Takeda (TSE:4502) Net Margin Falls to 0.7%, Challenging Earnings Quality Narratives

Reviewed by Simply Wall St

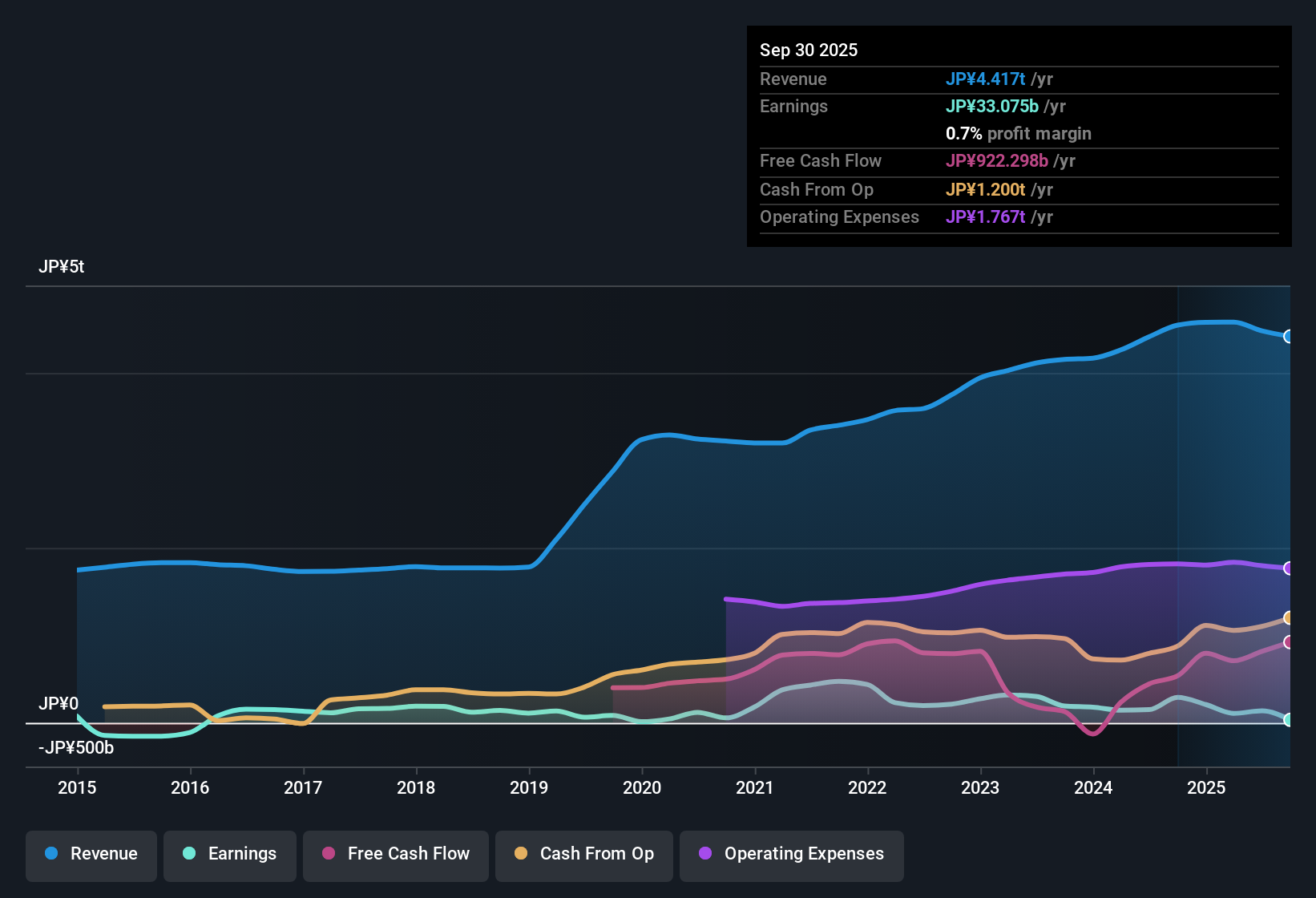

Takeda Pharmaceutical (TSE:4502) saw its net profit margin drop from 6.4% last year to 0.7%, alongside a 16.1% average annual earnings decline over the past five years. During the latest twelve months, results were weighed down by a substantial one-off loss of ¥147.7 billion. Analysts now expect earnings to rebound at an impressive 29.9% per year, well ahead of the Japanese market average. The current setup spotlights anticipated profit growth and offers renewed optimism for investors watching the turnaround story unfold.

See our full analysis for Takeda Pharmaceutical.Next, we set these headline numbers against prevailing narratives to see where perceptions and reality match or diverge according to investors and Simply Wall St analysts alike.

See what the community is saying about Takeda Pharmaceutical

Net Profit Margin Tumbles to 0.7%

- Takeda’s net profit margin fell sharply to 0.7%, down from 6.4% a year ago. The most recent period was affected by a substantial one-off loss of ¥147.7 billion.

- The analysts' consensus view acknowledges that while removal of headwinds such as VYVANSE’s generic erosion and strong pipeline momentum are seen as paving the way for long-term margin recovery, bears highlight that intensifying competitive and regulatory pressures alongside a heavy debt burden could jeopardize efforts to achieve these higher margins.

- Consensus narrative notes margin upside depends on late-stage pipeline launches outpacing new threats to established products and cost base.

- At the same time, critics highlight that ongoing cost inflation and pricing reforms could constrain any quick rebound toward historical margin levels.

- Curious how numbers become stories that shape markets? Explore Community Narratives Curious how numbers become stories that shape markets? Explore Community Narratives

DCF Fair Value Shows Hidden Discount

- At a current share price of ¥4,153, Takeda trades at a deep discount to the DCF fair value of ¥12,963.67. The company also holds a lower Price-to-Sales ratio (1.5x) than both the industry (1.6x) and peer average (4.1x).

- The analysts' consensus view sees this valuation gap as a potential opportunity for value-focused investors but highlights disagreement about the pace of earnings recovery and whether margin expansion can justify a higher multiple.

- Consensus narrative notes that bullish investors expect pipeline successes and global market access to drive sustainable growth and re-rate the share price closer to fair value.

- Meanwhile, less optimistic analysts see the risk that execution setbacks or further profit margin compression could mean the stock remains stuck in value territory.

Revenue Growth Lags Market Trend

- Revenue is forecast to grow at just 2.1% per year, trailing the Japanese market’s expected 4.5% pace. This reflects the challenge of overcoming prior declines and generic pressure.

- The analysts' consensus view observes that despite innovation in rare diseases and new launches like QDENGA, incremental top-line momentum remains modest relative to sector peers, raising questions over how quickly Takeda can return to above-market growth.

- Consensus narrative notes removal of generic headwinds and increased market access in emerging economies could boost revenue, but faster-moving competition and regulatory shifts limit visibility into near-term acceleration.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Takeda Pharmaceutical on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a unique interpretation of the figures? In just a few minutes, you can share your independent take and shape your version of the story. Do it your way

A great starting point for your Takeda Pharmaceutical research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

See What Else Is Out There

While Takeda faces ongoing profit margin pressure, high debt levels, and only modest revenue growth, its turnaround still hinges on overcoming competitive and financial headwinds.

If you want to prioritize companies with stronger balance sheets and less financial strain, discover opportunities through solid balance sheet and fundamentals stocks screener (1981 results) built for resilience and peace of mind.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Takeda Pharmaceutical might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4502

Takeda Pharmaceutical

Engages in the research, development, manufacture, marketing, and out-licensing of pharmaceutical products in Japan and internationally.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives