- Japan

- /

- Life Sciences

- /

- TSE:2395

Investors Continue Waiting On Sidelines For Shin Nippon Biomedical Laboratories, Ltd. (TSE:2395)

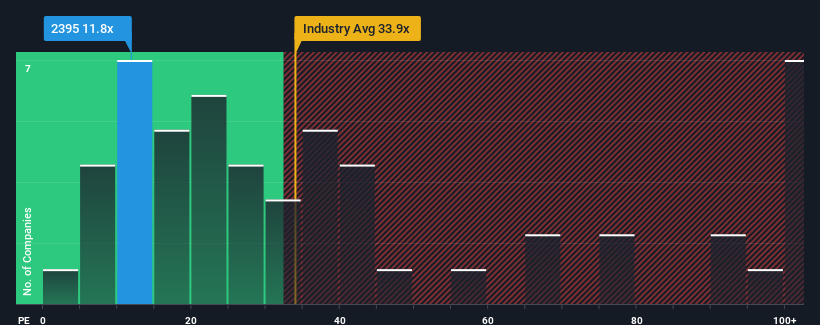

There wouldn't be many who think Shin Nippon Biomedical Laboratories, Ltd.'s (TSE:2395) price-to-earnings (or "P/E") ratio of 11.8x is worth a mention when the median P/E in Japan is similar at about 13x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

We've discovered 3 warning signs about Shin Nippon Biomedical Laboratories. View them for free.Shin Nippon Biomedical Laboratories hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. It might be that many expect the dour earnings performance to strengthen positively, which has kept the P/E from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

Check out our latest analysis for Shin Nippon Biomedical Laboratories

Is There Some Growth For Shin Nippon Biomedical Laboratories?

In order to justify its P/E ratio, Shin Nippon Biomedical Laboratories would need to produce growth that's similar to the market.

Retrospectively, the last year delivered a frustrating 10% decrease to the company's bottom line. This means it has also seen a slide in earnings over the longer-term as EPS is down 34% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Turning to the outlook, the next three years should generate growth of 15% per annum as estimated by the two analysts watching the company. That's shaping up to be materially higher than the 9.8% per year growth forecast for the broader market.

With this information, we find it interesting that Shin Nippon Biomedical Laboratories is trading at a fairly similar P/E to the market. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

What We Can Learn From Shin Nippon Biomedical Laboratories' P/E?

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Shin Nippon Biomedical Laboratories currently trades on a lower than expected P/E since its forecast growth is higher than the wider market. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing pressure on the P/E ratio. It appears some are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

And what about other risks? Every company has them, and we've spotted 3 warning signs for Shin Nippon Biomedical Laboratories (of which 1 can't be ignored!) you should know about.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:2395

Shin Nippon Biomedical Laboratories

A contract research organization, engages in the pharmaceutical development, transactional research, and medipolis businesses in Japan and internationally.

Proven track record and fair value.

Market Insights

Community Narratives