Assessing Astellas Pharma (TSE:4503) Valuation After a 21% Monthly Share Price Surge

Reviewed by Simply Wall St

See our latest analysis for Astellas Pharma.

The strong 21% share price gain over the past month has propelled Astellas Pharma’s momentum, fueling optimism after a subdued stretch. While this recent surge stands out, the one-year total shareholder return of 32% also reflects a healthy long-term trend.

If pharma’s rebound is piquing your interest, it might be the perfect time to find fresh opportunities via our pharma stocks with big dividends: See the full list for free.

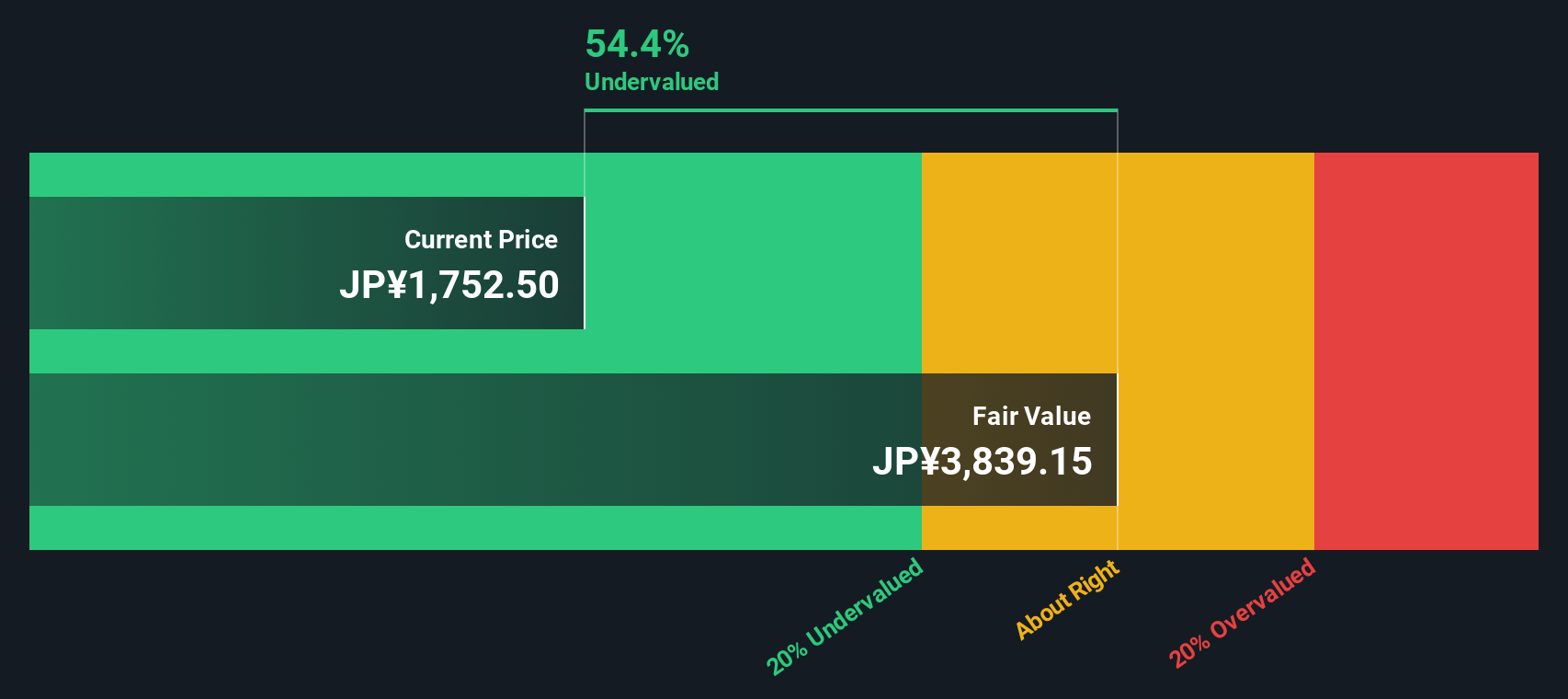

But with shares riding recent momentum, the big question is whether Astellas Pharma is actually undervalued at these levels or if the market has already factored in its future growth potential, leaving little room for upside.

Most Popular Narrative: 10.7% Overvalued

Astellas Pharma’s most widely followed narrative sees its fair value at ¥1,774, about 10.7% lower than the recent share price of ¥1,964.5. This puts recent market enthusiasm to the test and brings focus to what exactly is driving the valuation premium.

*Cost optimization initiatives (SMT) are running ahead of schedule, with early realized reductions in SG&A and R&D costs directly improving net margins and underlying profitability even as growth investments are maintained. Pipeline momentum is accelerating through near-term clinical readouts and global expansion opportunities in oncology and rare diseases. A diversified approach, including targeted protein degradation, Claudin 18.2 assets, and ADCs, provides greater earnings visibility and premium pricing opportunities for future revenue.*

What’s really fueling this narrative’s fair value? The numbers hinge on bold assumptions for pipeline momentum and future profit margins, paired with ambitious expansion targets. Unpack their forecast logic and see which hidden levers might surprise market watchers.

Result: Fair Value of ¥1,774 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, significant risks remain, including tightening global drug pricing and looming patent expirations. Both of these factors could quickly challenge this optimistic narrative.

Find out about the key risks to this Astellas Pharma narrative.

Another View: The DCF Model Tells a Different Story

Looking at Astellas Pharma through the lens of our SWS DCF model paints a much more optimistic picture. The current share price of ¥1,964.5 sits a substantial 48% below our calculated fair value of ¥3,793.55. This suggests there may be significant upside. But does the DCF model’s optimism hold up against real-world risks and recent performance?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Astellas Pharma for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 917 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Astellas Pharma Narrative

If you would rather see the figures for yourself or look deeper into the forecasts, you can quickly put together your own outlook in just a few minutes. Do it your way

A great starting point for your Astellas Pharma research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More High-Potential Investment Ideas?

Make your next intelligent move by checking stocks built for tomorrow’s growth. Skip the wait and secure your edge by using these unique screeners before everyone else uncovers the opportunities:

- Unlock value by targeting companies overlooked by the crowd with these 917 undervalued stocks based on cash flows, where steady cash flows meet low prices.

- Power up your portfolio and tap into the future using these 25 AI penny stocks as they ride the wave of artificial intelligence innovation.

- Start building stable, reliable income streams by tracking these 17 dividend stocks with yields > 3% that delivers consistently high yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4503

Astellas Pharma

Manufactures, markets, and imports and exports pharmaceuticals in Japan and internationally.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives