Why Investors Shouldn't Be Surprised By Transgenic Group Inc.'s (TSE:2342) Low P/S

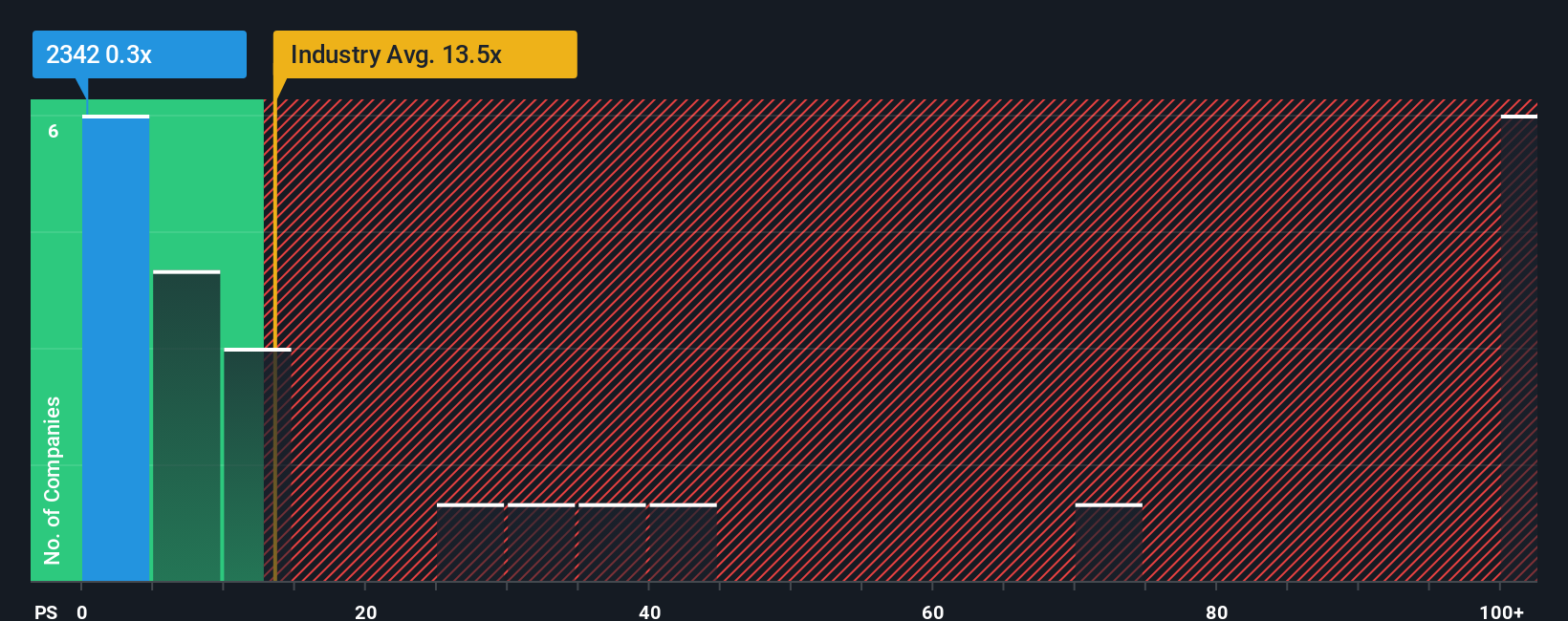

With a price-to-sales (or "P/S") ratio of 0.3x Transgenic Group Inc. (TSE:2342) may be sending very bullish signals at the moment, given that almost half of all the Biotechs companies in Japan have P/S ratios greater than 13.5x and even P/S higher than 91x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

View our latest analysis for Transgenic Group

What Does Transgenic Group's P/S Mean For Shareholders?

It looks like revenue growth has deserted Transgenic Group recently, which is not something to boast about. One possibility is that the P/S is low because investors think this benign revenue growth rate will likely underperform the broader industry in the near future. If not, then existing shareholders may be feeling optimistic about the future direction of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Transgenic Group will help you shine a light on its historical performance.Is There Any Revenue Growth Forecasted For Transgenic Group?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like Transgenic Group's to be considered reasonable.

Taking a look back first, we see that there was hardly any revenue growth to speak of for the company over the past year. Still, the latest three year period was better as it's delivered a decent 13% overall rise in revenue. Therefore, it's fair to say that revenue growth has been inconsistent recently for the company.

Comparing the recent medium-term revenue trends against the industry's one-year growth forecast of 327% shows it's noticeably less attractive.

With this in consideration, it's easy to understand why Transgenic Group's P/S falls short of the mark set by its industry peers. It seems most investors are expecting to see the recent limited growth rates continue into the future and are only willing to pay a reduced amount for the stock.

What We Can Learn From Transgenic Group's P/S?

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Transgenic Group revealed its three-year revenue trends are contributing to its low P/S, given they look worse than current industry expectations. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. If recent medium-term revenue trends continue, it's hard to see the share price experience a reversal of fortunes anytime soon.

It is also worth noting that we have found 3 warning signs for Transgenic Group (1 doesn't sit too well with us!) that you need to take into consideration.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Transgenic Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:2342

Transgenic Group

Develops, distributes, and licenses genetically modified animals and antibodies in Japan.

Mediocre balance sheet with low risk.

Market Insights

Community Narratives