Three High Growth Japanese Stocks With Significant Insider Ownership

Reviewed by Simply Wall St

Japan's stock markets have faced significant declines recently, with the Nikkei 225 Index falling by 6.0% and the broader TOPIX Index down by 5.6%. Amidst this volatility, investors are increasingly focusing on growth companies with high insider ownership as these stocks often indicate strong confidence from those closest to the business. In such a market environment, identifying stocks with robust growth potential and substantial insider ownership can be particularly appealing. These characteristics may suggest that insiders believe in the company's future prospects and are committed to its long-term success.

Top 10 Growth Companies With High Insider Ownership In Japan

| Name | Insider Ownership | Earnings Growth |

| Hottolink (TSE:3680) | 27% | 59.7% |

| Kasumigaseki CapitalLtd (TSE:3498) | 34.8% | 43.3% |

| Medley (TSE:4480) | 34% | 28.7% |

| Micronics Japan (TSE:6871) | 15.3% | 39.8% |

| Kanamic NetworkLTD (TSE:3939) | 25% | 28.9% |

| SHIFT (TSE:3697) | 35.4% | 32.8% |

| Money Forward (TSE:3994) | 21.4% | 66.8% |

| ExaWizards (TSE:4259) | 21.9% | 91.1% |

| Astroscale Holdings (TSE:186A) | 20.9% | 90% |

| freee K.K (TSE:4478) | 32.8% | 72.9% |

Underneath we present a selection of stocks filtered out by our screen.

Visional (TSE:4194)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Visional, Inc., along with its subsidiaries, offers human resources platform solutions in Japan and has a market cap of ¥312.30 billion.

Operations: Visional's revenue segments include human resources platform solutions in Japan.

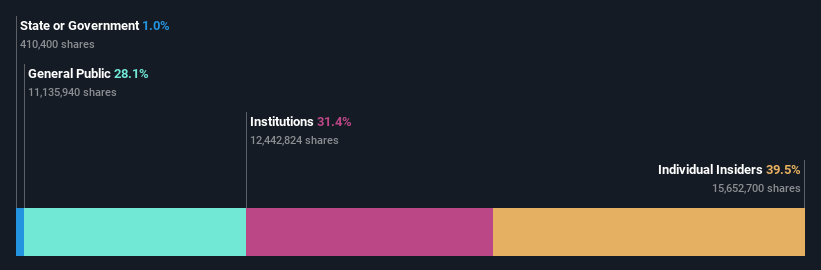

Insider Ownership: 39.5%

Return On Equity Forecast: 25% (2027 estimate)

Visional has demonstrated impressive growth, with earnings increasing by 74.3% over the past year and revenue forecasted to grow at 12.4% per year, outpacing the Japanese market's average of 4.3%. Despite its highly volatile share price, it trades at a significant discount of 47.6% below its estimated fair value. Earnings are projected to grow annually by 11.2%, surpassing the market's expected growth rate of 8.9%. Recent board meetings have focused on revising consolidated earnings forecasts, indicating active management involvement in steering future performance.

- Get an in-depth perspective on Visional's performance by reading our analyst estimates report here.

- Our valuation report unveils the possibility Visional's shares may be trading at a discount.

PeptiDream (TSE:4587)

Simply Wall St Growth Rating: ★★★★★☆

Overview: PeptiDream Inc., a biopharmaceutical company with a market cap of ¥359.40 billion, focuses on the discovery and development of constrained peptides, small molecules, and peptide-drug conjugate therapeutics.

Operations: Revenue segments for PeptiDream Inc. include constrained peptides, small molecules, and peptide-drug conjugate therapeutics.

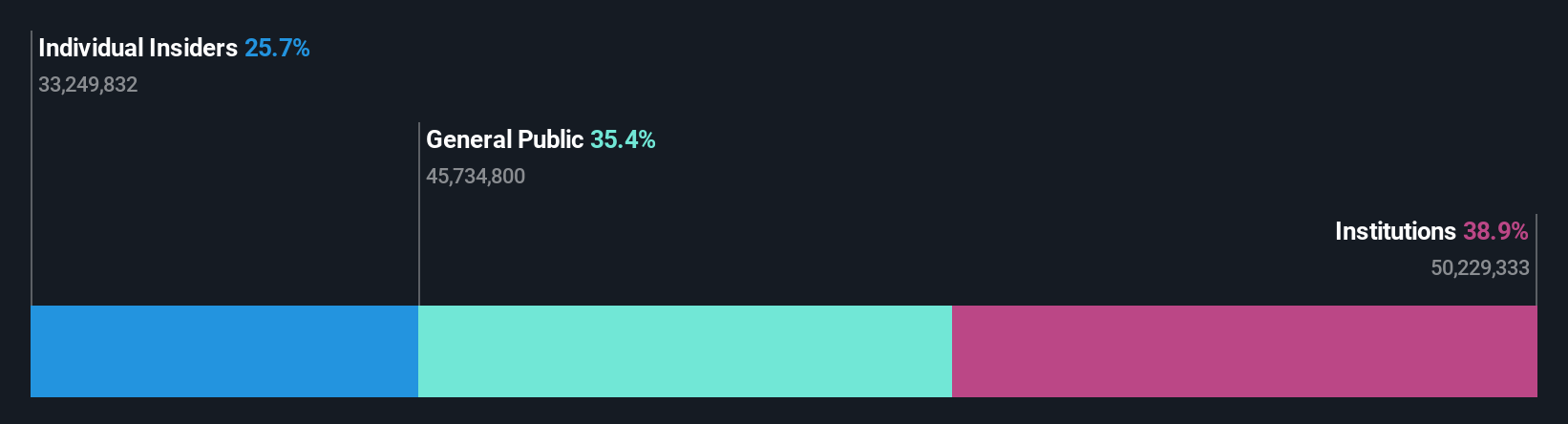

Insider Ownership: 26.1%

Return On Equity Forecast: 20% (2027 estimate)

PeptiDream has shown strong growth potential, bolstered by high insider ownership. Recent strategic expansions include a significant collaboration with Novartis Pharma AG, potentially yielding up to $2.71 billion USD in milestone payments and royalties. The company also raised its earnings guidance for 2024, projecting a substantial increase in operating profit to ¥20.10 billion JPY. Despite recent share price volatility and lower profit margins compared to last year, PeptiDream's earnings are forecasted to grow significantly at 22.6% annually, outpacing the Japanese market average of 8.9%.

- Click to explore a detailed breakdown of our findings in PeptiDream's earnings growth report.

- According our valuation report, there's an indication that PeptiDream's share price might be on the expensive side.

Capcom (TSE:9697)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Capcom Co., Ltd. is a global company engaged in planning, developing, manufacturing, selling, and distributing home video games, online games, mobile games, and arcade games with a market cap of ¥1.34 trillion.

Operations: Capcom generates revenue primarily from its Digital Content segment (¥103.38 billion), Amusement Facilities (¥20.09 billion), and Amusement Equipment (¥10.34 billion).

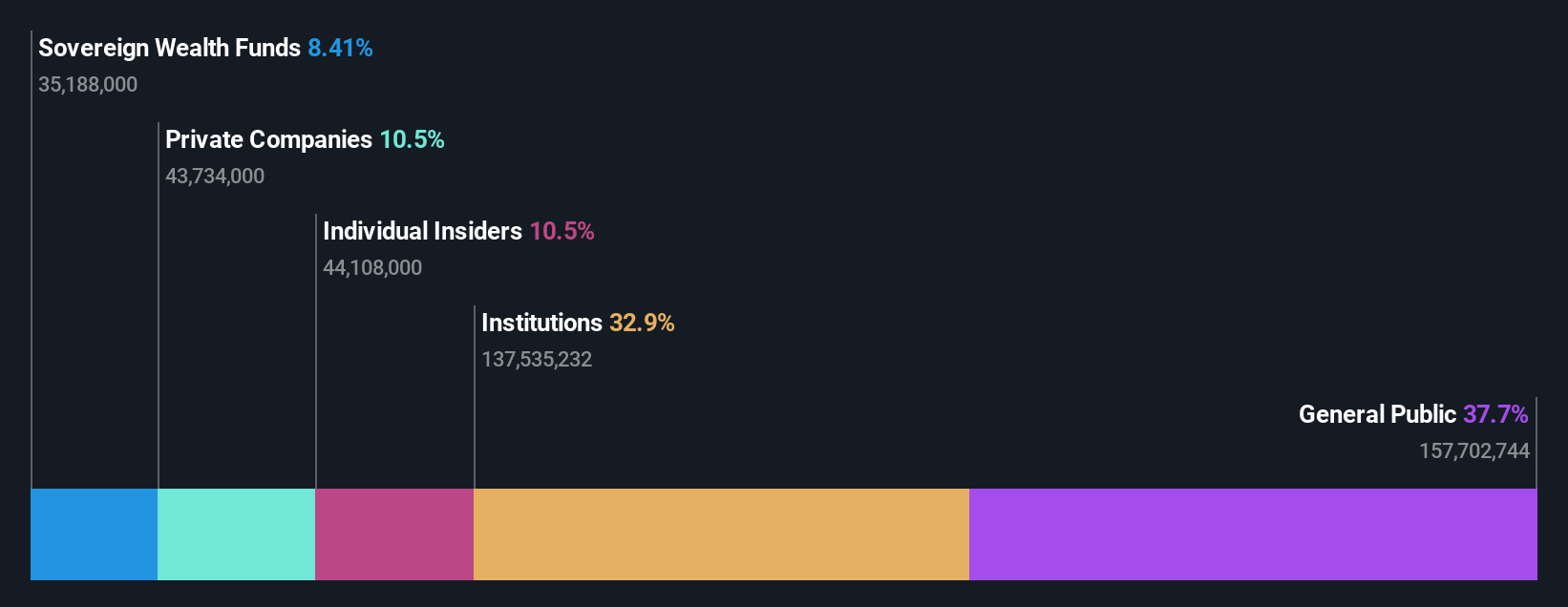

Insider Ownership: 11.5%

Return On Equity Forecast: 20% (2027 estimate)

Capcom demonstrates solid growth potential with high insider ownership. Its earnings are forecasted to grow at 14.33% annually, surpassing the Japanese market average of 8.9%. Revenue is expected to increase by 9.5% per year, outpacing the market's 4.3%. Recent events include an upcoming Q1 2025 earnings report on July 29, which may provide further insights into its performance trajectory following their AGM in June that addressed various strategic initiatives and corporate governance matters.

- Navigate through the intricacies of Capcom with our comprehensive analyst estimates report here.

- Our expertly prepared valuation report Capcom implies its share price may be too high.

Key Takeaways

- Take a closer look at our Fast Growing Japanese Companies With High Insider Ownership list of 100 companies by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4587

PeptiDream

A biopharmaceutical company, engages in the discovery and development of constrained peptides, small molecules, and peptide-drug conjugate therapeutics.

High growth potential with adequate balance sheet.