Will QDENGA’s Global Endorsement Offset Earnings Pressure for Takeda Pharmaceutical (TSE:4502)?

Reviewed by Sasha Jovanovic

- Takeda Pharmaceutical recently completed its seven-year Phase 3 TIDES trial for QDENGA, confirming the sustained protection and favorable safety profile of its dengue vaccine, with supporting data presented at a global pediatric infectious diseases congress.

- The World Health Organization’s addition of QDENGA to its prequalified vaccine list underscores its suitability for inclusion in public health efforts against dengue worldwide.

- We’ll assess how the downward earnings guidance, amid generic competition and new product developments, affects Takeda’s long-term growth narrative.

AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Takeda Pharmaceutical Investment Narrative Recap

To be a Takeda shareholder, you need confidence in its ability to offset declining revenues from mature products, like VYVANSE, with new launches and innovative pipeline assets. The completion of the long-term QDENGA trial demonstrates progress on expanding the portfolio, but with downward earnings guidance, generic competition remains the dominant short-term risk, and this news does not materially change that immediate outlook.

Alongside QDENGA’s data, Takeda’s recent FDA approval of HyHub devices for HYQVIA signals an effort to enhance patient convenience and drive incremental growth. While helpful, these product enhancements are not expected to significantly alter the near-term revenue trajectory compared to the broader challenge of offsetting generic erosion.

Yet, just as new product launches offer hope, the sharper than expected VYVANSE decline proves that headwinds from generics can still surprise and investors should be aware of...

Read the full narrative on Takeda Pharmaceutical (it's free!)

Takeda Pharmaceutical's outlook anticipates ¥4,696.5 billion in revenue and ¥339.5 billion in earnings by 2028. This projection relies on annual revenue growth of 1.6% and an earnings increase of ¥202.6 billion from the current ¥136.9 billion.

Uncover how Takeda Pharmaceutical's forecasts yield a ¥4906 fair value, a 17% upside to its current price.

Exploring Other Perspectives

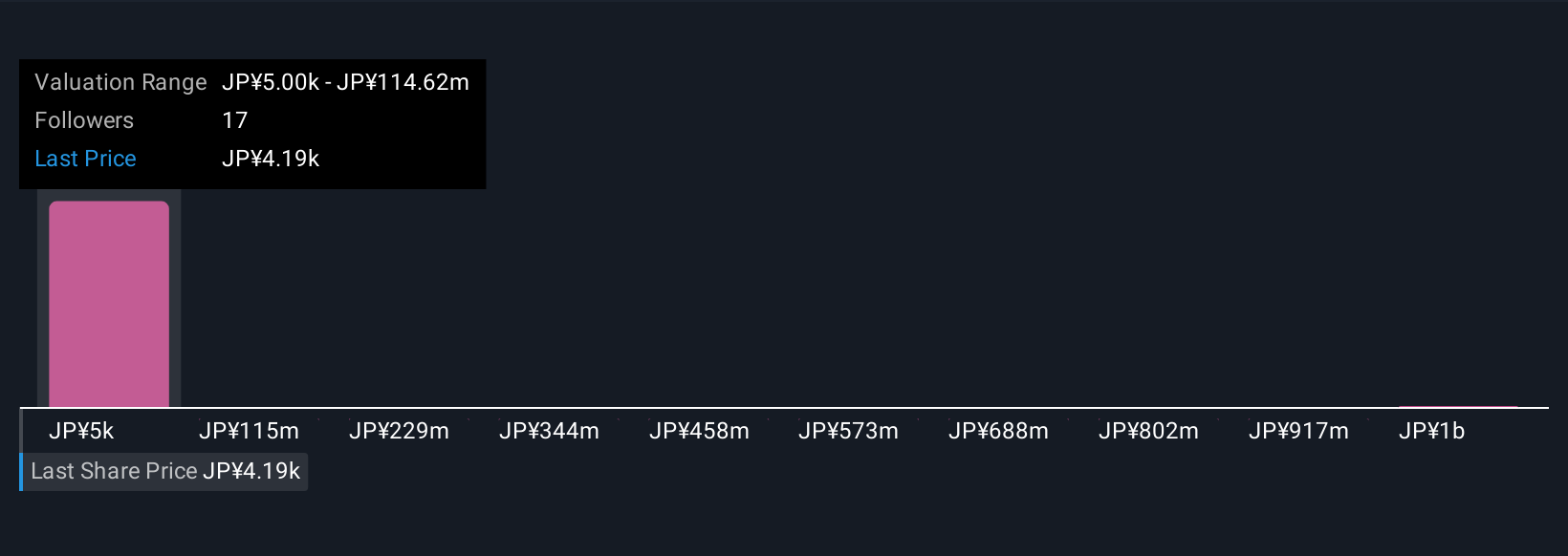

Simply Wall St Community members offer two fair value estimates for Takeda, ranging from ¥4,906 to ¥12,767 per share. These viewpoints span a wide spectrum while the sharp drop in earnings forecasts highlights why opinions about Takeda’s outlook can sharply diverge, explore several perspectives to inform your view.

Explore 2 other fair value estimates on Takeda Pharmaceutical - why the stock might be worth over 3x more than the current price!

Build Your Own Takeda Pharmaceutical Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Takeda Pharmaceutical research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Takeda Pharmaceutical research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Takeda Pharmaceutical's overall financial health at a glance.

Contemplating Other Strategies?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Takeda Pharmaceutical might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4502

Takeda Pharmaceutical

Engages in the research, development, manufacture, marketing, and out-licensing of pharmaceutical products in Japan and internationally.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives