Eisai (TSE:4523) Profit Soars 54%—Earnings Turnaround Reinforces Bullish Narrative

Reviewed by Simply Wall St

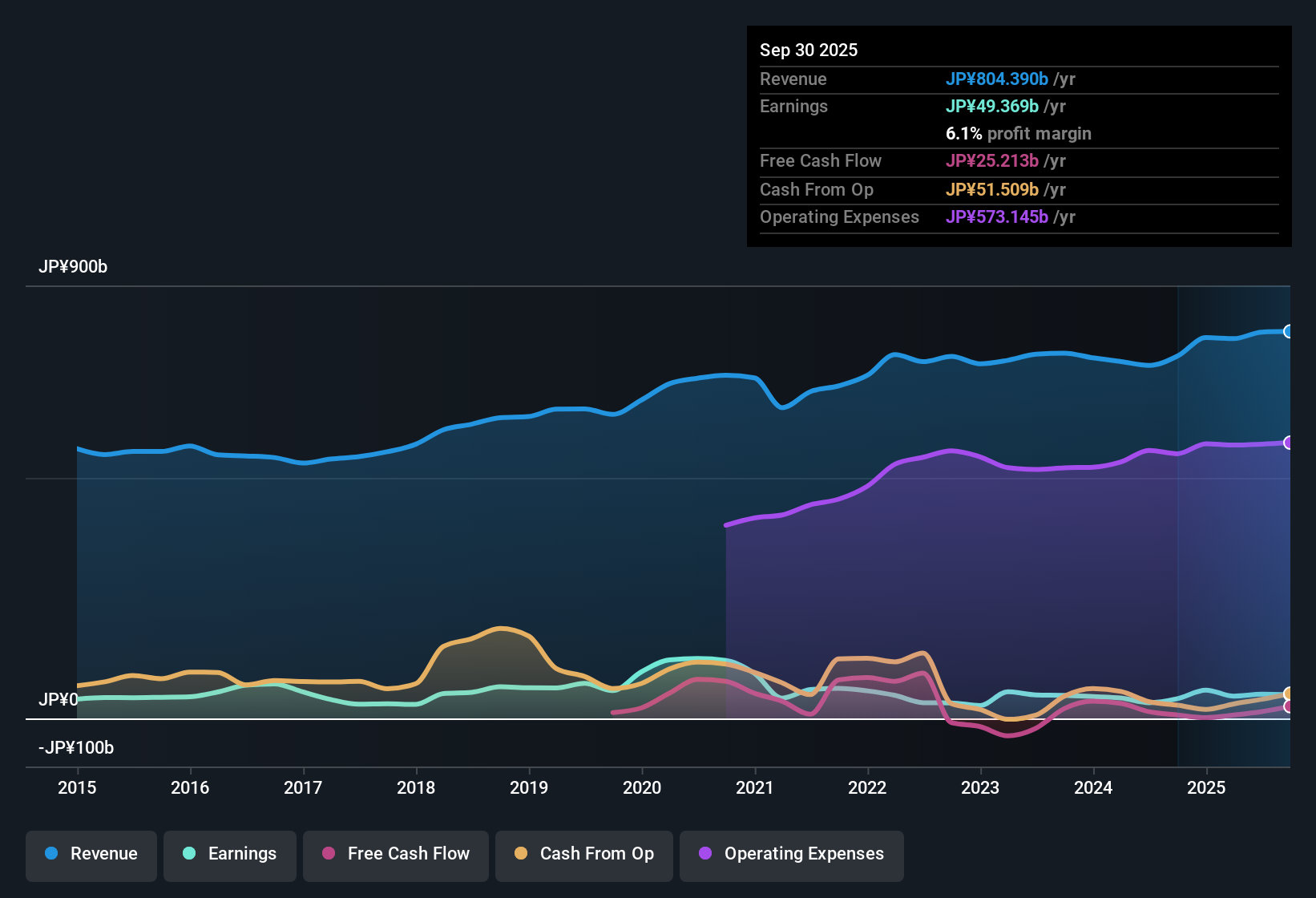

Eisai (TSE:4523) delivered a striking turnaround in its latest earnings report, with profits jumping 54.1% over the past year after having declined at an annualized rate of 14.1% for five years straight. Net profit margin climbed from 4.4% to 6.3% year on year, and the company now projects earnings growth of 13.7% annually, well ahead of the broader Japanese market forecast of 7.9% per year. Revenue is expected to grow slightly below the market rate at 4.1% per year. Despite the premium price-to-earnings ratio of 24.3x, strong earnings quality and ongoing profit growth point to a more robust risk/reward profile for investors.

See our full analysis for Eisai.We’ll now look at how these performance numbers compare to the prevailing narratives and expectations around Eisai, examining where the data supports consensus and where the story might be shifting.

See what the community is saying about Eisai

Margin Expansion Outpaces Revenue Gains

- Net profit margin rose from 4.4% to 6.3% over the past year, a sharper improvement than headline revenue growth. This points to gains from cost controls or a stronger product mix strengthening profitability.

- According to analysts' consensus view, profitability is not only benefiting from operational efficiencies but is also being supported by rapid adoption of Alzheimer's diagnostics.

- Consensus highlights that sustained demand for therapies like LEQEMBI, together with margin expansion, should drive long-term stability even though annual revenue growth (4.1%) is modest compared to the market (4.4%).

- The push toward an 8% ROE target by FY2026 and ongoing reductions in R&D and SG&A expenses further support the margin narrative, suggesting room for continued upside if execution holds.

- For a balanced view on how margin shifts are altering the story at Eisai and what could come next, see the full consensus narrative. 📊 Read the full Eisai Consensus Narrative.

Premium Valuation Versus Industry Peers

- Eisai trades at a price-to-earnings ratio of 24.3x, well above the Japanese pharmaceutical industry average of 13.9x and also higher than the peer average of 20x. This signals investors are willing to pay a premium even as forecast earnings growth is not dramatically higher than peers.

- Consensus narrative suggests this premium is being justified by robust profit growth and global momentum behind LEQEMBI, but also flags that, with current share price (¥4347) close to the analyst target price (¥5026.92), upside may be limited unless key catalysts such as new approvals or geographic expansion materialize.

- Analysts also point out that to deserve this valuation long-term, Eisai will need to keep growing earnings as forecast, maintain margin gains, and mitigate risk of pricing pressure or competition.

- The relatively slim gap between current price and target price puts a spotlight on execution risk if any of these factors falter.

Dividend Sustainability Remains a Key Risk

- Despite improved profits and margins, there remains a flagged risk around the sustainability of Eisai’s dividend, which could become a concern if pricing pressure or regulatory changes cut cash flow.

- Consensus narrative underscores this caution point, warning that overreliance on the Alzheimer’s franchise and global pressure on drug pricing could threaten future payouts.

- Potential 15% price reductions for key therapies and tougher regulatory scrutiny, especially in markets like Japan and the US, may squeeze profits at the margin just as obligations for dividends persist.

- With most growth concentrated in a few drugs, any setback, whether clinical or competitive, could quickly affect Eisai’s payout capacity. This raises the stakes for diversification efforts.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Eisai on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Looking at the figures from another angle? Share your unique perspective and build your own narrative in just a few minutes. Do it your way

A great starting point for your Eisai research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Eisai’s premium valuation and concentrated reliance on a few therapies leave its dividend and future growth vulnerable to pricing pressure and competitive threats.

If you want companies that can offer more reliable income streams, check out these 1972 dividend stocks with yields > 3% with healthy yields and well-supported payouts even in shifting markets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Eisai might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4523

Eisai

Engages in the research and development, manufacture, sale, and import and export of pharmaceuticals.

Proven track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives