Stock Analysis

Fast-Growing Tech Stocks In Japan Including Trend Micro

Reviewed by Simply Wall St

Japan’s stock markets have recently shown resilience, with the Nikkei 225 Index gaining 0.7% and the broader TOPIX Index up 1.0%, recovering from earlier sell-offs driven by U.S. growth concerns and yen fluctuations. Amid this volatile backdrop, investors are increasingly looking at high-growth tech stocks for potential opportunities. When evaluating fast-growing tech stocks in Japan, it's crucial to consider companies that demonstrate strong innovation capabilities and robust market positioning, especially in a fluctuating economic environment like today’s.

Top 10 High Growth Tech Companies In Japan

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Hottolink | 51.80% | 61.94% | ★★★★★★ |

| Cyber Security Cloud | 20.71% | 25.73% | ★★★★★☆ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| Medley | 24.97% | 30.50% | ★★★★★★ |

| SHIFT | 20.25% | 32.08% | ★★★★★★ |

| Kanamic NetworkLTD | 20.75% | 28.25% | ★★★★★★ |

| Material Group | 17.82% | 28.74% | ★★★★★☆ |

| Bengo4.comInc | 20.76% | 46.76% | ★★★★★★ |

| ExaWizards | 22.69% | 62.99% | ★★★★★★ |

| Money Forward | 20.68% | 68.12% | ★★★★★★ |

We'll examine a selection from our screener results.

Trend Micro (TSE:4704)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Trend Micro Incorporated develops and sells security-related software for computers and related services in Japan and internationally, with a market cap of ¥1.16 trillion.

Operations: Trend Micro generates revenue primarily from its security-related software and services, with significant contributions from Japan (¥84.17 billion), Asia Pacific (¥126.28 billion), Americas (¥70.46 billion), and Europe (¥63.59 billion). The company focuses on providing cybersecurity solutions across various regions globally.

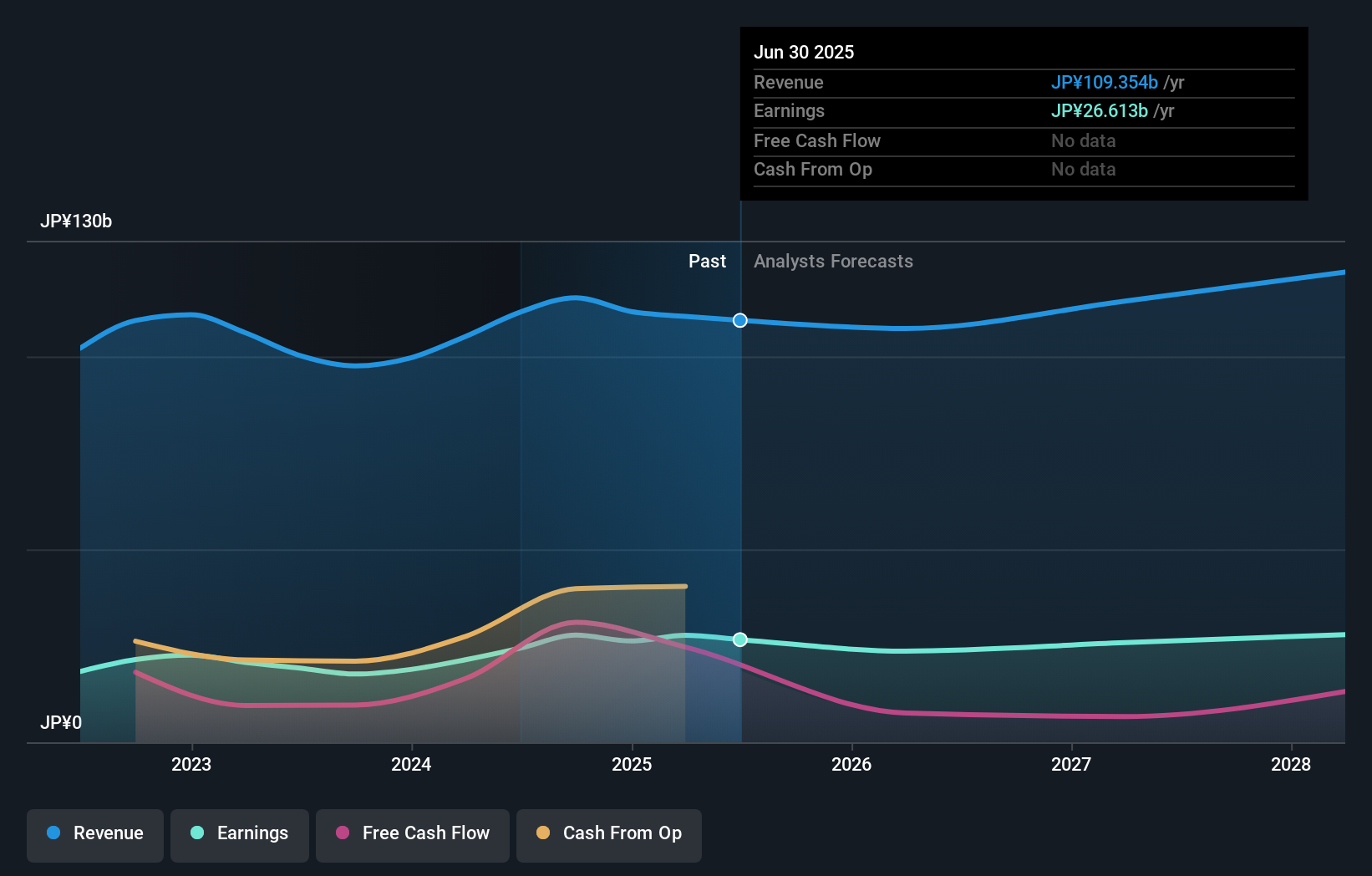

Trend Micro stands out in Japan's tech landscape with a robust focus on AI and cybersecurity. Recent partnerships, such as with GMI Cloud, underscore its commitment to enhancing security for AI implementations. The company's R&D expenses reflect this dedication, amounting to ¥25 billion ($0.17 billion) last year, supporting innovations like deepfake detection technology. Despite a 37.3% earnings drop last year, forecasted annual profit growth of 21.9% signals strong recovery potential.

Dexerials (TSE:4980)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Dexerials Corporation manufactures and sells electronic components, bonding materials, optics materials, and other products in Japan with a market cap of ¥370.05 billion.

Operations: The company's primary revenue streams are derived from its Electronic Materials and Components segment, generating ¥51.43 billion, and its Optical Materials and Components segment, contributing ¥48.07 billion.

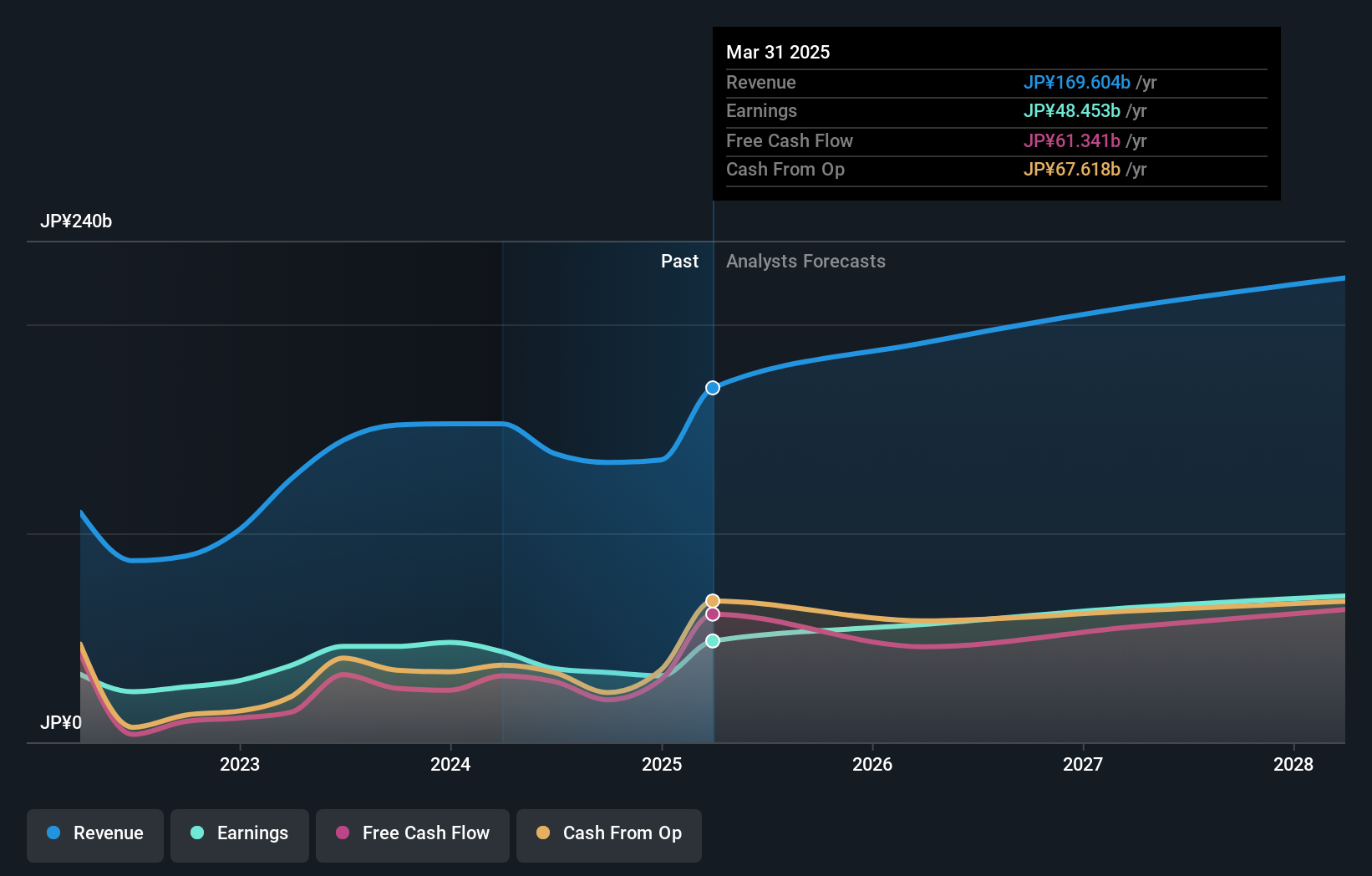

Dexerials continues to make strides in Japan's tech sector, particularly with its advanced materials and electronic components. The company's R&D expenses were ¥10 billion ($0.07 billion) last year, driving innovations that support a 26.7% earnings growth over the past year, outpacing the industry average of 7.8%. Dexerials' revenue is forecasted to grow at 5.7% annually, while earnings are projected to increase by 8.7% per year, indicating solid future prospects despite recent share price volatility.

- Get an in-depth perspective on Dexerials' performance by reading our health report here.

Understand Dexerials' track record by examining our Past report.

Capcom (TSE:9697)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Capcom Co., Ltd. is a company that plans, develops, manufactures, sells, and distributes home video games, online games, mobile games, and arcade games in Japan and internationally with a market cap of ¥1.34 trillion.

Operations: Capcom generates revenue primarily from its Digital Content segment, which contributed ¥103.38 billion, followed by Amusement Facilities at ¥20.09 billion and Amusement Equipment at ¥10.34 billion. The company's net profit margin stands out in the industry at 27%.

Capcom's revenue is expected to grow at 9.5% annually, outpacing the broader Japanese market's 4.3% growth rate. The company’s earnings are projected to increase by 14.5% per year, surpassing the market average of 8.6%. With a significant focus on R&D, Capcom spent ¥20 billion ($0.14 billion) last year to drive innovation in its gaming portfolio, contributing to high-quality earnings despite recent share price volatility over the past three months.

- Delve into the full analysis health report here for a deeper understanding of Capcom.

Examine Capcom's past performance report to understand how it has performed in the past.

Next Steps

- Gain an insight into the universe of 129 Japanese High Growth Tech and AI Stocks by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Trend Micro might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4704

Trend Micro

Develops and sells security-related software for computers and related services in Japan and internationally.