Nippon Shinyaku (TSE:4516): Exploring Valuation Following Recent Share Price Fluctuations

Reviewed by Simply Wall St

Nippon Shinyaku (TSE:4516) stock has seen mixed movement recently, with a slight uptick over the past week but declines over the past month and year. Valuation-focused investors may be assessing what is driving these swings.

See our latest analysis for Nippon Shinyaku.

While Nippon Shinyaku's share price has staged a modest recovery in the past week, momentum remains muted compared to its longer-term performance. The latest 1-year total shareholder return of -17.2% underscores how sentiment has yet to fully rebound. At the same time, short-term price moves hint at potential shifts in risk perception.

If recent volatility has you thinking about other opportunities in the market, now is the perfect time to broaden your search and discover fast growing stocks with high insider ownership

That leaves investors at a crossroads, deciding whether Nippon Shinyaku’s subdued share price signals an undervalued opportunity or if the current market already reflects all future growth prospects.

Price-to-Earnings of 7.2x: Is it justified?

Nippon Shinyaku’s shares are currently trading at a price-to-earnings (P/E) ratio of 7.2, while the last close price stands at ¥3,279. This is meaningfully below both the peer average and the broader Japanese market.

The price-to-earnings ratio shows how much investors are willing to pay today for a company’s earnings power. For pharmaceutical firms like Nippon Shinyaku, this multiple can reflect expectations around steady profits, drug lifecycles, and growth prospects.

In this case, the market seems to be assigning Nippon Shinyaku a low valuation compared to its peers. The peer average P/E is closer to 13x, and the Japanese pharmaceuticals industry average is 14.9x. The fair P/E ratio is estimated at 11.7x, which suggests the market could re-rate the stock higher if earnings quality holds and forecasts improve.

Explore the SWS fair ratio for Nippon Shinyaku

Result: Price-to-Earnings of 7.2x (UNDERVALUED)

However, persistently slow net income growth and subdued long-term returns could challenge optimism and limit the potential for a swift valuation recovery.

Find out about the key risks to this Nippon Shinyaku narrative.

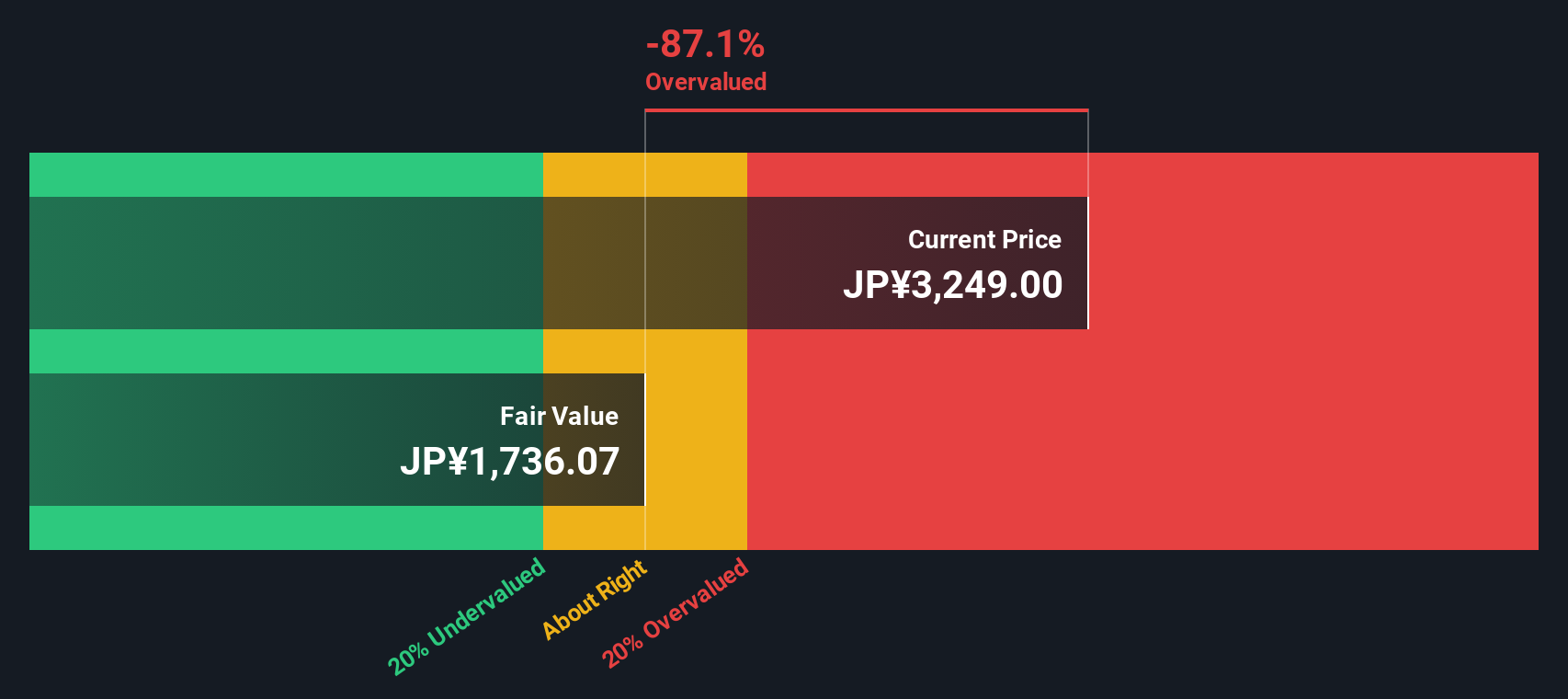

Another View: SWS DCF Model Challenges the Value Case

While traditional price-to-earnings compares Nippon Shinyaku favorably against peers, our DCF model paints a different picture. According to this method, the stock is currently trading above its fair value. This creates a mismatch between how profit multiples and intrinsic value estimates stack up. Which approach will the market follow next?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Nippon Shinyaku for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 874 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Nippon Shinyaku Narrative

If you see things differently or want to dive deeper into the numbers on your own, you can easily build your own perspective in just a few minutes. Do it your way

A great starting point for your Nippon Shinyaku research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don't let great opportunities pass you by. Leverage the Simply Wall Street Screener to spot unique growth, value, and income plays tailored to your goals.

- Capture the advantage of steady income and stability by checking out these 16 dividend stocks with yields > 3% offering reliable yields above 3%.

- Unleash your potential for big gains in emerging sectors by targeting these 25 AI penny stocks pushing boundaries with artificial intelligence innovation.

- Get ahead of the crowd by targeting value with these 874 undervalued stocks based on cash flows selected for strong fundamentals and attractive prices based on future cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nippon Shinyaku might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4516

Nippon Shinyaku

Manufactures and sells pharmaceuticals and foodstuffs in Japan and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives