Kyowa Kirin (TSE:4151) Valuation in Focus After Licensing Deal and Orphan Drug Designation

Reviewed by Simply Wall St

Kyowa Kirin (TSE:4151) has caught investors’ eyes following some major business updates this week. The company signed a multi-million euro licensing deal with Boehringer Ingelheim and received a key orphan drug designation for its rare disease therapy in Japan.

See our latest analysis for Kyowa Kirin.

These pipeline wins have coincided with a pick-up in Kyowa Kirin’s stock price momentum, with the share price posting a 3.41% gain over the past week and regaining ground after a recent dip. Still, the total shareholder return over the last year is down 3.1%, reflecting ongoing challenges even as the latest business updates hint at renewed growth prospects.

If you're following Kyowa Kirin for its innovative therapies, you might also enjoy discovering other standout names from the healthcare world. See the full list for free.

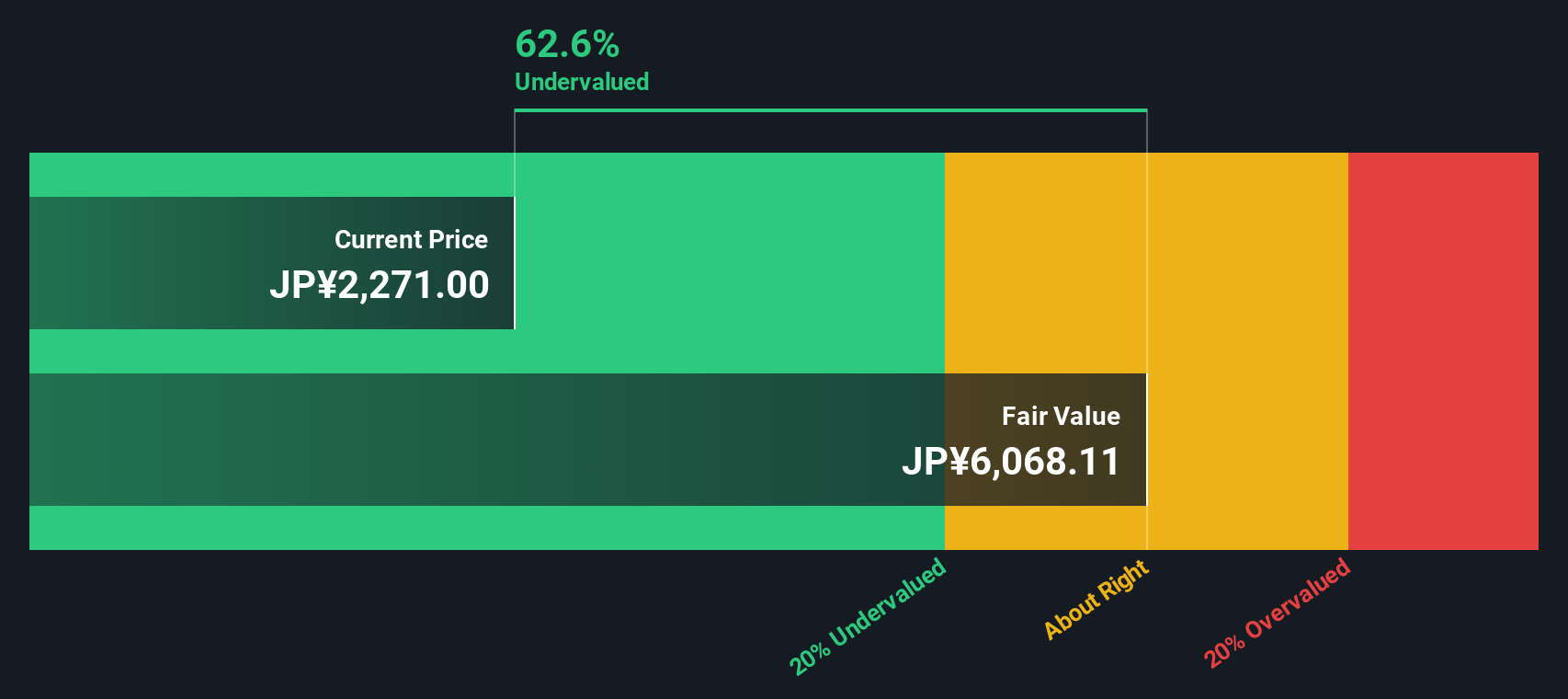

With these breakthroughs on the table and shares trading at a notable discount to analyst price targets, the big question is whether Kyowa Kirin is now undervalued or if the market has already recognized its future growth story.

Price-to-Earnings of 34.1x: Is it justified?

Kyowa Kirin’s current price-to-earnings ratio stands at 34.1x, a level that makes its shares look significantly more expensive than many direct rivals in Japan’s pharmaceutical sector.

The price-to-earnings (P/E) ratio is a common valuation metric that measures how much investors are willing to pay for each yen of earnings. For pharmaceutical stocks, it highlights the market’s view of future growth and profitability. In Kyowa Kirin’s case, this high P/E suggests investors are still pricing in strong future gains or resilience, despite the company’s recent profit drop and challenging industry returns.

Importantly, Kyowa Kirin’s P/E is more than double the JP Pharmaceuticals industry average of 14.8x and also notably exceeds the peer average of 19.9x. This premium persists even though the company’s earnings growth has recently stalled and current profit margins have compressed. Compared to an estimated fair P/E of 22.6x, the stock trades at a valuation that the broader market could eventually reconsider.

Explore the SWS fair ratio for Kyowa Kirin

Result: Price-to-Earnings of 34.1x (OVERVALUED)

However, sustained earnings pressure or slower revenue growth could challenge the bullish outlook, particularly if industry headwinds intensify in the coming quarters.

Find out about the key risks to this Kyowa Kirin narrative.

Another View: What Does Our DCF Model Say?

While Kyowa Kirin appears overvalued based on its high price-to-earnings ratio, the SWS DCF model offers a contrasting perspective. According to this approach, the shares are trading at a significant 55% discount to their fair value, suggesting upside potential if the underlying assumptions are accurate. Could this difference reveal a hidden opportunity, or is there a catch in the model’s optimism?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Kyowa Kirin for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 840 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Kyowa Kirin Narrative

If you’d rather reach your own conclusions or dig deeper into the numbers, you can quickly build a personalized view of Kyowa Kirin’s outlook for yourself in just a few minutes. Do it your way

A great starting point for your Kyowa Kirin research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Stock market trends move fast, and there are always exciting opportunities for those ready to seize them. Don’t let the best ideas pass you by. Expand your watchlist with these powerful screeners:

- Unlock potential by targeting these 840 undervalued stocks based on cash flows that the market may have overlooked but show strong fundamentals and future upside.

- Supercharge your growth strategy with these 27 AI penny stocks paving the way in artificial intelligence, automation, and next-level innovation.

- Start building income now with these 22 dividend stocks with yields > 3% offering yields above 3%, designed for investors seeking reliable and attractive returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kyowa Kirin might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4151

Kyowa Kirin

Engages in the research, development, manufacture, import/export, and market of pharmaceuticals products worldwide.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives