Kyowa Kirin (TSE:4151): Assessing Valuation After FDA Green Light for KOMZIFTI in AML Treatment

Reviewed by Simply Wall St

Kyowa Kirin (TSE:4151) just scored a milestone with full FDA approval of KOMZIFTI for adults battling relapsed or refractory acute myeloid leukemia with a susceptible NPM1 mutation. This development provides a new option in an area where choices have been limited.

See our latest analysis for Kyowa Kirin.

Kyowa Kirin’s momentum has picked up following the KOMZIFTI approval. The share price has climbed more than 11% over the past month and delivered a 10.4% year-to-date gain. While its one-year total shareholder return is a modest 4.3%, longer-term investors have seen more muted results. This trend suggests the company may be regaining its stride after recent volatility and headline events.

If you want to see what other innovative names are making moves in healthcare, check out the complete list in our See the full list for free..

With the approval now driving optimism, investors are left to consider whether Kyowa Kirin’s recent gains truly signal a new chapter, or if the market has already factored in all future growth. Could this be a buying opportunity, or is everything already priced in?

Price-to-Earnings of 36.8x: Is it justified?

Kyowa Kirin is currently trading at a price-to-earnings (P/E) ratio of 36.8x, which positions it as more expensive than comparable pharmaceutical industry stocks. With a last close price of ¥2,567.5, the market is demanding a significant premium.

The price-to-earnings ratio measures how much investors are willing to pay for each yen of earnings. In pharmaceuticals, this multiple often reflects anticipation of future growth, breakthrough products, or resilience through demanding regulatory environments.

However, Kyowa Kirin’s premium valuation stands out. Its P/E of 36.8x is noticeably higher than the Japan Pharmaceuticals industry average of 15.3x, and substantially above the estimated fair price-to-earnings ratio of 22.8x. This suggests the current price bakes in a lot of optimism or a scarcity premium, but it could also mean the stock is overvalued if future earnings do not catch up to expectations.

Result: Price-to-Earnings of 36.8x (OVERVALUED)

Explore the SWS fair ratio for Kyowa Kirin

However, weaker long-term returns and muted revenue growth could challenge the bullish outlook if the momentum from recent approvals does not continue.

Find out about the key risks to this Kyowa Kirin narrative.

Another View: What Does Our DCF Model Suggest?

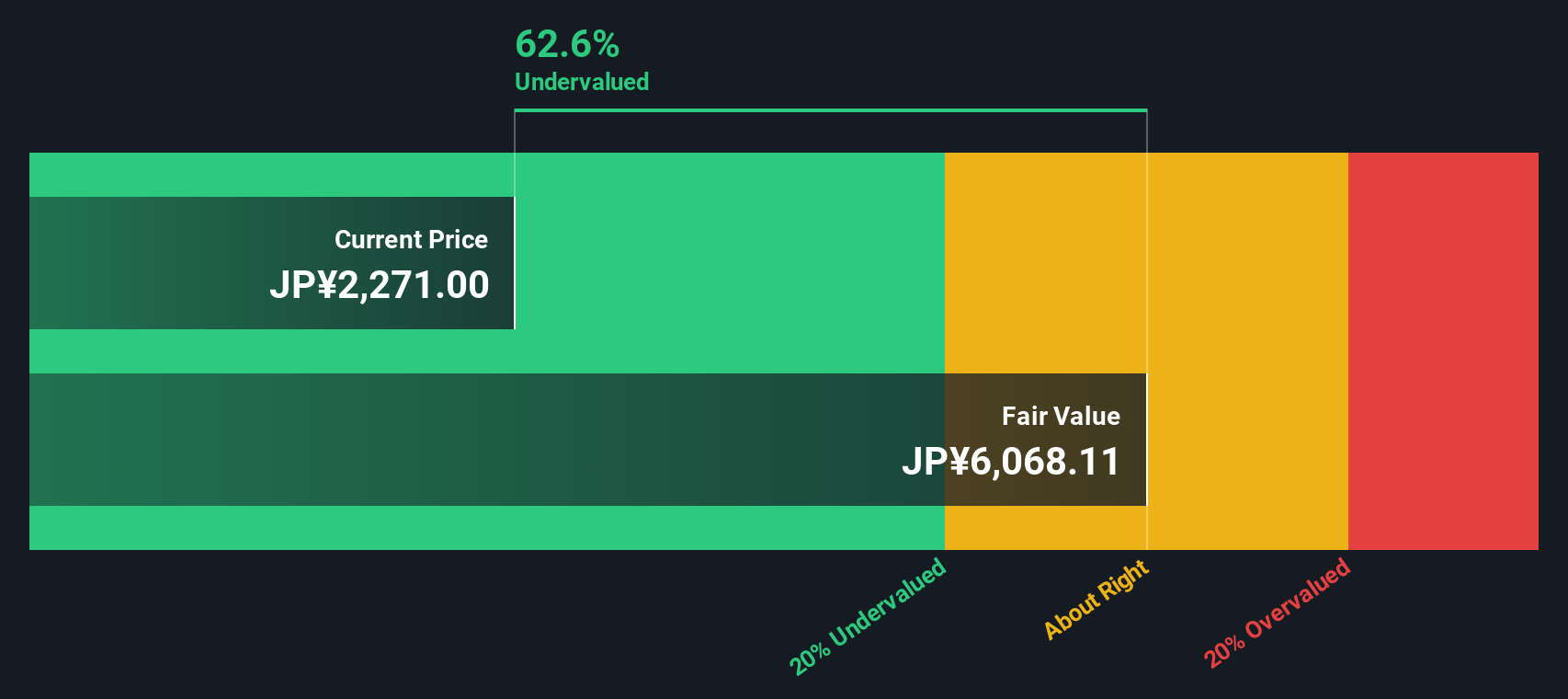

While the current price may look steep based on earnings multiples, our DCF model tells a surprisingly different story. According to this approach, Kyowa Kirin’s shares are trading at a hefty 51% discount to their intrinsic value, signaling significant potential upside. Could the true value be hiding behind the headlines?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Kyowa Kirin for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 917 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Kyowa Kirin Narrative

If you see the numbers differently or want your own take, you can shape your own Kyowa Kirin story in just a few minutes, your way. Do it your way.

A great starting point for your Kyowa Kirin research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Rather than settling for the usual picks, take your strategy to the next level by finding opportunities other investors might miss with our screeners.

- Start building a portfolio of cash-generating stocks; seize the edge with these 917 undervalued stocks based on cash flows that might be trading below their real worth right now.

- Tap into the explosive potential of machine learning and automation by uncovering winners with these 25 AI penny stocks making waves in artificial intelligence.

- Cement your income strategy with peace of mind by browsing these 17 dividend stocks with yields > 3% that offer yields above 3% and strong payout histories.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kyowa Kirin might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4151

Kyowa Kirin

Engages in the research, development, manufacture, import/export, and market of pharmaceuticals products worldwide.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives