Why Eisai (TSE:4523) Is Up 7.2% After Advancing Leqembi's Maintenance Dosing and FDA Submissions

Reviewed by Sasha Jovanovic

- In recent weeks, BioArctic AB's partner Eisai achieved key regulatory milestones for its Alzheimer's treatment Leqembi (lecanemab), including UK approval for less frequent intravenous maintenance dosing and completion of a rolling submission to the US FDA for a subcutaneous option following Fast Track designation.

- These developments set the stage for enhanced treatment convenience, broader patient access, and further data presentation at major industry conferences, highlighting Eisai's momentum in the evolving Alzheimer's therapy landscape.

- We'll explore how the introduction of subcutaneous dosing for Leqembi shapes Eisai's investment narrative and long-term market positioning.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Eisai Investment Narrative Recap

To own Eisai, I believe an investor needs conviction in the long-term potential of disease-modifying Alzheimer's therapies, especially Leqembi, and the company's ability to grow its neuroscience franchise while navigating fierce price and reimbursement pressure. The latest approval and rolling US submission for subcutaneous Leqembi adds meaningful short-term momentum but leaves the biggest near-term risk, increased regulatory and pricing scrutiny, largely unresolved, so current commercial and reimbursement challenges remain front and center.

The recent FDA approval of Leqembi IQLIK for subcutaneous maintenance dosing in early Alzheimer's is a key development. This aligns directly with catalysts around treatment convenience and patient access, with presentations at the CTAD conference underscoring Eisai's focus on differentiation as competitors advance their own therapies.

Yet against these advances, investors should note...

Read the full narrative on Eisai (it's free!)

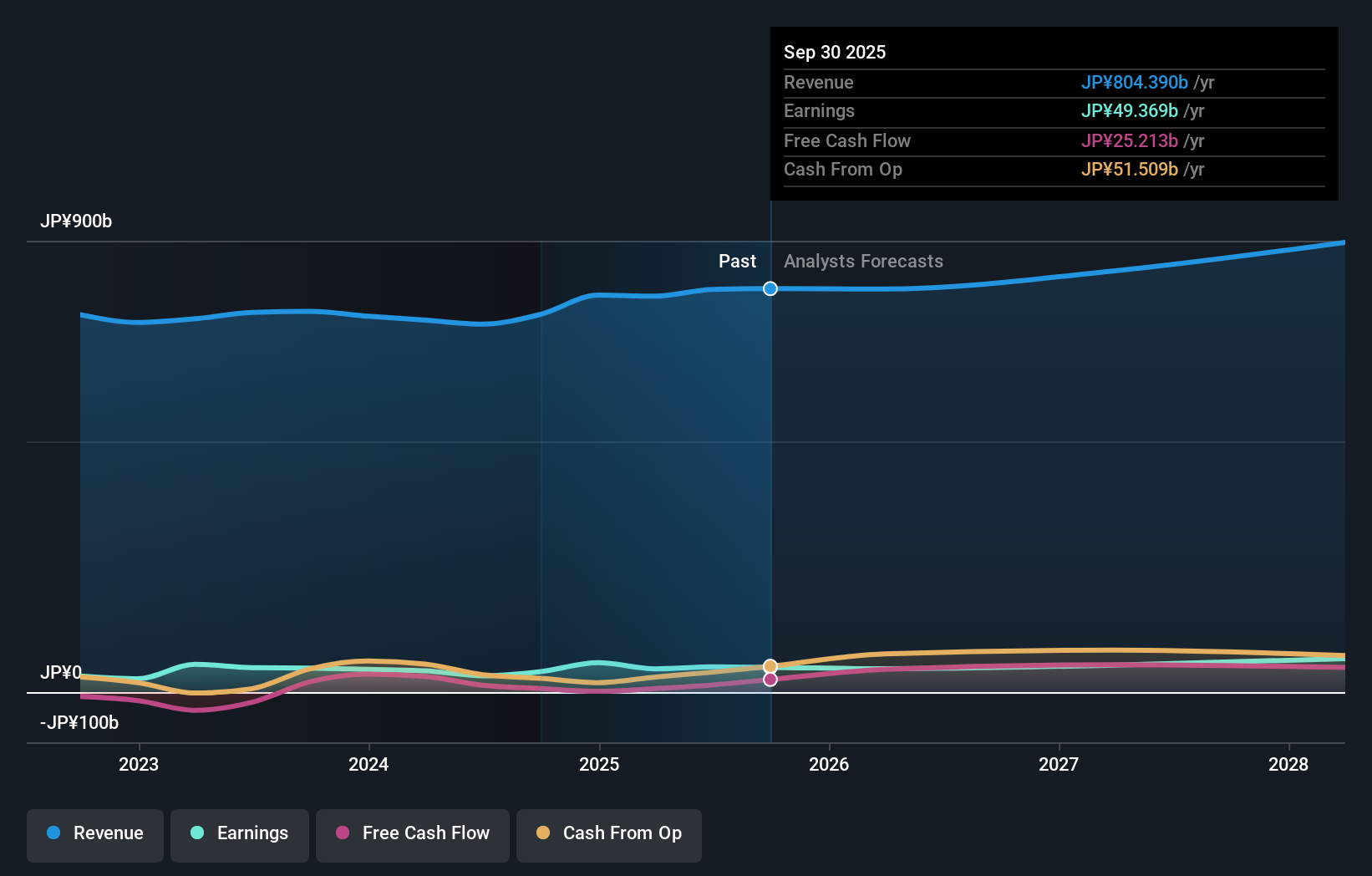

Eisai's outlook projects ¥897.0 billion in revenue and ¥66.6 billion in earnings by 2028. This assumes a 3.8% annual revenue growth rate and an increase in earnings of ¥16.3 billion from the current level of ¥50.3 billion.

Uncover how Eisai's forecasts yield a ¥5027 fair value, in line with its current price.

Exploring Other Perspectives

Simply Wall St Community members submitted two fair value estimates for Eisai between ¥5,026 and ¥6,739, reflecting wide-reaching views on the company’s outlook. While debate persists on valuation, the latest regulatory approvals for Leqembi highlight how much future performance may hinge on reimbursement and competition in Alzheimer’s treatment markets.

Explore 2 other fair value estimates on Eisai - why the stock might be worth just ¥5027!

Build Your Own Eisai Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Eisai research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Eisai research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Eisai's overall financial health at a glance.

Searching For A Fresh Perspective?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Eisai might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4523

Eisai

Engages in the research and development, manufacture, sale, and import and export of pharmaceuticals.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success