.3% last year, with earnings surging 36.5% over the past year. This marks a notable turnaround from its five-year average decline of 12.2% per year. The company’s shares are trading at ¥3,035, below their estimated fair value of ¥5,115.43, but the price-to-earnings ratio stands at 17.9x, commanding a premium to both peers and the broader Japanese pharmaceutical industry. Investors are watching the rebound in profits and premium valuation closely, as the mix of high-quality earnings and potential risks around dividend sustainability and future growth shape the outlook.

See our full analysis for Mochida Pharmaceutical.Next, we’ll compare these headline results to the stories circulating among investors. Some commonly held views are about to be put to the test against the numbers.

Curious how numbers become stories that shape markets? Explore Community Narratives

Net Margin Trend Backs Quality Claims

- The net profit margin reaching 5.7% this year, up from 4.3% last year, marks a sharp turnaround from Mochida’s longer-term average decline of 12.2% per year over the past five years.

- The recent improvement in profitability highlights a key claim from the prevailing market view that high-quality earnings are driving positive sentiment.

- Annual margin growth stands out against the backdrop of multi-year declines, calling attention to a meaningful change in earnings trajectory.

- The margin recovery puts Mochida ahead of many peers in the Japanese pharma space, supporting the case for a more durable profit base.

Premium P/E Multiple Defies Discounted Share Price

- Mochida’s price-to-earnings ratio sits at 17.9x, which is higher than both the peer average of 10.1x and broader industry average of 14x, even as shares trade at ¥3,035, well below the DCF fair value of ¥5,115.43.

- The prevailing market view focuses on this unusual combination:

- The market is awarding a significant premium for perceived earnings quality, which reinforces bullish stances on the company’s long-term story.

- Despite this premium, the gap between Mochida’s current share price and DCF fair value is substantial, hinting at potential upside if recent profitability gains prove sustainable.

Dividend Sustainability Remains a Key Watchpoint

- While current profitability has strengthened, the EDGAR summary flags real investor attention on risks related to dividend sustainability and future growth outlook.

- Prevailing analysis points out a tension that investors are weighing:

- High-quality earnings support the view that profits could continue to grow, which would typically underpin ongoing dividends.

- However, after several years of declining earnings, questions linger about whether this margin boost is a trend or a blip, so the ability to maintain or improve dividends is not yet guaranteed in the absence of clearer long-term growth signals.

For more on how profit margins and valuation are shaping market sentiment, check out the consensus narrative for Mochida Pharmaceutical and see what’s dividing investors today. 📊 Read the full Mochida Pharmaceutical Consensus Narrative.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Mochida Pharmaceutical's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Mochida’s rebound in profit margins comes after years of declining earnings. This raises real questions about whether this turnaround is truly sustainable.

If you want steadier performance regardless of market shifts, check out stable growth stocks screener (2083 results) to discover companies with reliable growth through different cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4534

Mochida Pharmaceutical

Manufactures and sells pharmaceuticals and healthcare products in Japan.

Flawless balance sheet with proven track record and pays a dividend.

Market Insights

Community Narratives