FDA Expands PADCEV Combo Approval and It Might Change the Case for Investing in Astellas Pharma (TSE:4503)

Reviewed by Sasha Jovanovic

- On November 21, 2025, Pfizer Inc. and Astellas Pharma Inc. announced that the FDA approved PADCEV (enfortumab vedotin-ejfv) combined with pembrolizumab as a perioperative treatment for adult patients with muscle-invasive bladder cancer ineligible for cisplatin-containing chemotherapy, following positive Phase 3 results.

- This approval expands treatment options for a challenging patient group and highlights continued clinical progress in antibody-drug conjugates and immuno-oncology combinations.

- We'll examine how the expanded FDA approval for PADCEV plus pembrolizumab could reshape Astellas Pharma's investment narrative and future growth outlook.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Astellas Pharma Investment Narrative Recap

To be a shareholder in Astellas Pharma, you need confidence in the company’s ability to deliver growth through expanding indications for its key brands, robust clinical progress, and continued innovation in oncology. The recent FDA approval for PADCEV plus pembrolizumab as a perioperative treatment strengthens the most important near-term catalyst, franchise momentum for strategic oncology assets. However, concentration risk remains elevated due to reliance on a handful of recently launched brands, and this catalyst does not materially lower that risk just yet.

The October 2025 earnings guidance upgrade stands out as highly relevant: management raised full-year revenue and profit targets, citing surging PADCEV and VYLOY sales. This ties directly to the positive impact from major regulatory advancements in strategic brands, but also underscores how much Astellas’ future growth depends on these products. Execution on further global launches and expanding eligible patient pools will remain pivotal in light of this momentum.

Yet, investors should be aware that despite these wins, Astellas faces a potential risk from the looming loss of exclusivity for key products, especially...

Read the full narrative on Astellas Pharma (it's free!)

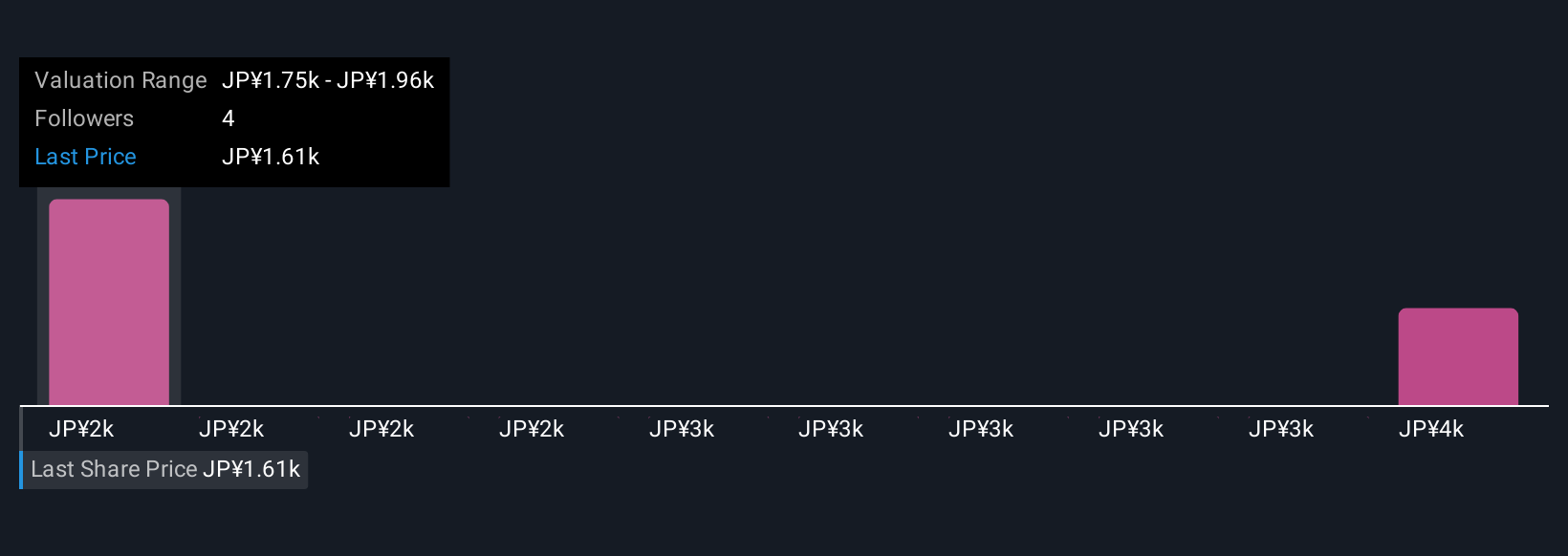

Astellas Pharma is expected to generate ¥1,868.3 billion in revenue and ¥184.0 billion in earnings by 2028. This is based on an annual revenue decline of 1.3% and an earnings increase of ¥102.4 billion from the current earnings of ¥81.6 billion.

Uncover how Astellas Pharma's forecasts yield a ¥1792 fair value, a 10% downside to its current price.

Exploring Other Perspectives

Simply Wall St Community fair value estimates for Astellas Pharma range from ¥1,792 to ¥4,142 across 2 individual views, reflecting wide divergence. While many see upside from oncology catalysts, concentration risk tied to blockbuster drugs could shape outcomes very differently for each participant.

Explore 2 other fair value estimates on Astellas Pharma - why the stock might be worth 10% less than the current price!

Build Your Own Astellas Pharma Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Astellas Pharma research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Astellas Pharma research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Astellas Pharma's overall financial health at a glance.

Contemplating Other Strategies?

Our top stock finds are flying under the radar-for now. Get in early:

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4503

Astellas Pharma

Manufactures, markets, and imports and exports pharmaceuticals in Japan and internationally.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026